Inforgraphic

January inflation figure beats forecast

Updated: 2011-02-16 10:40

By Li Woke (China Daily)

4.9% CPI growth less than expected but economists remain cautious

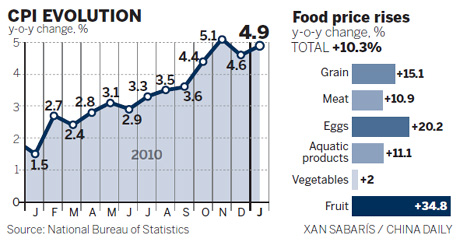

BEIJING - The consumer price index (CPI), a major gauge of inflation, grew a lower-than-expected 4.9 percent year-on-year in January but economists warned that inflation remains a threat that may lead to further monetary tightening policies.

Food prices, which account for about a third of the basket of goods in the CPI calculation, surged 10.3 percent year-on-year.

The latest inflation figure, up from December's 4.6 percent, was close to November's 28-month high of 5.1 percent, according to the National Bureau of Statistics (NBS) on Tuesday.

The surprisingly low figure - compared to market expectations of at least 5 percent - was announced after the NBS said it had reduced the weighting of food prices in the CPI by 2.21 percentage points and increased that of living costs by 4.22 percentage points as home prices rocketed.

The bureau said the adjustment added 0.024 percentage points to January's figure, and denied claims that it had dragged down the figure by 0.3 percentage points.

The NBS said it regularly adjusts the composition of the CPI basket.

In a sign of accumulating pressures, soaring global commodity costs pushed producer prices up 6.6 percent in the year to January, accelerating from 5.9 percent in December and well above the 6.1 percent rise forecast by analysts.

"The large increase in the producer price index (PPI) suggests that price pressures will remain uncomfortably strong, at least for the next few months," Reuters quoted Brian Jackson, economist with the Royal Bank of Canada in Hong Kong as saying.

The NBS attributed the rising prices in January to the lunar new year's demand boom and the severe cold weather in many parts of the country, which cut grain and vegetable production.

"The extremely cold weather and the Spring Festival holiday spending pushed prices up 1 percent from a month ago," it said on its website.

"Although the newly released figure was lower than forecast, inflation will persist for the rest of the year," said Zuo Xiaolei, chief economist at China Galaxy Securities.

The central bank raised interest rates on Feb 8 for the third time since mid-October, indicating more aggressive monetary tightening policies may be in the pipeline.

To mop up excessive liquidity in the market, Beijing has also raised the required reserve ratios for banks seven times since January 2010 and ordered them to tighten credit.

"Those tightening measures are just a beginning," Nomura Securities said in a report.

"China is expected to increase interest rates by 100 basis points this year, and by 125 basis points in 2012," Nomura said.

Price pressures persist as Chinese banks loaned out 1.04 trillion yuan ($157 billion) in January, double the amount for December. The country's total money supply increased 53 percent in the last two years.

Yao Wei, an economist with the Paris-based Societe Generale, said China is expected to raise the reserve ratio for banks several times this year along with two interest rate hikes in the first half of this year.

In addition, the Chinese currency "will continue to appreciate to ease inflation", said Chen Zhiwu, professor with the Yale School of Management.

Despite all the factors pushing up inflation, the government should be able to keep prices under control, Xinhua quoted Ba Shusong, a researcher with the Development Research Center of the State Council, as saying.

He said prices were usually high in the run-up to the Spring Festival holidays, but government measures would take hold and prices would stabilize. China has set a goal to limit inflation to 4 percent this year.

Lu Ting, an economist with the Bank of America-Merrill Lynch, expected a moderate decline in the CPI in February.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.