Reform 2.0

Updated: 2012-03-02 08:47

By Andrew Moody (China Daily)

|

|||||||||||

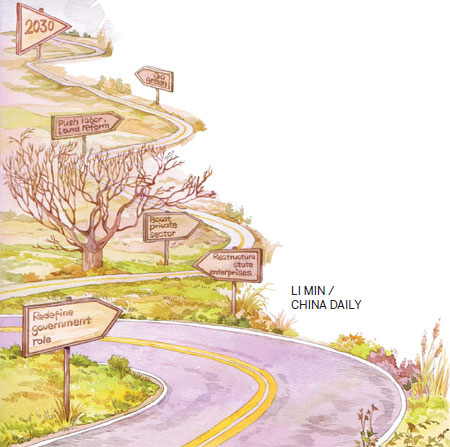

Three decades of reforms have served China well, but country has reached a turning point in development path

China needs to change if it is to join the top league of wealthy nations by 2030, according to a road map for reform set out in a near-500 page document produced by the World Bank. It calls for major market reforms throughout the economy and, in particular, a fundamental restructuring of China's State-owned enterprises (SOEs), which dominate the key strategic industrial sectors.

|

||||

The report, co-authored by the Development Research Center (DRC) - which reports directly to China's top governing body, the State Council - warns of the dangers of the economy facing slower growth if changes are not made, and points to the risks of the country falling into the so-called middle-income trap.

This is where economies remain stuck in the rut of being cheap manufacturing centers and fail to move on to the next level of development - a problem that has beset such countries as Venezuela and Argentina.

The report, China 2030: Building a Modern, Harmonious and Creative High-Income Society, has attracted much coverage with The Wall Street Journal saying it was a warning that China was facing an "economic crisis" if deep reforms were not implemented.

But Robert Zoellick, president of the World Bank, who was in Beijing this week for the report's launch, insisted however, that China was not facing any impending reverse.

"I see it as more of an issue of stress points that will expand over time, rather than a crisis," he said.

"The case for reform is compelling because China has now reached a turning point in its development path. Managing the transition from a middle-income to a high-income country will prove challenging; add to this a global environment that will likely remain volatile for the foreseeable future and the need for change assumes even greater importance."

The report sets out six strategic directions for China: making the transition to a market-led economy, including structural reform of SOEs; accelerating the pace of innovation; seizing the opportunity to "go green" so as to ease current environmental stresses; developing a better social security and healthcare system; strengthening the fiscal system and ensuring better funded local authorities; and, finally, seeking mutually better relations with the rest of the world.

But the one that has grabbed the headlines is reform of the SOEs, which control half of the industrial assets of the country.

They dominate most of the major industrial sectors and range from the big banks such as Bank of China, through oil companies like Sinopec to airlines such as Air China.

Many of the larger ones have shares listed on major stock exchanges around the world but are regulated by the State-owned Assets Supervision and Administration Commission (SASAC).

Because they employ so much of the country's capital and labor resources, they are key to any market-driven reforms in the economy.

Klaus Rohland, the country director for the World Bank for China, based in Beijing, would like to see the number of large-scale SOEs reduced from the current 117 through major privatizations and sell-offs.

"You could probably run this number down quite considerably but we don't provide any numbers in the report," he says.

"We believe the number of sectors reserved for strategic enterprises is way too large and there are a number of areas that the State-owned enterprises are in, where you just don't really understand why this would be strategic."

He says it is important for SOEs to be exposed to more competition from private enterprises.

"One of the key things is to keep working with the State-owned enterprises to ensure they are at least exposed to some competition."

Michael Spence, a Nobel Prize winner and professor of economics at New York University's Stern School of Business, speaking from his home in Milan, Italy, says the China 2030 report had echoes of China's current 12th Five-Year Plan (2011-15) on which he was an external adviser.

"I think it is kind of consistent with the way the 12th Five-Year Plan is put together and the more progressive side of policymaking in China."

He adds there should be no pressure for China to suddenly change course and adopting the current Western model.

"I don't think moving to the Western model with governments that are excessively leveraged and with insufficient assets to deal with the liabilities they have undertaken is especially a good idea," he says.

One of the major questions, however, is whether without the sort of reforms outlined in the report, the economy could be heading for a crisis.

Duncan Innes-Ker, senior economist, Economist Intelligence Unit and who believes the report reflects an interesting debate going on in China, says the real problems could emerge after 2020.

"This is a very real and big concern on a number of different scales. You have got the demographic problem of the labor force beginning to contract and the economy is going to be moving to being much more consumption-driven, so containing inflation is going to be a much bigger problem," he says.

"You have also got the added problem of not being able to increase productivity by taking workers from agriculture and moving them into the urban sector. Productivity gains will only be achieved by better training of workers and moving into higher value added sectors."

Oliver Barron, head of NSBO China, a Chinese government policy investment research house, says there is often too much focus on China heading for a crisis since crises are the natural order of things for most economies.

"If you just take the United States, it had the savings and loans crisis of the 1990s, the dotcom bubble around 2000 and then we had the financial crisis in 2008. They are part of a natural economic cycle," he says.

Today's Top News

Rescuers race against time for quake victims

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Telecom workers restore links

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|