An unthankful US deal

Updated: 2013-10-18 08:12

(China Daily)

|

|||||||||||

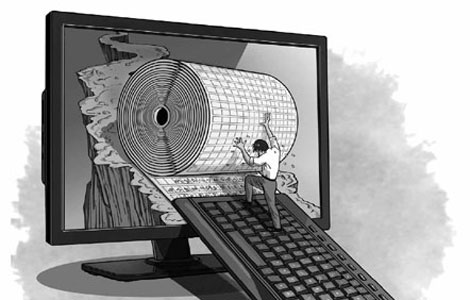

Instead of defusing the time bomb of a historic debt default, the United States has come up with a last-gasp deal to only fund its government until Jan 15 and raise the debt ceiling until Feb 7.

This might be the best what US politicians could provide at the moment. But it is certainly not what is aspired for by millions of Americans who have suffered because of the political debacle and many foreign debt-holders who are worried about the safety of their US investment.

US President Barack Obama was right to say that US leaders needed to "earn back" the trust of the American people in the aftermath of the crisis. Yet no less urgent is the task of the world's largest economy to restore its reputation as an economic safe haven.

If concerns that crisis-driven politics has become the "new normal" in Washington cannot be immediately addressed, there is little chance for the US economy to emerge out of the great financial crisis that the Lehman Brothers' bankruptcy triggered five years ago.

The Congress deal on Wednesday offers a temporary fix to pull the US economy from the brink of a catastrophic debt default that could have devastated the global economy. The deal, in all fairness, fails to address the root cause of the US' long-term fiscal troubles.

Washington's political dysfunction is the apparent reason why international investors doubt its ability to honor its signature. It is the fast-growing debt that has been eroding global confidence in the US government's capability and commitment to do so. Even its unprecedented, massive monetary stimulus program has pressed down borrowing costs for long.

The stopgap plan has also set up a forum of US politicians to negotiate a more permanent budget deal while leaving open the possibility of another bitter budget fight and another government shutdown early next year.

The international community would welcome swift US efforts to lift the cloud of uncertainty it has imposed on its own as well as the rest of the world's growth prospects.

But before the US can come up with serious long-term deficit-reduction plans to rein in excessive government spending, countries that hold US Treasuries including China may have to expedite preparations for once-unthinkable scenarios.

(China Daily 10/18/2013 page8)

Today's Top News

Elderly group sorry about roles in turmoil

US not budging on its arms restrictions on China

Beijing criticizes Abe's shrine offering

UK hails Chinese nuclear investment

US debt deal a temporary fix

Local govt debt not 'fatal' issue: BNP Paribas

FDI increases as economy strengthens

Capitals work together on pollution

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|