10 reasons to be optimistic

Updated: 2016-02-26 08:56

(China Daily Europe)

|

|||||||||

Growth

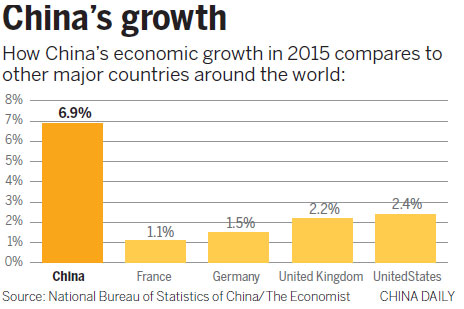

China's GDP growth of 6.9 percent in 2015 remains one of the fastest of any major economy in the world.

Although it was the slowest annual rate increase in 25 years, it was significantly greater that of major European countries (Germany 1.5 percent, France 1.1 percent and UK 2.2 percent) and the US' 2.4 percent.

India grew faster than China for the first time since 1999 with 7.5 percent growth but its economy is less than a quarter of the size of China's.

Such is the scale of the Chinese economy that even by growing at a slower rate, it is effectively still creating an economy equivalent to the size of South Africa's every year.

India would have to grow by 35 percent to add that capacity and the UK by 22 percent.

The Chinese government is likely to set itself the goal in the upcoming Five-Year Plan (2016-20) to become a "moderately well-off society" and join the high-income club of nations by 2020, which will require at least 6.5 percent growth every year for the rest of the decade.

Lord O'Neil, the UK's commercial secretary, told the 48 Group's Chinese New Year Gala Dinner in London recently China's growth was still the envy of any developed country.

Startups

China has the highest number of startup businesses in the world.

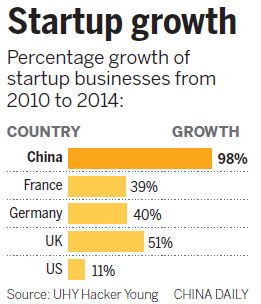

According to research by accountants UHY Hacker Young, the number of new businesses launched in 2014 was 1.6 million, 98 percent more than in 2010.

The growth in startup businesses in the United States in the same year was just 11 percent.

The United Kingdom saw a 51 percent rise whereas growth in Germany had 40 percent and France 39 percent.

Chinese Vice-President Li Yuanchao said at Davos that there were now 2,300 entrepreneurial spaces and 2,500 incubators for startups across China and these facilities were growing by 20 percent a year.

The government launched a $6.5 billion venture capital fund for emerging industry startups last year.

Hotbeds for new businesses are China's so-called Silicon Valley at Zhongguancun in Beijing, a technology hub, and at Shenzhen, once better known only for low cost manufacturing.

Many Chinese graduates, who 20 years ago might have wanted a career with foreign multinationals, now start businesses after gaining PhDs or after spells working for companies such as Google.

Employment

One of the traditional fears about a slowing economy is its potential impact on employment.

There appears no longer a direct correlation between growth and jobs, largely because of demographics and China's declining workforce.

The national unemployment rate was just 4.99 percent in January, one of the lowest levels among leading economies.

There were 13.12 million new jobs created urban residents in 2015, exceeding the government's target.

Zhao Chenxin, a spokesperson for the National Development and Reform Commission, said on Feb 17 that he hoped China's current growth rate would maintain a healthy level of employment.

Chinese Premier Li Keqiang also made clear in his first speech after the Spring Festival holiday that creating jobs was a priority.

"As long as the labor market remains stable, the economic fundamentals are stable," he said.

Inflation

The rate of inflation, particularly that of food prices and specifically pork (a key component in most Chinese diets) has traditionally been a key indicator of the health of the economy.

Although China's consumer price index rose for a third consecutive month in January, according to the official figures released by the National Bureau of Statistics on Feb 18, the increase of 1.8 percent year-on-year, up from 1.6 percent in December, was a far cry from levels seen before the financial crisis.

When inflation hit an 11-year high of 8.7 percent in February 2008, its effects were severe on household budgets.

The producer price index, which indicates changes in wholesale prices, also dropped 5.3 percent in January. It was down for the 47th consecutive month.

Change

While many still view the Chinese economy as the workshop of the world, producing inexpensive manufactured goods, that is a very outdated picture.

The economy already has been significantly rebalanced with services, high-tech industries and advanced manufacturing becoming new engines of growth.

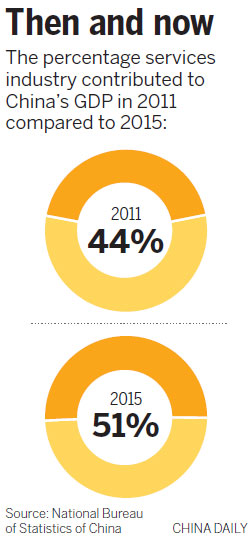

Services now make up 51 percent of GDP, compared with 44 percent in 2011, and the sector grew at 8.6 percent in the third quarter, well above the 6.9 percent rate of the economy as a whole.

With initiatives such as the Shanghai Free Trade Zone, China hopes financial services will be a key sector of the economy.

President Xi Jinping, on his visit to the UK in October, was keen to foster closer ties with the City of London, seeing it as a route to internationalize the yuan.

The UK could be a partial role model with its services sector growing from 46 percent of GDP in 1948 to 78 percent now.

The growth of services is also key to boosting consumption, another vital aspect of rebalancing the economy. The per capita disposable income of Chinese grew 7.4 percent in 2015, 0.5 percent faster than the overall economy.

Workers

The fast-emerging, highly skilled quality of the workforce is one of the real strengths of the Chinese economy.

China has some 100 million college graduates, an increasingly large number educated at top universities around the world, and is on target to have 300 million by 2030.

Seven Chinese mainland universities and five Hong Kong universities rank among the top 200 in the current QS World University Rankings.

There is also a huge emphasis on vocational training, with Germany seen as a role model.

The government wants to increase the number of vocational places from the current 29.34 million students by a third to around 38.3 million by 2020.

Peter Williamson, professor of international management at Cambridge University's Judge Business School, says China's huge number of engineering graduates are creating a new phenomenon of rapid innovation.

"They are speeding up the innovation process dramatically, often cutting the time needed by half and reducing the cost," he says.

Belt and road initiative

China's Belt and Road Initiative, set out by Chinese President Xi Jinping in 2013, remains one of the government's key strategies.

Vice-President Li Yuanchao re-emphasized the importance of the strategy, in his Davos speech on Jan 21, in providing a new growth engine for the economy.

Through the initiative the government hopes to foster trade between the landlocked central and west of China with central Asia and Europe through building new infrastructure and developing economic ties.

The New Silk Road Economic Belt, as the overland portion is called, could lead to a much bigger commercial relationship between China and the EU.

Yang Yanyi, head of the Chinese Mission to the EU, said China and the EU are coming to grips with the enormous possibilities and opportunities presented by the Belt and Road Initiative.

The initiative also includes developing a Maritime Silk Road connecting China with Southeast Asian and South Asian countries, Africa and Europe.

Infrastructure

Sometimes accused of building roads to nowhere, China actually has some of the most advanced infrastructure anywhere in the world.

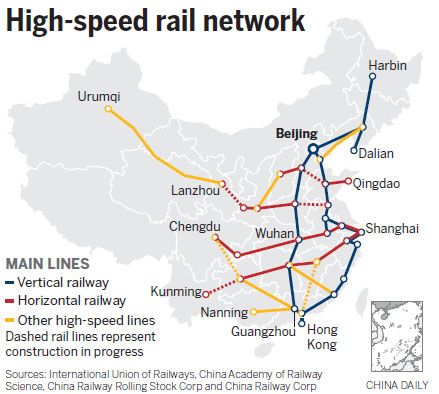

China invested some 800 billion yuan ($122 billion, 111 billion euros) in its railways in 2015 and now has 19,000 kilometers of high-speed rail, more than any other country in the world.

