Economy

Property tax rule pushing up cost of renting

Updated: 2011-02-12 10:59

By Xu Junqian (China Daily)

SHANGHAI - The government's latest property rules are providing extra impetus for rent increases in many Chinese cities, according to a survey conducted by China Youth Daily.

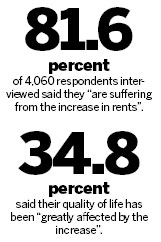

In the survey, 81.6 percent of the 4,060 respondents interviewed said they "are suffering from the increase in rents". Among them, 34.8 percent said their quality of life has been "greatly affected by the increase".

The respondents came from 31 different cities across the country, and nearly 70 percent of them were born in the 1980s.

Not surprisingly, those renting a home in big cities like Shanghai and Beijing were being hit the hardest.

On Jan 28, the Shanghai municipal government introduced the first ever property tax on buyers of second homes. The tax was the latest in a series of measures adopted by the central government in the hopes of reining in soaring property prices. The changes have also included restrictions on the number of homes that can be bought and an increase in the minimum down payments required for purchases of second homes.

And the efforts are not confined to Shanghai. Chongqing municipality has also introduced a property tax.

"House rent has increased by 20 percent since mid-2010, and has climbed to a historic high level," said Li Yongzhe, a real estate agent of Gucheng Agency in Shanghai.

"The government's tightening policy has scared away many potential buyers," said Li. "Instead of rushing to buy homes, many have chosen to rent."

That trend, he and other property agents said, has greatly driven up the demand for rental properties in Shanghai.

Shu Wei, a 24-year-old computer engineer from Central China's Hunan province who is now working in Shanghai, is thinking about moving to a remoter place in the city because he can't afford the rising cost of rent, even though he is sharing a two-bedroom apartment with two other people.

"I wouldn't even think of buying a house in Shanghai now," Shu said. "But housing issues have still become a burden for me."

| ||||

"In the past several years, property prices have not been the only thing that has jumped; commodity prices have undergone a huge increase as well," he said. "Besides, the introduction of the property tax is also adding to the cost of property investment, and landlords are very likely to transfer all of the new costs to tenants."

He Yongfang, a landlord in Shanghai, agreed with Xue's opinion. She said that, while recently signing a contract with a tenant, she raised the rent she charges by 10 percent.

"The price of everything is inflating," said the 53-year-old housewife. "So it's reasonable that I increase my income a little bit."

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.