Economy

Global policymakers discuss debt crisis, market turmoil

Updated: 2011-08-07 14:18

(Agencies)

ACRIMONY OVER S&P

|

|

Standard and Poor's building in New York, in this August 2, 2011 file photo. The United States lost its top-notch AAA credit rating from Standard & Poor's on August 5, in an unprecedented reversal of fortune for the world's largest economy. [Photo/Agencies] |

Defending its downgrade of the US credit rating, S&P cited the acrimonious debate in Washington on raising the debt ceiling and near political paralysis over the best way to reduce the country's $14.3 trillion debt, which on the current trajectory could climb above 100 percent of national output this decade.

The US Treasury said the rating agency's debt calculations were wrong by some $2 trillion.

S&P has confirmed it changed its economic assumptions after discussion with the Treasury Department but said that did not affect its decision to downgrade, a decision slammed by President Barack Obama's National Economic Council head Gene Sperling.

"It smacked of an institution starting with a conclusion and shaping any argument to fit," Sperling said in a statement.

Obama called on lawmakers once again on Saturday to set aside partisan politics and work together and to put the nation's fiscal house in order and stimulate the stagnant economy.

S&P's one-notch downgrade of the US sovereign credit, while not totally unexpected, adds another level of uncertainty.

Loss of gold-plated status for the world's benchmark interest rate risks pushing up borrowing costs on everything from car loans, mortgages and corporate debt to government bonds worldwide.

"However justified, S&P couldn't have picked a worse time to downgrade the US," said Rabobank in a note to clients.

Mark Mobius, executive chairman of Templeton Emerging Markets group, predicted further volatility in markets, and said emerging market currencies and stocks could become safe havens.

"During the sub-prime crisis safety was in US dollars and US Treasuries. Now that anchor to the global community is deteriorating," said Mobius, whose unit oversees $50 billion in emerging market assets, in an email to Reuters.

DEBT ADDICTION

China, the largest foreign holder of US debt, took the world's economic superpower to task for allowing its fiscal house to get into such disarray.

"The US government has to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone," THE Xinhua news agency said in a commentary that scorned America for its "debt addiction".

On Sunday, a commentary in the People's Daily, said Asian exporters, who depend on demand from the United States, could be among the biggest victims of the mounting US economic woes.

"The lowering of the United States' long-term sovereign credit rating has sounded a warning bell for the international currency system dominated by the US dollar," said economist Sun Lijian, writing in the paper.

China and Japan have called for coordinated action to avert a new worldwide financial crisis.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

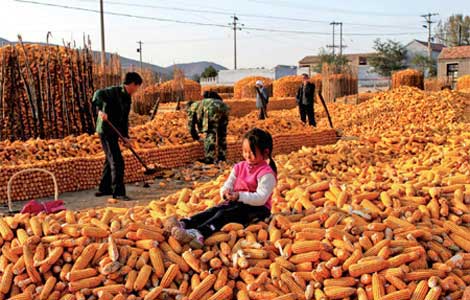

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival