Misreading Chinese rebalancing

Updated: 2013-07-31 09:49

By Stephen S. Roach (China Daily)

|

|||||||||||

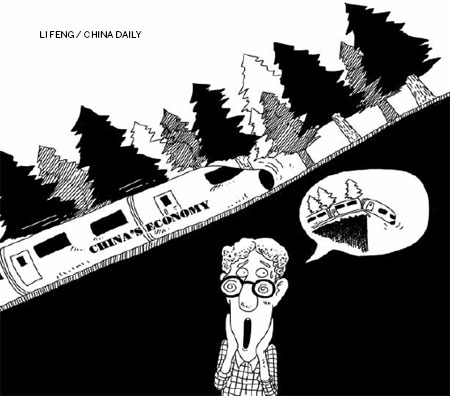

The punditocracy has once again succumbed to the "China Crash" syndrome - a malady that seems to afflict economic and political commentators every few years. Never mind the recurring false alarms over the past couple of decades. This time is different, argues the chorus of China skeptics.

Yes, China's economy has slowed. While the crisis-battered West could only dream of matching the 7.5 percent annual GDP growth rate that China's National Bureau of Statistics reported for the second quarter of 2013, it certainly does represent an appreciable slowdown from the 10 percent growth trend recorded from 1980 to 2010.

But it is not just the slowdown that has the skeptics worked up. There are also concerns over excessive debt and related fears of a fragile banking system; worries about the ever-present property bubble collapsing; and, most important, the presumed lack of meaningful progress on economic rebalancing - the long-awaited shift from a lopsided export- and investment-led growth model to one driven by internal private consumption.

With respect to the last point, recent shifts in the composition of Chinese GDP appear disconcerting at first glance. Consumption (private as well as public) contributed only 3.4 percentage points to economic growth in the first half of this year, and an estimated 2.5 percentage points in the April-June period - a deceleration on a sequential quarterly basis that underscores a cyclical, or temporary, weakening in Chinese consumer demand.

At the same time, the contribution from investment surged from 2.3 percentage points of GDP growth in the first quarter of 2013 to 5.9 percentage points in the second quarter. In other words, rather than shifting from investment-led to consumer-led growth, China appears to be continuing along its investment-led growth track.

For an unbalanced economy that has under-consumed and over-invested for the better part of three decades, this is unnerving. After all, China's leadership has been talking about rebalancing for years - especially since the enactment of the pro-consumption 12th Five-Year Plan (2011-15)in March 2011. It was one thing when rebalancing failed to occur as the economy was growing rapidly; for the skeptics, it is another matter altogether when rebalancing is stymied in a "slow-growth" climate.

This is superficial thinking, at best. The rebalancing of any economy - a major structural transformation in the sources of output growth - can hardly be expected to occur overnight. It takes strategy, time, and determination to pull it off. China has an ample supply of all three.

Related Stories

GDP slowdown, IPO freeze chill equity investment firms 2013-07-26 08:22

China keeps 7.75% GDP forecast: IMF 2013-07-19 09:31

China's Q2 GDP growth slows to 7.5% 2013-07-15 10:24

GDP is not the only measure 2013-07-03 17:46

Today's Top News

Trilateral FTA talks still at exploratory stage

Israelis, Palestinians will meet again soon: Kerry

Apple faces more staff abuse charges

Japan diplomat seeks to mend ties

Beijing and Canberra to resume trade talks

Top leader vows to meet growth target

PBOC repo move to ease concerns

China expected to rise in luxury travel market

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|