Europe awash in cheap cash, eurodollar in long-term fall

Updated: 2012-03-05 08:07

By Daryl Guppy (China Daily)

|

|||||||||||

|

Europe is now awash with cheap money. This comes from the second round of the European Central Bank lending. This is the longer-term refinancing operation and it has boosted investor confidence. Many observers believe it does little or nothing to address the core problems of the eurozone debt crisis.

The first round of cheap ECB loans for banks held the European financial system together but some predict European banks will hoard this new cash rather than buying sovereign bonds or lending to business.

In the short term this removes the bulk of the refinancing risk facing European banks, which are overweight on sovereign bonds from Greece, Italy, Spain and other weaker European countries. The largest holders of Greek debt are French banks and, in turn, the largest holders of French bank debt are American banks. Longer-term refiancing seems an ideal solution for everybody, even if the repayment deadline has been pushed out to just three years.

The offer of three-year loans at 1 percent interest is a gift for the banking sector. This longer-term quantitative easing could reach 1 trillion euros ($1.35 trillion). The ECB has gifted cheap money to the banks that banks have then lent to governments in Italy and Spain at substantial premiums. The cheap money has flowed into the weakest sectors of the eurozone.

Almost two thirds, or 325 billion euros, of the first round of the longer-term refinancing program in December was taken up by banks in Greece, Ireland, Italy and Spain. Some complain that this is no longer a European Union but a Transfer Union with money flowing from the North to the South of Europe.

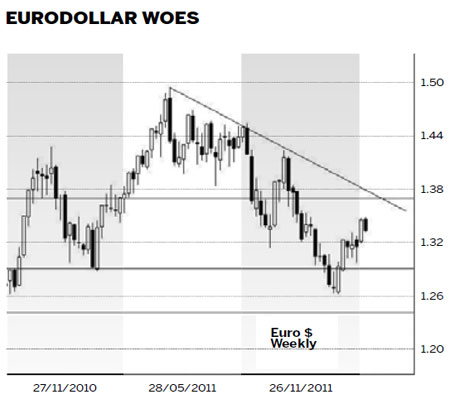

Eurozone confidence about the euro is shown in the volatility of the eurodollar chart. It's useful to step back from the volatility of daily trading and look at the bigger picture using a weekly chart. This puts the daily price activity into a broader context.

The first reaction to the December longer-term refinancing was to push the eurodollar down. The eurodollar fell quickly below the $1.29 level. The next strong historical support level was near $1.24 but the eurodollar developed a rebound from near $1.26 with a rapid rise above the support stance level near $1.27.

The latest round of longer-term refinancing may have a similar effect so traders are ready to short the eurodollar with a decline from $1.35 toward support near $1.27. This is a fall of around $0.04 and is slightly larger than the December reaction fall.

Optimists will see a rebound from $1.29 and a continuation of the current upward trend. These are short-term reactions and they must be put into a broader context.

The eurodollar remains in a long-term downward trend. The downward trend starts from the May 2011 high at $1.49. The failure of the rally in September and again in October provided the three anchor points to confirm the position of this downward trend line. This is now a sustained and well tested downward trend line.

The general trend direction remains down so traders treat any move toward $1.37 as a rally. This suggests that any rally in the eurodollar will encounter strong trend-line resistance near $1.37. This level is also a strong historical resistance level. This gives two strong resistance features that will make for a strong downward trend and a high probability that the eurodollar will retreat from the $1.37 level.

The downside targets are provided by the historical support and resistance levels. The stronger support level is near $1.29. This is the upper edge of a broad consolidation band that stretches between $1.24 and $1.29.

The continued reaction retreats away from the downward trend line, suggesting a steady move toward testing support near $1.29. This is the initial downside target .

The eurodollar volatility means rises of $0.10 can develop within two to three weeks. Falls of $0.10 can develop just as quickly. This makes for interesting trading but it is very difficult for export and import industries.

The strength of the downward trend suggests the latest round of liquidity will not be sufficient to change the long-term direction of the trend although it will contribute to rally and retreat behavior within the environment of the downward trend.

The author is a well-known international financial technical analysis expert.

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|