Photos

For investors, glamorous bounty lies in looted treasures

Updated: 2010-12-15 09:32

By Cheng Yingqi (China Daily)

Sale of the centuries

The global economic crisis did not only strike down some of the world's biggest financial institutions, it also shook investors faith in the traditional markets, such as property and gold. Enter the art market.

"In a sense, art (and antiquities) started to look relatively safer for emerging Chinese entrepreneurs, as long as the works were authentic," said Wang Dingqian, president of My Humble House, a Taiwan antique dealers.

The price gap between relics from the reigns of emperors Qianlong (1735-95) and Yongzheng (1722-35) is a good example of the impact of hot money. Although experts believed first-class chinaware from Yongzheng's rule is more exquisite, Qianlong items attract high prices.

Yongzheng was on the throne for only 13 years, while Qianlong ruled for 60 years, "so less chinaware was produced under Emperor Yongzheng," explained Liu at Rongbao.

"The limited number puts constraints on the total value of Yongzheng chinaware in circulation," he said. "People are naturally inclined to turn to bigger markets and, consequently, without hot money driving up the price, (items) does not reach the same prices as Qianlong chinaware."

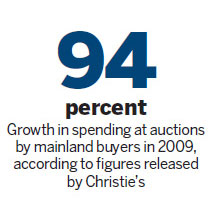

Wang also said he believes the growing influence of mainlanders at auctions is in step with the country's economic development, and that a nation's financial clout determines the depth of its collectors' pockets.

The market for Chinese art, including calligraphy, oil painting and chinaware, started to expand in 2003 amid decline in the domestic stock and stamp market and roaring international gold prices. That year, the country's per capita GDP was $1,090 and cultural consumption volume was 580 billion yuan. Today, those figures have risen to about $3,100 and 700 billion yuan respectively, according to data published online by the Ministry of Culture.

|

||||

"The price of Chinese artwork has been low for a long time because Chinese people used to be poor," said Wang. "The price hike is a signal of China's growing economic force, especially post-financial crisis.

"In the past, Western people bought more chinaware, so we went abroad to buy antiques. Now Chinese people are buying more the auction houses are coming to us."

Auctions for chinaware before 2000 were primarily held in Europe and the US but are now in Hong Kong, while sales of ancient Chinese paintings and calligraphy have slowly shifted to the Chinese mainland.

Sotheby's now hosts exhibitions twice a year in Beijing and Shanghai to introduce the world's art masters, such as Van Gogh and Picasso, to the mainland audience.

"It's a long-term plan," added Sotheby's executive Chow. "I believe that when China's nouveau riche want to buy art, they will buy the classics."

|

|

|

|

|

|

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.