Credit agency boss gives a low rating

Updated: 2015-11-20 08:14

By Cecily Liu(China Daily Europe)

|

|||||||||||

Methods used are too US-centric and contributed to world financial crisis of 2008, he says

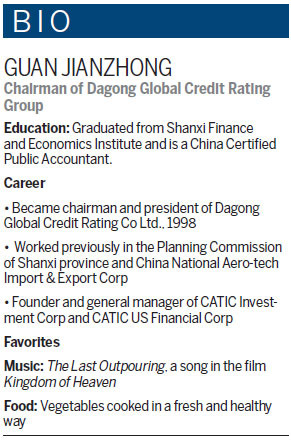

Restructuring the international rating system is the only way to promote the recovery of the world economy, and China can play a leadership role, says Guan Jianzhong, chairman of Dagong Global Credit Rating Group.

The new rating system must be able to determine the debtors' ability to repay loans in the future based on the way they pay loans today, as opposed to simply observing that they have made the loan repayment, he says.

|

Guan Jianzhong, chairman of Dagong Global Credit Rating Group, says the international rating system should be restructured. Cecily Liu / China Daily |

Guan, who developed the first Chinese credit rating methodology and established the first credit rating Postdoctoral Research Station in China, is a keen thinker with a particular focus on financial markets. He is also well known in China for having published several influential books on the global financial system and the thinking behind ratings.

He is pushing for a new world order for credit rating, convinced that the current US-centric systems are flawed and must be changed fundamentally to bring the world out of its economic malaise.

"The world credit rating system is dominated by US-headquartered rating agencies, and their ideology is very US-centric. I think their rating strategy made a big contribution to the 2008 financial crisis, which essentially was caused by debtors unable to pay back the excessive amounts they borrowed," Guan says in an interview in London where he spoke at the Boao Forum for Asia Financial Cooperation.

"I think it is wrong for the world's debtors to guide our thinking on how rating should be done. Instead, creditors should have more say in the rating system as it ultimately serves their interest a lot more."

Dagong, founded in Beijing in 1994, has a different method of analyzing credit. Fundamental to this is the examination of the way debtors repay their loans, which contrasts with many Western rating agencies' method of just analyzing whether a loan is being repaid, Guan says.

For example, a company that repays a loan by revenue collected in the day-to-day running of the business is rated highly, compared with one that pays loans by selling illiquid assets or borrows from other sources, which are rated less favorably because these sources of funding are classified as unsustainable.

"To correctly rate risks is very important because rating determines resource allocation," Guan says. "If the most reliable and productive debtors receive access to funding they will make a big contribution to economic growth, and to get this right is the driver for world economic recovery."

The three major US credit rating agencies - Standard & Poor's, Moody's and Fitch - have set up their credit rating service networks worldwide and controlthe credit ratings markets.

After analyzing these credit rating agencies' ideology, Guan discovered that they all use a country's political and economic system and financing capacity to determine the sovereign credit rating, a method he disagrees with.

More specifically, these agencies have five key criteria to determine sovereign ratings: political reliability, economic strengths, economic outlook as measured by the openness of its economy and financial markets, the independence of the central bank to issue currency, and the government's financing capacity.

"This ideology is fundamentally flawed. It explains why a country like the US is able to claim that it will never fail to repay debts no matter how indebted it becomes, because the answer is that its government is able to print money to repay debts," Guan says.

Today's Top News

China ready for risks after yuan included in SDR

Premier League coaches to aid China's soccer goal

Chinese companies invest in City Football Group

Investment expected as Xi arrives in Zimbabwe

Xi's Zimbabwe visit to elevate bilateral ties to new high

Xi says climate summit a 'starting point'

Xi warns against mentality of zero-sum game

What world leaders say about the planet's future

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|