Top News

Chinese green investments set to take lead

Updated: 2011-01-07 11:39

(China Daily European Weekly)

|

|

The Chinese organizations are motivated by cost reduction, climate change, enhancing their public image, and retaining and attracting customers, according to the report that was commissioned by Johnson Controls and the International Facility Management Association (IFMA).

In 2010, a survey was conducted among more than 2,800 decisionmakers responsible for managing commercial buildings and their energy.

Ninety percent of respondents in China said they paid more attention to energy efficiency than they did in 2009 and 95 percent indicated that energy efficiency was a priority in planned new construction and retrofit projects.

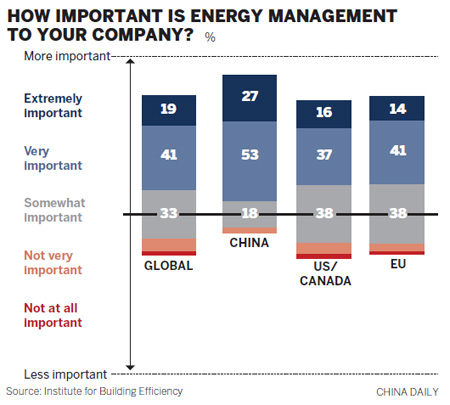

Eighty percent of those surveyed consider energy management very or extremely important which was significantly higher than in Europe (55 percent), the United States (53 percent) and only slightly less than India (85 percent).

Cost savings was the most important driver for energy efficiency investment in China, considered very or extremely significant for more than 85 percent of decision makers.

Chinese business leaders have been varied in their response to economic conditions.

While 42 percent of respondents say they have invested less in energy efficiency over the last 12 months compared to historical levels due to the recession, 58 percent of respondents have actually invested the same or more.

Efficiency investments are a fast and low-risk way to cut operating costs.

In China, planned capital and operating budget investment in energy efficiency was very strong. Nearly all respondents in China planned to make capital (90 percent) and operating (93 percent) investments in energy efficiency over the next 12 months, far greater than the global average.

While enthusiasm for energy efficiency is high, building executives point to several barriers in the way of their energy use reduction goals.

The top barrier among Chinese respondents is uncertainty about the return on investment (34 percent), followed by a lack of technical expertise to identify opportunities (20 percent). In contrast, North America and Europe cite capital availability as the most important barrier.

More than half of Chinese respondents require less than a three-year simple payback when making significant energy efficiency investments.

On average, the maximum allowable payback for efficiency measures among Chinese leaders is 3.4 years, compared to an average of 3.1 years among the global sample, 3.2 years in the US, and 2.8 years in India.

A large fraction of facility leaders in China are also considering renewable energy technologies as part of their new construction or building retrofit projects, including: Solar thermal (74 percent), geothermal (34 percent), solar electric (68 percent), biomass (29 percent) and wind (43 percent).

China Daily

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.