Inforgraphic

Side effects seen for dealers

Updated: 2011-01-27 14:02

By Li Fangfang (China Daily)

|

|

|

A woman walks by an empty auto-sales shop in Laiguangying, Beijing, on Jan 20. Sales at many auto shops have been slow since the capital instituted new rules meant to reduce the frequency of gridlock in the city. [Photo / China Daily] |

Second-hand sellers' future now in doubt

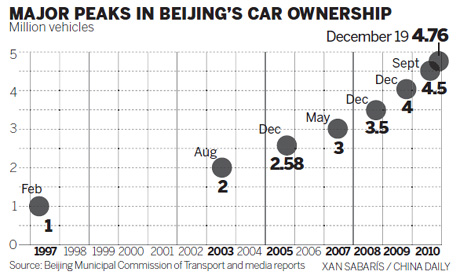

BEIJING - The Beijing government's restrictions on new license plates were meant to contend with traffic congestion, but are simultaneously threatening the livelihoods of many local dealers of second-hand cars.

Even so, the dealers are finding ways to expand their businesses into surrounding provinces.

Because only 17,600 license plates will be issued to individual buyers each month this year, the new restrictions' effects on car dealers, especially smaller dealers without after-sale services, and second-hand car dealers, have been dire.

Some small second-hand dealers in Beijing's south have closed their doors and sent employees home for an early holiday, according to The Beijing News.

"Since only one person out of 11 can win permission to buy a car, nobody who has that permission would buy a cheap second-hand car," said Luo Lei, deputy secretary-general of China Automobile Dealers Association.

"They would rather buy a new car directly instead of using a second-hand car at first for practice."

According to Luo, 90 percent of the second-hand cars collected in Beijing were sold in the Beijing market last year, while 10 percent went to surrounding areas. Yet, because of the restrictions on the issuing of new license plates, "the ratio may be reversed this year," he said.

Lu Yan, director of Beijing municipal commission of commerce, said earlier that the policy of restricting license plates will have a major effect on Beijing's retail industry in 2011.

He estimated the loss caused by the policy will be about 60 billion yuan ($9.11 billion).

The desired growth rate for Beijing's retail industry has been set at 10 percent this year. Lu described that as "quite low", but said the industry will still find achieving such a goal difficult.

| ||||

Chi Yifeng, general manager of Yayuncun Automobile Trade Market, the largest dealership in Beijing, said: "There will be about 300,000 cars sold to second-hand dealers this year in Beijing. If we can sell 10 percent, or 30,000 of them to Beijing buyers, that will be good news."

In order to find buyers, his company began trying new tactics, such as placing car evaluations online. Such information was made available to dealers in Hebei, Shandong, Shanxi, Jilin, Liaoning and Heilongjiang provinces, who were then offered used cars from Beijing, he said.

Another manager with Beijing Jintai Kaiyuan Car Sales Service Co Ltd, who refused to give his name, said the company plans to establish second-hand car agencies outside Beijing in the hope of forming a regional network for its second-hand Citroen car business.

The company is now looking into possible opportunities in second- and third-tier cities in Hebei and Shandong provinces, he said.

But analysts said that until the government commits itself to regulating the second-hand car market, China's second-hand car dealers will face an unclear future.

Su Hui, an analyst with the China Automobile Dealers' Association, encouraged the government to adopt such regulations "as soon as possible".

The association submitted several suggestions to the Ministry of Commerce last year, calling for better governance of China's used-car market.

"A national industry standard on the assessment of second-hand cars is necessary to better protect consumer interests," Su said.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.