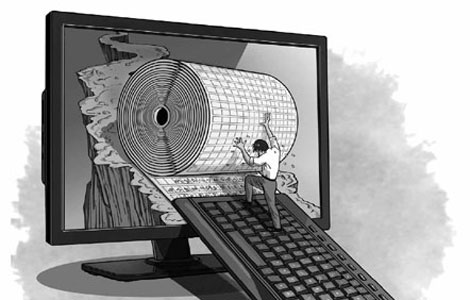

The fatality of debt addiction

Updated: 2013-10-16 07:25

By Lu Feng (China Daily)

|

|||||||||||

The stalemate between US President Barack Obama's administration and Republican- majority House of Representatives over raising America's debt ceiling has partly shut down the federal government since Oct 1. On Oct 10, Obama rejected Republicans' offer of increasing the debt ceiling for six weeks, aiming to push the negotiations' deadline to around Thanksgiving.

On Oct 13, members of the Senate, the upper house of Congress, did make some progress during their talks but they could not reach a deal. On Oct 17, the US government will hit the ceiling mandated by Congress on how much it can borrow to fulfill its financial commitments.

New York's Bryant Park has a giant electronic screen displaying the "national debt clock". The clock was designed and installed in 1989 by Seymour Durst, a New York real estate developer, who was worried about the rising national debt and shows the changes in the US' national debt over the years. According to the clock's reading the total US national debt was near $16.97 trillion on Oct 16, 2013, compared with $2.87 trillion in 1989.

Though the US has a law that puts a cap on the total amount of the government's public obligations, it has failed to prevent politicians from consistently passing expenditure bills breaching the legal borrowing limit. The US' debt ceiling has been raised 74 times since 1962, roughly once every eight months, with the issue often becoming the subject of a Democrat-Republican contest.

In 2011, a delay in passing a law to raise the national debt ceiling caused widespread panic and prompted a major global rating agency to downgrade America's AAA credit rating. The situation is getting even worse this year.

The US government's revenue is not enough to cover its expenditure. The deficit for the 2013 fiscal year (which ended on Sept 30) alone was $750 billion. Obama says he has managed to reduce the deficit by almost half, from $1.4 trillion in 2009. But the Republicans say the amount is still huge considering that the deficit was $458 billion in 2008, the year before Obama's first term, and $160 billion in 2007. The war of words continues.

The deficit and debt could increase further in the coming years because the Affordable Care Act offers government subsidy to millions of Americans who cannot afford healthcare insurance. The ACA is projected to cost $2.6 trillion in the first 10 years. The Republicans demand renegotiation over the ACA as a precondition for raising the debt ceiling, but Obama says he will not allow them to hold ordinary Americans hostage for their political agenda.

The stalemate has had a huge impact on US diplomacy; it prevented Obama from attending the Asia-Pacific Economic Cooperation meeting in Bali, Indonesia, earlier this month. It will hurt the US economy, too. The possibility of the Federal Reserve's quantitative easing (QE) measures tapering off has driven up interest rates, and government spending cuts and fiscal uncertainties are hampering economic activity. America's GDP growth rate has been lowered from 2.3 percent to 1.9 percent this year, and the government shutdown will cost the US about 0.15 percent of the GDP growth rate every week in the fourth-quarter.

The implications of a possible payment default by the US government will be far greater than the evolving political drama on Capitol. According to the US Department of Treasury, if the debt ceiling is not raised by Oct 17 to allow the government to borrow from the capital market, the government will have only $30 billion left, not enough to cover its regular fiscal expenditure for even a couple of days. If that happens, a US government default would become imminent.

It is widely acknowledged that a default would be catastrophic: credit markets could go into a free fall, US interest rates could skyrocket, with the negative spillovers devastating the global economy.

Although the likelihood of a default is still slim because the two sides are likely to reach a last-minute agreement to prevent a catastrophe, the standoff on Capitol has been sending alarming signals to the rest of the world.

The economic dilemma the US government faces is clear. The likely last-minute compromise may avoid an immediate economic earthquake, but it will only prolong the chronic illness that is the US' debt addiction. The Fed's extremely loose QE policy and the resultant low yields have made the US more dependent on debt, which is not sustainable.

The impact of the US government's love affair with debts and American politicians' verbal sparring will also be felt by China and the rest of the world. The US is still and will remain the most powerful economy, but its obsession with debt has revealed one of its strategic soft spots. So to better understand China-US economic relationship we have to make a balanced assessment of the strengths and weaknesses of the US economy.

The US predicament highlights the importance of fiscal and financial discipline. Drawing lessons from the US will help other countries, including China, accord priority to sustainable fiscal and financial policies. China's public finances have a solid foundation, and time will prove that the Chinese government's policy of carefully managing budget deficits and potential financial risks is wise and prudent.

The developments on Capitol raise the potential risk of China holding $1.277 trillion in US Treasuries. The Chinese government will indeed hold the US government responsible for fulfilling its debt obligations. But it should also address the external imbalance by reforming its macro-economic policies, move ahead with its "going-out strategy" and support Chinese enterprises to invest abroad in a more diversified manner so as to improve China's external portfolio.

The author is a professor at the National School of Development, Peking University.

(China Daily 10/16/2013 page9)

Related Stories

The fatality of debt addiction 2013-10-16 07:25

Senate leads hunt for shutdown and debt limit deal 2013-10-14 00:11

Boehner offers debt extension; WH says likely OK 2013-10-11 03:54

Debt ceiling deadline looms over US Congress 2013-10-08 08:38

White House open to short-term hike in debt limit 2013-10-08 02:53

China urges US to prevent debt default 2013-10-07 22:08

Today's Top News

Overseas M&A deals reach record high in 1st half

ODI set to become more diverse

Renewed move to streamline bloated sectors

Most EU urbanites breathe in pollution

Cooking fumes debated as cause of pollution

Agreements with UK to boost wider use of yuan

Nation honors father of Xi Jinping

$100b trade target for 2017

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|