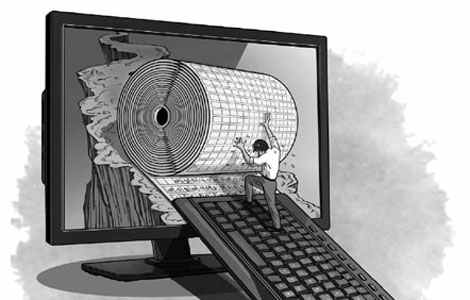

US debt deal a temporary fix

Updated: 2013-10-17 23:35

By WEI TIAN in Shanghai,PU ZHENDONG and CHEN JIA in Beijing (China Daily)

|

|||||||||||

Another fiscal crisis looming 'within months'; the yuan under pressure to rise

|

|

|

National Park workers remove a barricade at the Martin Luther King Jr. Memorial as it reopens to the public in Washington on Thursday. A last-minute deal on the debt ceiling by the US Congress ended the government shutdown. Kevin Lamarque / Reuters |

The US government is back in business after a last-minute deal late Wednesday night in Washington prevented the government from defaulting on its loans.

However, experts said that the debt-ceiling crisis will raise its head again and China must refrain from holding massive US dollar assets.

The US Congress passed a bill on Wednesday to extend the nation's borrowing authority and end a 16-day partial shutdown of the government just two hours before the deadline beyond which the Treasury had warned it might not be able to pay its bills.

But the measure adopted by Congress only funds the government until Jan 15 and allows it to borrow freely until Feb 7.

Beijing said it welcomes the progress in resolving the issue.

"The US is the largest economy in the world, and the proper resolution of this issue serves not only its own interests but also world economic stability and development," Foreign Ministry spokeswoman Hua Chunying told reporters at a regular news briefing on Thursday.

Her comments came as China's Dagong Global Credit Rating downgraded the US sovereign rating to A- from A with a negative outlook.

Markets cheered the deal, with the Dow Jones Industrial Average, Nasdaq and S&P 500 all closing up by more than 1 percent on Wednesday. Shares in Tokyo, Singapore and Sydney had gained slightly by Thursday afternoon.

But the dollar and European shares fell on Thursday as market relief at the last-minute deal gave way to worries over the economic impact of the 16-day government shutdown and the prospects of a re-run early next year.

Chinese observers warned that another crisis is possible within months, and the uncertainties will add pressure to the appreciation of the yuan and increase the risks of China's huge reserves of US debt.

The US government has raised its debt ceiling nearly 80 times since 1960.

"The issue (of debt ceiling) is not yet fundamentally resolved. It will come back in three months," said Li Daokui, a professor at Tsinghua University and a former central bank adviser.

"Countries will reduce their holdings in US Treasury bonds, pushing up gold prices and causing the renminbi to rise further," Li said, adding that the credit ratings of US bonds might be downgraded in the coming days.

He Weiwen, a co-director of the China-US/EU Study Center at the China Association of International Trade, said a long-term solution to the US debt issue would be to raise its domestic corporate income tax, but that doesn't seem to be a feasible option in the near term.

Another way out would be for either Democrats or Republicans to win more seats in the mid-term election next year to change the current balance in Congress, He said.

"In either case, there would be less noise from the face-off between the two parties."

He said China has to continue diversifying its $1.28 trillion foreign exchange reserves into other assets such as gold and government bonds of other nations.

China also needs to speed up opening its capital account to ease upward pressure on the yuan and allow more individual holdings of dollar assets, he said.

Another possible impact on China would be on exports as the US government is likely to reduce spending, said Alfred Schipke, the International Monetary Fund's senior resident representative in China.

Schipke said the priority for China is to advance financial reforms to prevent a further buildup of risks, and foster a more efficient allocation of investment, and boost household capital income.

Christine Lagarde, head of the IMF, urged the US "to reduce uncertainty surrounding the conduct of fiscal policy by raising the debt limit in a more durable manner".

Dagong estimated that the depreciation of the US dollar had caused a loss of $628.5 billion to foreign creditors since the US government began to monetize its debts by using the quantitative easing policy to maintain its government solvency.

Experts also slammed the role played by the US political system in exacerbating the crisis.

"State debt is an important benchmark of a country's financial market. A default will disrupt financial stability, which is suicidal for Americans," said Zhang Yuyan, director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences.

"Elites in American society, Democrats and Republicans, are now deeply divided over the future direction of the country. Their previous consensus is torn apart, which is associated with the stagnation of the US and global economy," said Zhang.

Shen Dingli, vice-dean of the Institute of International Affairs at Fudan University in Shanghai, said, "Washington has a sound political system to find a balance of power, which many times prevents bad policymaking, but the system can be low in efficiency, and wasteful in capital and energy.

Related Stories

China warns on risks of US debt default 2013-10-17 21:16

US govt to reopen as Obama signs last-minute bill 2013-10-17 17:22

China trusts US to quickly solve debt crisis 2013-10-17 14:48

US Senate passes deal to end debt crisis 2013-10-17 08:44

Today's Top News

UK hails Chinese nuclear investment

US debt deal a temporary fix

Local govt debt not 'fatal' issue: BNP Paribas

FDI increases as economy strengthens

Capitals work together on pollution

Mayor of Nanjing under probe

FDI rose 4.88% in September

Former mistresses are active online whistle-blowers

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|