It is also exporting its high-speed and light rail systems to countries in Africa and could be a partner in the UK's HS2 high-speed rail project, providing both technology and capital.

China is also behind the setting up of the new the Asian Infrastructure Investment Bank, a multilateral financial institution with an authorized capital of $100 billion, which has the support of leading European countries.

Beijing Capital Airport, whose Terminal 3 was designed by British architect Norman Foster, is the world's largest and one of a large number of state-of-the-art airports across the country, which make New York's JFK Airport and many in Europe appear very dated.

The Chinese government is likely to step up infrastructure spending this year, believing that modern transport networks will underpin future growth.

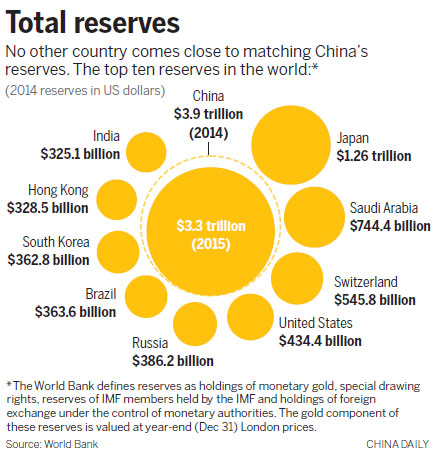

Foreign reserves

One of the key strengths of the Chinese economy is its financial firepower.

It had $3.3 trillion in foreign exchange reserves by the end of 2015, the largest arsenal of any country in the world.

Chinese financial authorities were able to deploy these reserves when the yuan came under pressure after an adjustment to the exchange rate mechanism last year.

They have also been deployed to bolster China's stock markets after a year-long bull run ended abruptly last year.

Although there have been concerns about their recent depletion - down $513 billion in 2015 - they remain a substantial war chest and insurance policy to cope with most contingencies.

China also has increasing fiscal strength, with revenues from taxes and fees rising by 5 percent last year.

The government is set to relax its normal 3 percent fiscal budget deficit rule this year to invest further in infrastructure and other projects.

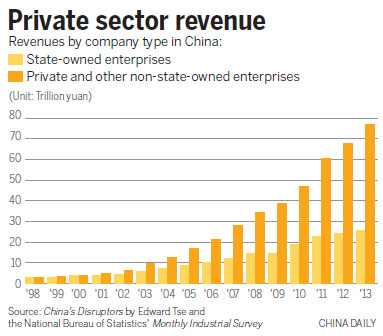

Private sector

Many assume China's economy is mainly made up of leviathan state-owned enterprises, but almost the opposite is true.

The country's private sector is now one of the most vibrant in the world and makes up some 60 percent of GDP.

Revenues of the non-state sector in the economy have risen 18 times since 2000, according to the National Bureau of Statistics.

China's e-commerce companies such as Alibaba and Tencent (which owns instant messaging service WeChat) as well as companies like computer giant Lenovo and telecommunications group Huawei, are having a global impact. More than a fifth (106) of the Fortune 500 companies are now Chinese.

Some of China's private sector activity is still not widely known but Chinese companies going out and making acquisitions in Europe and the United States may soon become one of the biggest global trends.

President Xi Jinping predicted in 2014 that China's outbound investment would increase almost tenfold to $1.25 trillion over the next decade.

Edward Tse, founder and chief executive officer of Gao Feng Advisory, the management consultancy, says China's private companies are now "the real driving force of the economy".

"The financial headlines underestimate just how dynamic China's private sector has become," he says.

Today's Top News

Points of view

Small island makes a big difference

Rubio, Cruz gang up on Trump in debate ploy

'Invented-in-China’ products to the fore at MWC

Beijing edges NYC as home to most billionaires

110,000 refugees, migrants reach EU by sea in 2016

Tech giants reveal 5G innovations in Barcelona

Mechanism to be built to monitor ceasefire in Syria

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|