How Alibaba IPO learnt from Facebook's mistake

Updated: 2014-09-17 10:56

By Dai Tian(chinadaily.com.cn)

|

|||||||||||

|

|

The booth of Alibaba Group Holding Ltd at an exhibition in Hangzhou, Zhejiang province, Sept 9, 2014. [Provided to China Daily] |

From choosing NYSE over Nasdaq to a Q&A-led roadshow, Alibaba appears to have taken Facebook's lesson to heart as the Chinese Internet behemoth rolls out its initial public offering. Only the final offer price is yet to be decided.

With strong demand from investors for the year's most anticipated debut, Alibaba Group raised its IPO price range to $66 to $68 on Monday, up from $60 to $66, and resisted directly bumping the upper bound to $70, which could make it the world's biggest IPO, edging Agricultural Bank of China's $22.1 billion listing in 2010.

"Alibaba has drawn a lesson from Facebook and maintained a conservative stand on pricing," said Cao Junbo, chief analyst of iResearch Consulting Group, to chinadaily.com.cn.

|

|

| Alibaba options expected to be listed on Sept 29: exchanges |

|

|

| Jack Ma shows up in Singapore for Alibaba IPO roadshow |

Avoid too high or too low

At the top of current price range, Alibaba is asking for 29 times of its estimated earnings in the year through March 2015, Bloomberg reported, as Chinese Internet peer Baidu trades at about 35 times estimates of this year's earnings and Tencent, another Internet company, at 37 times.

Facebook, in comparison, asked for 65 times of its 2013 estimated earnings on its debut two years ago, according to Business Insider, as it raised its price range to $34 to $38, up from $28 to $35, and set the final offer at the upper bound.

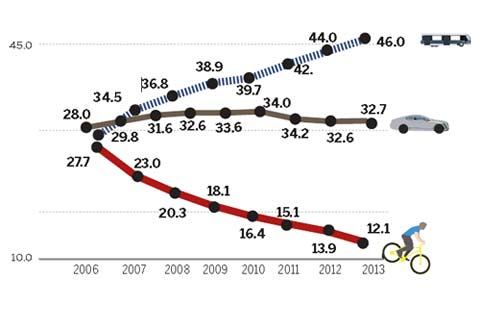

Whereas, the social network giant only saw its stocks struggle to stay above its IPO price on the initial trading day and almost halved to as low as $19.7 within the first three months. The share price has since recovered and stood at $76.08, up 2 percent on Sept 16.

"Alibaba is leaving room for a good debut," said Cao, adding that the company still has time to decide the final price before its chairman Jack Ma ring the opening bell on Friday.

The 49-year-old founder told several hundred potential investors at a luncheon in Hong Kong that Alibaba was being careful not to set valuations too high or too low, reported New York Times quoting an audience member.

NYSE verse Nasdaq

Unlike its US-listed peers, including Baidu and JD, Alibaba announced in June to seek listing on New York Stock Exchange other than Nasdaq. To avoid a Facebook-style shock is said to be the main reason behind.

Alibaba executives are worried about Nasdaq's ability to handle their mega-sized IPO, since the exchange botched Facebook's debut in 2012, according to Reuters citing two sources familiar with the situation.

Related Stories

Companies bask in 'Alibaba effect' 2014-09-17 08:01

To US consumers, China's Alibaba is a non-entity 2014-09-16 14:02

Alibaba boosts IPO as demand strengthens 2014-09-16 10:01

Ma touts tower of 'BABA' in HK 2014-09-16 05:02

Alibaba kicks off Asia roadshow in HK 2014-09-15 17:49

Today's Top News

'Yes' in Scotland could mean 'maybe' for Chinese companies

Police cooperate to help extradite Chinese fugitives

Xi, Modi set friendly tone for visit

Collector has 'proof' of atrocities

Naked newborn survives typhoon

How Alibaba IPO learnt from Facebook's mistake

Russia to beef up troops in Crimea

10 problems of Chinese society

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|