Hospitable gateway to Europe

Updated: 2014-03-14 12:44

By Cecily Liu (China Daily Europe)

|

|||||||||||

ICBC bullish on yuan business growth in Luxembourg and beyond

Industrial and Commercial Bank of China, the world's largest bank by market capitalization, is banking on the favorable investment climate in Luxembourg to provide the springboard for its expansion plans in Europe, a top bank official says.

"Luxembourg is an important financial center in Europe, with efficient regulations, obvious geographical advantage, and a government that readily welcomes foreign investment in the country," says Gao Ming, chairwoman of ICBC Europe.

According to Gao, Luxembourg is not only the largest investment fund center in Europe, but also a leading destination for private banking in Europe. This was also why the bank chose the grand duchy to be its European headquarters, she says, adding that it now also has a presence in seven other European cities.

"The advantage of Luxembourg being a small country is that we feel we are close to the government and close to the regulators. If the regulators require anything from us, they will tell us. If we have any questions for the regulators, they will answer fast," Gao says.

She says that Luxembourg's central location facilitates the flow of talent in the financial services industry and also improves the city's competitiveness. Through the speedy implementation of the European Union directives, Luxembourg has also ensured that there is adequate investment protection.

Gao feels that the biggest draw for Chinese lenders is that being a part of the Schengen area, the company employees based in Luxembourg can easily travel to other Schengen countries for business.

ICBC first had a presence in Luxembourg in 1998 as a representative office, which was quickly upgraded to a branch in 1999. In 2006, ICBC established a subsidiary in Luxembourg, in order to prepare for the bank's expansion to other European countries using the European Union's single passport policy.

In January 2011, ICBC established five European branches, in Paris, Amsterdam, Brussels, Milan and Madrid. At the same time, ICBC (Luxembourg) S.A. changed its name to ICBC (Europe) S.A., to signify its position as the bank's European headquarters.

"At that time, Europe was still under the shadows of the financial crisis with a heavy atmosphere, and the opening of the five ICBC branches really helped bring hope," Gao says.

The five branches quickly grew, and all of them achieved profits in the first six months of their operation, in June 2011. Having achieved success, ICBC then established Warsaw and Barcelona branches in November 2012.

Gao says ICBC Europe now employs a strong team of 300 people, of which 80 are based in Luxembourg. Additionally, ICBC also has a branch in Frankfurt and a subsidiary in London. Although both entities are managed by ICBC's head office in Beijing, they deal with ICBC Europe extensively for businesses on a daily basis.

In 2012, ICBC also established three centers, focusing on cash management, private banking and investment banking. All three centers are located in Paris, a city frequently visited by Chinese outbound business delegations.

Gao says these centers' establishment signifies a milestone for ICBC Europe, expanding the bank's business focus beyond traditional retail and commercial banking activities such as deposits, loans and trade finance.

She says one factor behind ICBC Europe's focus on investment banking is the growing number of Chinese outbound merger and acquisition deals in European countries in recent years.

"We can help provide financial consultancy to Chinese companies at early stages of the M&A process, followed by services like evaluating the cost of the M&A activities once a target is found. We also help clients structure a deal, and in the post-M&A stage offer clients commercial banking services," Gao says.

ICBC Europe's private banking service has helped many of the bank's existing clients, who are high net worth individuals, to invest in Europe. Investment options range from real estate and luxury products to acquisitions of small businesses, for example, vineyards. It also helps Chinese clients manage immigration into Europe through the investment route.

ICBC Europe has also helped European clients to invest in renminbi products and opportunities in China, and has been closely working with the team in Beijing on new yuan products, Gao says.

More opportunities are in the offing in line with the rapid internationalization of the Chinese currency in recent years, she says, adding that investors in overseas financial centers like Luxembourg can now invest in overseas and domestic renminbi products.

An ideal example of opportunities emerging in recent years is the Renminbi Qualified Foreign Institutional Investor (RQFII) scheme, launched by the Chinese government in 2011, which allows overseas institutional investors to invest in China's financial markets.

Such opportunities have sparked the interest of many Western financial centers, including Luxembourg, London, Frankfurt, Paris and Switzerland. To compete for such opportunities, financial services players in each center are now keenly developing renminbi products and services, she says.

