How to get them back to the banquet

Updated: 2012-03-02 08:49

By Drew Bernstein (China Daily)

|

|||||||||||

As an auditor in China since 1999 whose firm serves as the independent auditor for over 25 Chinese companies and as an independent director of two Chinese companies, I have spent hundreds of hours on early morning conference calls, logged hundreds of thousands of miles on trans-polar flights, visited perhaps 100 Chinese cities and sat through hundreds of board meetings. Along the way, I have learned a lot about the differences between the US and Chinese business culture and how each reacts to challenging business situations.

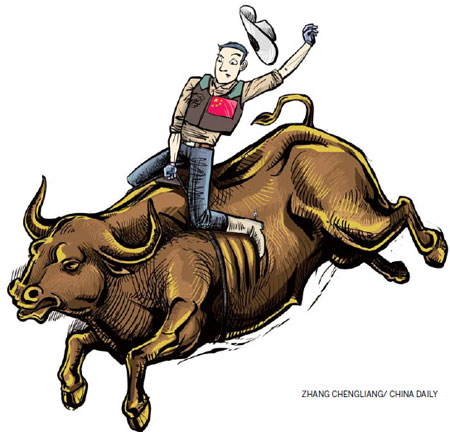

The last 18 months have presented the most challenging business environment for US-listed Chinese companies, many of which have been the subject of a blistering firefight between short sellers, who seem to believe every Chinese company is fraudulent; and Chinese management, many of whom believe they have been unfairly victimized or slandered for short-term profit. The individual exchanges have increased scrutiny of US-listed Chinese companies, and many Chinese companies themselves appear to have given up on being public altogether in the US markets.

That said, the stocks of US listed Chinese companies have started to show signs of life in the early part of 2012, after their share prices were obliterated last year. While investors may not have returned to the banquet table with huge appetites, they are nibbling around the edges. Over the next two months most Chinese companies will complete their annual audits in a stringent new environment, in which the quality audit firms will use expanded procedures and demand a very high standard of compliance.

The theory is that if the companies survive that process, investors may start to have a little more faith in their financial numbers and Chinese companies will re-emerge as valuable investment opportunities. There is no question that the past 18 months have taught us some hard-won lessons that we need to remember. Here are a few important warnings, and the lessons to be drawn from them:

Warning 1: Know what you own

Several years ago it was not uncommon for investors to take a position in a stock simply because it had the word China in its name and was part of a large, high-growth market. Funds that would typically perform extensive due diligence before investing in a US company seemed to throw the rules out of the window when it came to China. The investing public suffered from a serious communication deficit and as a result there were many misunderstandings between investors and the Chinese companies in which they invested. Investors need to make sure that they have a clear understanding of the Chinese marketplace, management's short-term and long-term goals and legal ownership structure so that the investors can properly underwrite the investment and its risks.

Lesson 1: If you don't know China you will probably lose money there.

Warning 2: There are no shortcuts to reliable numbers

You cannot have reliable numbers in China unless you have good internal accounting and good external auditing. The problem is that there is limited supply of both, so costs can be high. Chinese companies in second- or third-tier cities have a difficult time attracting CFOs from the limited pool of Mandarin and English speakers with a high-level understanding of US generally accepted accounting practices (GAAP) and internal controls. Many Chinese companies now regret having chosen a small US firm without significant resources or experience, or uninsured Chinese mainland or Hong Kong firms that are outside the jurisdiction of regulatory inspections of the Public Company Accounting Oversight Board (PCAOB).

When choosing an audit firm for a Chinese company, ask a few simple questions: Do they have significant Chinese staff with strong expertise in US GAAP accounting? Do they perform the audit without contracting out any significant functions to other local Chinese firms? Have they been PCAOB reviewed without significant deficiencies? And do they carry US liability insurance? If they meet those criteria, the firm is likely to be a good choice.

Lesson 2: Accounting in China is only as trustworthy as the professionals involved, so choose wisely.

Warning 3: Disclose, disclose, disclose - and then disclose more.

The dozens of class action lawsuits filed over the past 18 months against US-listed Chinese companies follow a basic model - either the company failed to disclose negative information promptly or it made disclosures that were deliberately misleading about the nature of the business or certain transactions. In a culture where "face" is important, some Chinese companies have failed to appreciate the importance of strong, timely disclosure. Over the course of my practice I have seen countless cases in which Chinese companies announce deals before their counsel and other professionals have reviewed the underlying contracts, or fail to communicate effectively with their investor relations firms. These companies have painted targets on their backs and are now facing the consequences of the class action plaintiffs' bar.

Lesson 3: Chinese companies must tell the market the good, the bad and the ugly to survive.

Warning 4: Fully inform your professionals

If you were faced with a potentially serious illness, would you go to your doctor and give a partial or misleading description of your symptoms? Amazingly, this is common practice for some Chinese companies in the way they deal with their professionals and the share price. The consequences are often dictated by the initial steps that the information can lead to: delisting, class action lawsuits, director resignations, and share price decimation. It is not enough to have a strong core team of legal, auditors and investor relations advisors. Management must tell them the full picture quickly and accurately so they can get the best possible advice. If not, a minor ailment can soon develop into a terminal illness.

Lesson 4: Don't let your surgeon operate with one hand tied behind the back.

Warning 5: Before you pull the trigger, take a deep breath

When a crisis hits, people's blood pressure rises, their voices grow tense, and they may rush important decisions. An independent investigation of a Chinese company is one of the most uncomfortable experiences there is. I have seen many cases where the temperature rises and the process grinds to a halt over relatively minor issues and misunderstandings. While I would not wish one of these investigations on anyone, once you are embroiled in it you need to be patient and be prepared to over-communicate at each stage of the process. If you feel the process is going off the rails, take a deep breath, let everyone's emotions subside, and usually you will be able to move forward and possibly even come out of the process with deeper mutual respect.

Lesson 5: Move quickly but deliberately in the face of a crisis.

The author is co-managing partner of Marcum Bernstein & Pinchuk. The views do not necessarily reflect those of China Daily.

(China Daily 03/02/2012 page9)

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|