Economic growth set to fall

Updated: 2011-12-27 07:57

By Lan Lan (China Daily)

|

|||||||||

A member of an influential think tank predicts a slowdown for China in 2012

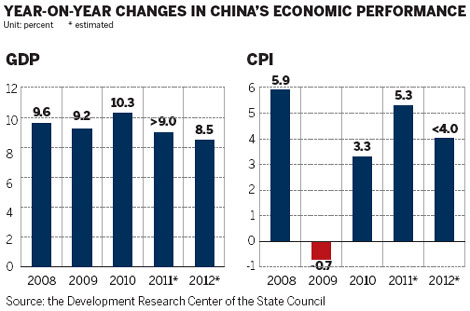

BEIJING - China's economic growth is expected to fall to about 8.5 percent in 2012, but only if the ongoing eurozone debt crisis doesn't evolve into a new global economic meltdown, a senior economist of the State Council's policy research think tank said on Monday.

In an exclusive interview with China Daily, Yu Bin, director-general of the department of macroeconomic research at the Development Research Center of the State Council, said that economic growth is likely to dip below 9 percent in the fourth quarter, but full-year growth may be slightly higher.

"Eastern coastal cities saw obviously slower economic growth in 2011. Meanwhile, the potential for additional investment in infrastructure continues to shrink, signaling that the potential for economic growth has started to decline," said Yu.

China has entered the final stages of high-speed economic growth after three decades of rapid expansion, said Yu, adding that the economy is under pressure, caused by short-term sluggish demand overlapping with a slower potential growth rate in the medium and long terms.

Emerging economies, often seen as the engine of the global economy, are incapable of "unhooking" their connection with the dismal economic situation facing developed economies, influenced by market fluctuations and deteriorating environments for exports and asset fluidity.

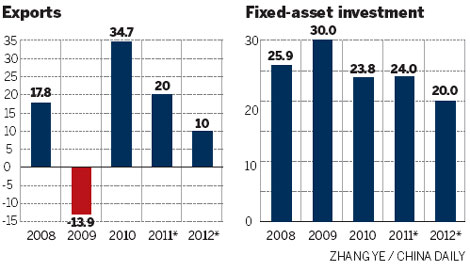

China's export growth is forecast to decline to about 10 percent in 2012, from about 20 percent this year, Yu said. The nation's exports to the European Union, its biggest market, have seen a rapid slowdown since September.

Fixed-asset investment growth may fall by about 4 percentage points to 20 percent in 2012, said Yu. The relatively high growth rate seen this year has been largely driven by the high-speed growth of the manufacturing and real estate industries, which account for about 60 percent of fixed-asset investment.

A decrease in exports of around 10 percent will drag down investment in the manufacturing sector by 3 to 4 percent.

However, bold stimulus measures similar to the 4 trillion yuan ($632 billion) stimulus package announced by the government in 2008 in response to the global financial crisis will not be repeated, said Yu. If the rate of growth declines, loosening policies would be unlikely to promote acceleration. On the contrary, they could generate bubbles and create new risks, judging by the experiences of Japan and South Korea.

The nation's short-term macroeconomic policies have been unable to promote relatively rapid economic growth in the medium to long terms. China's economic fundamentals, such as the structure of demand, population and the labor supply have changed.

The country must promote growth through innovation and push on with substantial reforms in the economic structure, said Yu.

He also warned of the risks from a slowing economy, including the local government debt crisis, bad bank assets and overcapacity.

China's consumer price index is expected to fall below 4 percent in 2012, said Yu. Meanwhile, inflation will drop below the 4 percent level seen this month. That will see inflation running at an annual pace of about 5.3 percent in 2011, higher the government's target of 4 percent.

The think tank's economic forecast for 2012 is more optimistic than those of most investment institutions, some of which have predicted that China's economic growth might fall below 8 percent next year.

"If the actions to control the ongoing eurozone debt crisis fail, a possible new (global) debt crisis would deal a huge negative blow to the Chinese economy," said Zhang Jianping, senior researcher at the Institute for International Economic Research under the National Development and Reform Commission

Miao Wei, the minister of Industry and Information Technology, said on Monday that industrial output is expected to grow 11 percent in 2012, easing from an estimated 13.9 percent this year.

Chen Jia and Ji Ran contributed to this story.