Overseas investment set for 'golden era': Official

Updated: 2013-12-12 08:15

By Li Jiabao (China Daily)

|

|||||||||||

China's overseas investment will maintain robust growth in the coming year thanks to the central government's reform plans, officials said on Wednesday.

"The government's reform plans suggest that China will further open up the overseas investment of Chinese enterprises. Policies will be optimized, and support will be increased. It's certain that the robust trend of China's overseas investment will continue," said Zhang Wei, vice-chairman of the China Council for the Promotion of International Trade and the China Chamber of International Commerce.

Zhang made the comments during the CCOIC's annual conference in Beijing.

China unveiled a comprehensive reform plan after the Third Plenum of the 18th Communist Party of China Central Committee in November. The plan includes boosting private companies and enhancing overseas investment.

"China's private enterprises will experience a 'golden era' for development as the government will emphasize a level playing field and the free flow of resources," Zhang said.

Except for particular industries such as national security and key resources, private companies will be allowed to enter all industries as long as they meet the market requirements. They will become a new pillar of the country's economic development alongside State-owned enterprises, Zhang said.

He added that many SOEs top the world's lists by size but "their competitiveness significantly falls behind transnational corporations in other countries.

"A very urgent problem is that they generally don't have modern management systems during the process of going abroad," Zhang said.

"We noticed failures among China's overseas investment projects in recent years. Our major challenges are insufficient competitiveness, which constrained the profits of overseas investment projects, and protectionism in many regions, which led to the failure of many projects," he added.

"Chinese enterprises should not only go abroad for tapping international markets - they should be more active in establishing global business rules, or even lead the setting of the rules. We will not only make use of our competitive advantage but also upgrade our industries and technologies through opening up," Zhang said.

Wei Jianguo, vice-chairman of the China Center of International Economic Exchanges, said that "now is the best time for China's private companies to go abroad for overseas investment."

"Private companies can make the best of their advantages. They have flexible management systems and make decisions very swiftly. They can follow global business practices more easily," Wei said.

In 2012, China's overseas investment totaled $87.8 billion, up 17.6 percent year-on-year and leaving the country the world's third-largest investor for the first time, according to the Ministry of Commerce. In the same year, total global foreign direct investment dropped 17 percent from a year earlier.

"China's overseas investment totaled $89 billion in the January-October period, and I expect the full-year volume will stand between $90 billion and $100 billion,' he said.

"China's overseas investment will be equal to its FDI inflows in the next two years, at about $120 billion," Wei said.

Francisco Sanchez, former undersecretary of the United States Department of Commerce, said that the US is now the most favored investment destination after Hong Kong for companies from the Chinese mainland.

"More and more Chinese investors have become aware of the opportunities in the US market. The market size is huge, and the employees are well-educated. Energy costs are declining," Sanchez said.

He added that the US welcomes overseas investment, especially from China, as foreign capital "is very important for US economic development.

"The US has no review purposely targeting Chinese investment. About 98 percent of Chinese investment projects in the US were not reviewed by the Committee on Foreign Investment in the United States. The remaining 2 percent passed their reviews," he added.

The CFIUS, an inter-agency committee of the US government, reviews foreign investment proposals from all over the world, rather than just those from China, mostly based on any national security implications, according to Sanchez.

lijiabao@chinadaily.com.cn

(China Daily 12/12/2013 page16)

Today's Top News

Putin blames internal reason for economic slowdown

Syria chemical weapons disposal plan to be released

Overseas investment set for 'golden era'

No better way to protect US than surveillance

Central bank may tighten credit

Talent plan to unleash creativity

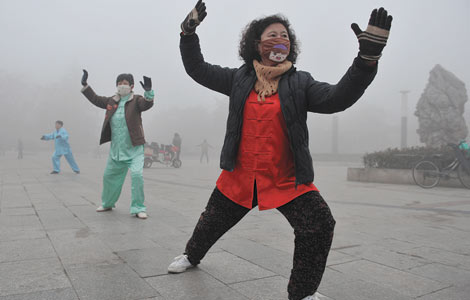

Pilots must qualify to land in haze

'Containing China' a Japan's strategy

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|