Gold rush

Updated: 2011-11-04 08:53

By Alexis Hooi and Yan Yiqi (China Daily)

|

|||||||||

Bright prospects for precious metal in China as growing economic might, global financial uncertainties fuel demand

| ||||

"Counters are always swarmed with buyers, regardless of whether prices go up or down," says Caibai saleswoman Zhang Caixia.

Caibai is one of Beijing's premier locations for gold products. On Sept 25, the store lowered gold jewelry prices for the second time this year, from 432 yuan ($68, 50 euros) a gram to 419 yuan. Weeks earlier, gold prices had climbed to record highs.

Recent deals like these have helped fan a frenzy for gold among increasingly affluent Chinese buyers, as more turn to the precious metal as a form of investment amid global economic and financial uncertainty.

China now ranks second in terms of consumer demand for gold, behind India, based on latest available figures from the World Gold Council (WGC), the major market development organization for the gold industry.

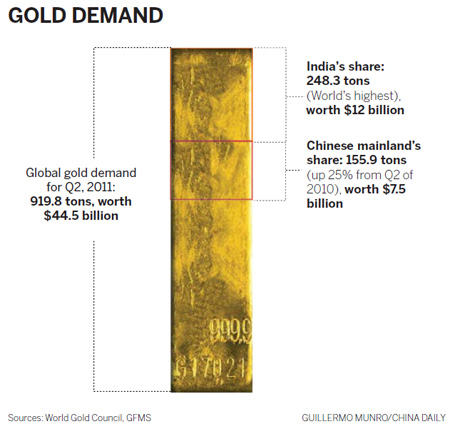

Gold demand on the Chinese mainland in the second quarter of this year (Q2) alone hit 155.9 tons, worth $7.5 billion (5.5 billion euros), the WGC reports. In contrast, India's demand stood at 248.3 tons, worth $12 billion, during the same period.

In terms of gold bars and coins, Chinese buyers on the mainland actually overtook their Indian counterparts to snap up 90.9 tons of the metal in the first quarter of the year. That amount was about 5 tons more than those purchased by Indian buyers, WGC reports. But Q2 saw Chinese mainland gold bar and coin investors falling back behind buyers in India and purchasing 53 tons, about half the amount of India's 108.5 tons.

Global gold demand for Q2 was 919.8 tons and worth $44.5 billion, the second highest quarterly value on record, the WGC says. Gold prices also reached a series of record highs in Q2 and the average price for the period rose 26 percent year-on-year and increased 9 percent over the previous quarter, the council says. After peaking at $1,541 per ounce (28.35 grams) in early May, gold corrected back below $1,500 per ounce.

Despite the high prices, Chinese demand for gold grew about 25 percent in Q2 compared to the same period last year and the growth is "likely to continue due to increasing levels of economic prosperity, high levels of inflation and forthcoming key gold purchasing festivals", the WGC says. Conversely, consumer demand for gold in the United States dropped 22 percent to 44.5 tons during the same period. Europe, excluding the erstwhile Commonwealth of Independent States, dropped 48 percent to 54 tons.

China is also the world's largest gold producer and many expect it to report higher output this year, with production likely to outpace the 340 tons in 2010, figures from the Ministry of Industry and Information Technology show.

The country's gold output this year rose by 8.436 tons, or 3.87 percent year-on-year, to hit 226.388 tons from January to August, the ministry reported. In August alone, China produced 31.889 tons of gold, up from 30.08 tons in July. The combined output value of Chinese gold producers hit 169.1 billion yuan in the first eight months of the year, up 23.14 percent year-on-year.

"China, along with India, has understandably been one of the focal points in the gold market over the last decade as its share of total global demand has climbed from 6 percent in 2000 to 18 percent in 2010. The remarkable shift in the global demand balance has come about due to the combined forces of growing wealth, deregulation and increased access. It has also been propelled by heightened economic concerns that have rekindled consumer affinity for gold," says Marcus Grubb, the managing director for investments at the WGC.

"Gold demand is expected to remain firm through this year and next. Chinese consumers will continue to drive up gold demand as economic growth in the nation is still strong."

Earlier WGC predictions saw gold demand in China doubling by 2020, but there are now expectations of that happening sooner.

The WGC identifies four key factors driving Chinese gold demand in a period of "ongoing global economic and financial uncertainty". These include gold investment being rooted in Chinese culture, impending inflationary fears in emerging markets, the country's central bank being positive on gold and limited domestic investment channels.

Chinese investors already form the second-largest gold investment market in Q2, after India, with demand of 53 tons giving a local currency value equivalent to 16.7 billion yuan, the WGC says.

"Domestic investors were keen to buy into the rising gold price, while high inflation rates also remained a key driver of demand," it says.

"The underperformance of the domestic stock market and a sluggish property sector further fueled purchases of bars and coins."

