Economic growth only hope for Italy

Updated: 2011-12-30 09:04

(Xinhua)

|

|||||||||

|

|

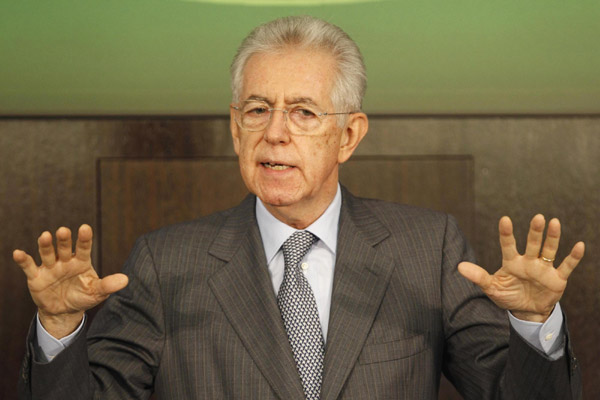

Italian Prime Minister Mario Monti speaks during his year-end news conference in Rome December 29, 2011. [Photo/Agencies] |

MILAN, Italy - As Prime Minister Mario Monti starts a new phase of his action plan, international markets are challenging Italy, the third largest eurozone economy struggling to warn off a dramatic deepening of its debt-driven crisis by trying to revitalize its economic growth.

Monti's cabinet of technocrats has just launched what he named the "grow phase" of its austerity plan after a first 30-billion-euro (38-billion-US dollars) package won final approval in parliament last week.

The new phase will focus on measures aimed at stimulating growth and competitiveness that will include a reform of the labor market, liberalizations and structural changes in Italy's obsolete infrastructures.

However, despite having trended lower in the past weeks, the yields on the Italian government bonds have showed to be still unsustainably high recently. On Thursday, Italy sold seven billion euros ($9 billion) three- seven- and 10-year bonds at lower yields than in recent sales. But the demand was weaker than expected and the interest rates still too high, Francesco Previtera, the head of research of Milan-based Banca Akros ESN, noted.

Nervousness in the international markets was mainly caused by lack of liquidity as "most of the funds provided to banks by the European Central Bank (ECB) in the past days have not been put into use yet," he told Xinhua.

As the sale of Italy's debt was a test on the market, it put pressure on the euro that, after the Italian auction, fell 0.3 percent against the US dollar, coming close to its year low of $1.2871 experienced last January, he added.

The market turmoil is caused by the eurozone instability, which is itself closely linked to the Italian difficult financial situation, Monti outlined in his end-of-year address on Thursday, but he is confident that the austerity measures will save Italy from a total "collapse".

According to local experts, if such measures are a necessary first step, and also assumed that thanks to these Italy will manage to balance its budget by 2013, the crucial problem remains slow productivity growth.

In fact, the package will surely hit growth in the short term by reducing the domestic demand, as it adds new taxes to the already extremely high Italians' burden (over 45 percent of gross domestic product).

The Italian banking association (ABI) has indicated that the third eurozone economy is expected to contract by 0.7 percent in 2012.

"But these previsions are still quite positive compared to a possible 1.6-percent drop of the GDP forecast by Italy's leading industrial association Confindustria,"an economics professor at Milan Bocconi University, Marco Onado, told Xinhua.

"Italy's situation is still quite worrying, and the only effective remedy is growth," he said adding his best wish for Monti's government is he will be able to overcome the powerful interest-group resistance that has opposed to structural reforms in the past.