It is time to come out of the shadows

Updated: 2012-03-23 08:46

By Giles Chance (China Daily)

|

|||||||||||

The major geopolitical consequence of the credit crisis of 2008 has been to push China out from behind the shadow of the West to stand in the front on its own. The chronic economic weakness of the United States and, more recently, Europe has left a vacuum in global leadership. By virtue of China's size and economic strength, it has to fill at least part of that global power vacuum whether it wants to or not. In my book Is China Ready I ask whether China is in a position yet to take on these large new responsibilities or whether the Western credit crisis came too early for China, by a decade or two. In the Financial Times of London a couple of weeks ago the British financial journalist John Gapper demanded that China stop telling the world it is a poor and developing country, and asked it to face up to its responsibilities as a leader of the new world order.

But for China to pass from isolation and poverty to playing a leading world role, within the space of 30 years, places a heavy responsibility on the country's leadership. This is especially so in a world in which globalization and advances in media have brought every computer and television screen into the most private processes of government and decision-making. It is only reasonable to expect that China will take a few years, at least, to develop its full capacity to exercise global power and influence alongside the US and Europe. How long can China delay taking up its position of global leadership?

In the world of international finance, China has already become a global leader. The huge capital needs of China's economy are driving a revolution. In 2010 the Hong Kong stock market led the US, London and Tokyo in the amount of new equity sold by companies to investors through initial public offerings, making up one-third of the $235 billion of capital raised in this way. As a result, Hong Kong and Shanghai have become the new hot space for global financial institutions, ranging from commercial to investment banking, from private equity to insurance.

Yet it is the size of China's savings, rather than China's huge need to raise capital, that has really given China global leadership in international financial markets. China's large stock of foreign exchange and its position as the world's largest creditor not only give it the prospect of financial returns from its foreign savings in future years, but also real muscle in the international financial and political arena, particularly with respect to the US, the world's largest debtor.

Since the late 1990s China's success in using its huge and skilful labor force to make and export labor-intensive products that the rest of the world needs has made China into the world's largest exporter. China's booming exports have built up the stock of Chinese earnings held in foreign currencies to become the world's largest store of foreign exchange. China has been widely criticized around the world for running huge trade surpluses that destabilize the global economy and hollow out the labor-intensive industries of the US and Europe.

Yet most of China's trade surpluses have resulted from huge foreign companies, like Wal-Mart and Carrefour, increasing their product sourcing from Chinese factories. The vice-governor of the People's Bank of China, Yi Gang, estimated publicly three years ago that more than three-quarters of China's trade consisted at that time of "processing" trade, whereby China imports components and raw materials mainly from neighboring Asian countries, and re-exports the finished products to developed markets, after assembly and packaging in China. In this situation, an increase in the dollar value of the Chinese currency would not, on its own, make a lot of difference to the pattern of China's trade with the US and Europe, because an increase in the price of the exported product in dollars would be matched by a corresponding increase in the imported price.

But on a per capita basis, the size of China's reserves held in foreign currencies shrink beside those of a number of other rich countries with smaller populations, such as Japan, Singapore and Norway. Hundreds of millions of Chinese families remain poor, yet the aging of China's population and the shrinking of the Chinese labor force from about 2015 will reduce China's economic growth rate. Thus, the investment return on China's stock of foreign savings will become a vital factor in improving Chinese living standards in the years ahead.

This important reality was directly addressed by China's leadership when the China Investment Corporation was established in 2007 to oversee the management of China's overseas financial assets. China has been pushed into a position of global financial and economic leadership by the need to protect the value of China's overseas savings for future generations of Chinese.

When China began to run large trade surpluses, initially these were reinvested mostly back into US dollars, because the foreign earnings had been generated in dollars, and the US possessed both the world currency and the world's largest and most liquid financial markets. From about 2004, China became one of the largest financers of borrowing by the US government.

But the financial crash in 2008 revealed the weakness of the US economy and its currency. China needed to find ways other than investing in dollars to maintain the value of its savings. But the two other large global financial markets in Europe and Japan do not present alternatives that are much more attractive than the US, in terms of safety and long-term investment return.

A longer-term solution to China's global investment problem is to remove the risk of foreign currency depreciation against the yuan by attracting foreign companies and institutions to China's own financial markets to borrow and raise equity capital. For this approach to work, though, China's own financial markets need to become big, safe and open to foreign companies and institutions, and the Chinese currency has to become globally traded on a 24-hour basis.

China is starting to develop this position by using its position as the world's largest exporter to increase trade settlement in renminbi. A renminbi currency area has started to emerge, spreading outward from East Asia to emerging countries including Russia, India and Brazil, as far as Europe, with Hong Kong and London proposed as the two main renminbi trading centers. As the renminbi evolves over the next few years into a major global currency, China will be able to invest its savings into securities denominated in its own currency, thereby reducing the dangers that derive from foreign currency depreciation and foreign credit risk.

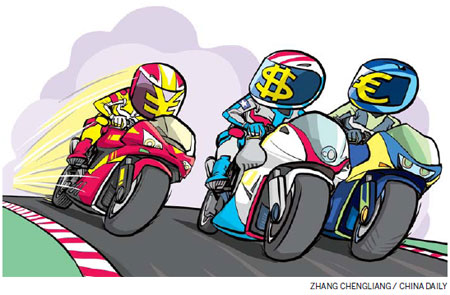

In this way the renminbi will inevitably become a reserve currency, one the central banks of other countries will use to back their own currencies. It is possible that within a decade there will be three major currencies in the world: the euro, the dollar and the renminbi. But can the euro and the dollar survive as reserve currencies if the US and Europe fail to recover from their severe economic problems?

Of course we don't know the answer to this question, but it illustrates the weight of responsibility that rests on China's currency, and on the country's central bank, which issues it. China will gain large economic benefits from having the renminbi as a major global reserve currency, including cheaper and easier borrowing, and the profits that come from the interest paid on renminbi-denominated securities held by central banks outside China.

But with those benefits come the responsibilities of playing a major, even perhaps the major, role in world international financial and monetary affairs. Presently the International Monetary Fund, based in Washington, is the major world forum for managing the global financial system. And since 2008 the G20 countries have overtaken the US-centered G8 as the central global organization for monitoring and managing the world economy. It is essential both for the future of China and of the world that China is a leader in these global economic and financial institutions.

China may not wish to come from behind the shadow of the US into a central position on the world stage, but the time for China to become a global leader in economic and financial affairs is now.

The author is a visiting professor at Guanghua School of Management, Peking University. The views do not necessarily reflect those of China Daily.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|