But analysts have warned that China's bullion investments may slow down this year compared with sharp growth in 2010 as record-high gold prices raised the risk of price volatility. Hit with a recent slew of restrictions on residential property purchases, Chinese investors might also be turning to the commercial and industrial property market instead with its higher returns compared with gold and the stock market.

Still, Sun Fengmin, the secretary-general of the Gems and Jewelry Trade Association of China, says the global economic situation has pushed investors in the country to look for safer investment channels.

"In the period of global economic and financial uncertainty, gold's role as a monetary asset, global currency and risk diversifier all make it an attractive international asset class for domestic investors," Sun says.

Zhang Tiantian, 29, a government official in Hangzhou, capital of Zhejiang province, has been buying gold coins for her three-year-old daughter since she was born. The first gold coin she bought in 2008 cost 10,000 yuan and the same weighted one she purchased this year set her back 16,000 yuan.

"I buy one gold coin for her every year," Zhang says. "I am investing for her future." She says gold coins are relatively resilient to price fluctuations.

"I will keep buying her the coins until she is 24, whether prices rise or fall. Some of my friends choose to buy stocks or funds for their children, but I don't have faith in these," she says.

Sun Fengmin agrees that the surge in Chinese gold purchases is rooted in culture.

"Since ancient times, gold in China has been associated with good luck and is considered to be the color of emperors. It is a tradition to give gold as a gift after a child is born, on birthdays and during the Chinese New Year. It is also an integral part of wedding jewelry," Sun says.

Jewelry still dominates the Chinese gold market, accounting for almost 64 percent of all gold demand last year. Chinese gold jewelry demand also more than doubled in the last seven years, from 224.1 tons in 2004 to 451.8 tons last year, WGC figures show.

Global jewelry demand in Q2 was 442.5 tons, 6 percent higher from a year earlier. China, India and Turkey together accounted for 59 percent of global jewelry demand at 260.1 tons in Q2 and recorded a combined growth of 36.1 tons year-on-year.

"This year, around 6.6 million brides will receive gold as part of their rituals. As a result, over 75 percent of all urban Chinese women now own more than one piece of gold jewelry. Two-thirds of Chinese women regard gold jewelry to be as much an investment as a statement of personal style, and consumers are keenly aware of the value of what they own," the WGC says.

Beijinger Yang Aiping, 52, was one of the many Chinese shoppers who turned to the offerings at the Caibai store for a gold necklace and bracelet set for her future daughter-in-law.

"It would be better if she can wear them in her daily life, but I wouldn't mind if she doesn't," Yang says. "Young people can regard gold jewelry as old-fashioned. But they can also keep them and pass them on to their children as heirlooms. I believe gold is the last thing to depreciate."

"Increasing prosperity among Chinese consumers, supported by very strong growth in the domestic economy, is still a driving force behind gold jewelry demand," the council says.

"However, the investment motive also remains a key influence, fueled by the persistent high inflation that has kept real interest rates negative for some time. The predominance of 24 carat gold in this market partly reflects this investment motive, given its higher purity, as well as reflecting the demand for jewelry with better product design and quality."

|

The surge in Chinese gold purchases is rooted in culture, as gold in China is associated with good luck and is considered to be 'the color of emperors'. Provided to China Daily |

The WGC also points to buoyant gold demand in the country's technology sector, where the highly conductive metal can used for gold-plated contacts, connectors and wiring in items ranging from computers to cell phones.

Global technology demand for the precious metal was up by 2 percent at 117.9 tons from 116.1 tons in the second quarter of 2010, generated by an increase in demand from the electronics sector, the council reports. That meant a quarterly record of $5.7 billion, up 28 percent from the next highest in the last quarter of 2010 at $4.5 billion.

"The electronics industry will continue to see demand for tablets, smartphones, and e-readers accelerating, as well as increased demand for industrial processors that enable devices to harness renewable energy, such as solar panels. In addition, the industry has also seen strong demand for electronic components across all ranges of vehicle production," the WGC says.

"Gold has benefited from the growth in this market, although supply chain cost pressures continue to drive some manufacturers to seek cheaper alternative materials to gold. Apart from the modest decline in Japanese output, most of the other major markets recorded healthy gains for the period. China again led the way with a year-on-year rise of almost 20 percent.

"The country is becoming an increasingly important center for electronic component manufacturing and assembly," the council says. "It is perhaps not surprising therefore that increased use of gold in Chinese electronics manufacturing helped fuel global electronics demand in 2010."

All these will help China become a significant player in fueling growth in the gold sector. "The strength of demand in China, coupled with an overall drop in recycling activity, demonstrates that consumers have adjusted to the current price environment and expect the upward price trend to continue," the WGC's Grubb says.

"In addition, ongoing macro economic uncertainty, the continued sovereign debt crisis and widespread inflationary pressures, will result in gold demand remaining strong."

|

The global economic situation has pushed Chinese investors to look for safer investment channels. Provided to China Daily |