Economy

Foreign M&As given oversight

Updated: 2011-02-14 07:31

By Wang Xing and Ding Qingfen (China Daily)

Panel will review proposed overseas purchases of domestic companies

|

|

BEIJING - China will establish a ministerial panel to review foreign firms' attempts to buy or merge with domestic companies, laying the ground for the country's first formal process for scrutinizing the national-security questions that arise from international deals.

|

||||

The State Council said the committee will review foreign companies' attempts at buying or merging with domestic companies whose business pertains to defense, agriculture, energy, resources, infrastructure, transportation, technology or equipment manufacturing.

The National Development and Reform Commission, China's top economic planning organization, and the Ministry of Commerce (MOC) will lead the review panel, according to the new rules.

The arrangement forms a part of China's long-term plan to build a formal process to judge the merits of foreign takeovers.

The country launched an anti-monopoly law in 2008 that requires foreign firms to pass tests meant to prove that they pose no threat to China's national security. The law also calls for the protection of important Chinese industries. Such provisions led to the cancelling in 2009 of Coca-Cola's $2.4 billion bid to take over the Chinese fruit juice maker Huiyuan Juice Group.

Before that, multinational firms that wanted to buy or merge with Chinese companies faced little scrutiny and had to meet few requirements.

"The new arrangement is part of China's progress in establishing a modern economic regulatory system, which is good," said Zhang Yansheng, director of the Institute for International Economics Research under the National Development and Reform Commission.

He said China's chief difficulty in enforcing the new rules arises from its scant experience in reviewing foreign acquisitions, adding that China will not use the panel as a weapon to block normal foreign investments.

According to the statement, foreign deals will be evaluated according to their prospective effects on China's economic stability, social order and on its ability to research and develop technology used in protecting national security. The new rules will take effect next month.

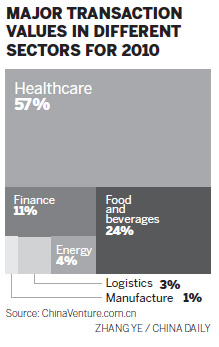

China recorded 1,798 mergers and acquisitions in 2010. The transactions had a disclosed value of $82 billion, an increase of 13.8 percent above the amount in 2009, according to figures from ChinaVenture Group, a Beijing-based investment consulting firm.

And the number of foreign takeovers grew by 57.9 percent over the previous year. Thirty Chinese firms were acquired by overseas buyers in deals with disclosed value of $2.39 billion, according to ChinaVenture Group.

The bulk of the foreign acquisitions last year were made by Japan, the United States and France and mainly concerned companies in the pharmaceutical and beer-brewing industries, according to the research firm.

Chen Gong, chairman of Anbound Group, a private industry think tank, said China should establish its own mechanism to review foreign acquisitions of domestic companies, since many Chinese companies have often been blocked in their attempts at buying foreign companies. He said the evaluation should be open and transparent.

In 2005, the State-owned oil group CNOOC suffered a huge setback when, faced with political opposition, it had to abandon its $18.5 billion bid for the US company Unocal. The US Committee on Foreign Investment is also poised to veto a $2 million deal made by China's Huawei Technologies to buy the assets of the US technology firm 3Leaf Systems, according to a report from the Wall Street Journal on Feb 11.

Wang Zhile, a researcher at the Chinese Academy of International Trade & Economic Cooperation under the MOC, said China welcomes foreign investment.

"The new panel will play an active role in guiding the foreign investment to where it's most needed in China," he said.

According to figures from Dealogic, an international data provider, Chinese companies recorded a failure rate of 11 percent in their attempts at buying or merging with foreign firms. That measure takes into account announced cross-border deals that were withdrawn, rejected or allowed to expire. The rate for the US was 2 percent and that for the UK was 1 percent.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.