London, for example, received a RQFII quota of 80 billion yuan ($13 billion;9.4 billion eruos) last year, agreed on during British Chancellor George Osborne's visit to China. Luxembourg's Finance Minister Pierre Gramegna recently said that he will express his wish for Luxembourg to be granted a RQFII quota during his upcoming visit to China.

Aside from government efforts, private players in Luxembourg and other cities are also quickly warming up to new renminbi products and services and are ready to prove their capabilities and generate revenue from the investment opportunities, Gao says.

ICBC Europe helps many Chinese and European traders to finance and invoice their transactions in the renminbi currency. It also helps businesses to manage their offshore renminbi accumulated as a result of business transactions.

ICBC Europe, Gao says, also helps European companies to issue renminbi bonds and cites the example of the 750 million yuan bond its client Renault issued last year, along with ICBC Asia in Hong Kong.

Other examples of cross-border renminbi services ICBC Europe provides include renminbi deposits, loans, foreign exchange and derivatives trading, remittances and liquidity support for renminbi accounts.

ICBC Europe's revenue from renminbi businesses has grown to 35 percent of its total profits for the year ending December 31, 2013, as a result of high demand for renminbi businesses in Europe. About 24 percent of ICBC Europe's assets are now denominated in renminbi, says Gao.

In 2011, ICBC Europe became the first European-domiciled bank to be approved by the People's Bank of China to enter the China Inter Bank Bond Market. Today, the bank invests about 1.9 trillion yuan in this market.

"This is really a milestone for us. We can invest the offshore renminbi we accumulate in Europe into China's domestic bond market, which gives us good returns. We can also use this capacity to do lending and financing for businesses," Gao says.

Last year ICBC Europe established a new renminbi clearing service, which allows renminbi transactions against other currencies made in Europe to be cleared in real time, through ICBC's networks globally.

Gao says the clearing facility greatly supports renminbi trade and investment transactions in Europe, as a reliable clearing platform would help clients to exchange renminbi for any currency, when required.

Although there is no agreed definition of an official offshore renminbi center, some academics believe the existence of an official clearing bank is a prerequisite. Official clearing banks typically work with the People's Bank of China, the central bank, directly to settle cross-border transactions.

Gao says that while banks like ICBC Europe can facilitate the clearing of renminbi services through their own channels, having an official clearing bank would certainly improve the liquidity of renminbi transactions in Luxembourg, in addition to providing "an image boost" for the country's efforts to become an offshore renminbi center.

She says Luxembourg's historical advantage as a financial hub for funds and private banking already gives it a head start in the offshore renminbi race.

"Going forward, I think Luxembourg should press ahead with its agenda of building up the renminbi businesses," Gao says.

She adds that if Luxembourg is successful in its request to gain a RQFII quota, then many more opportunities would open up for investors. ICBC Europe, Gao says, hopes to play an important role in the growth of Luxembourg's renminbi businesses, due to its unique advantage as a Chinese bank with competitiveness in the European market and a diverse range of services.

"We want to be the bank of choice for Chinese clients coming to Europe and for European clients investing in China," she says.

cecily.liu@chinadaily.com.cn

|

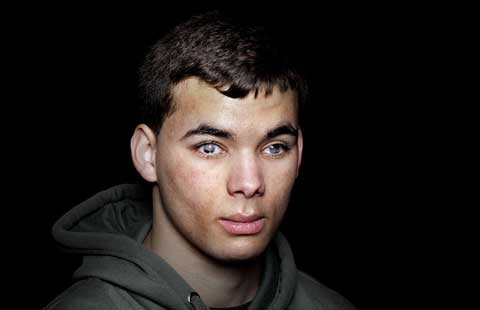

Gao Ming, chairwoman of ICBC Europe, says that Luxembourg's central location facilitates the flow of talent in the financial services industry. Cecily Liu / China Daily |

( China Daily European Weekly 03/14/2014 page18)

Today's Top News

US rejects Crimean vote, citing sanctions

Probe focues on missing jet's pilots

Source: Vodafone to buy Spain's Ono

Crimea votes to join Russia

Alibaba opts for IPO in US

Stronger police presence urged

Crimea kicks off referendum

G8 prepares expulsion of Russia

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|