Carbon market helps cut emissions

Updated: 2013-07-29 08:39

By Jiang Xueqing and Chen Hong (China Daily)

|

|||||||||||

Substantial step taken to clean up environment and save energy, report Jiang Xueqing and Chen Hong in Shenzhen, Guangdong province.

On July 18, one month after China launched its first pilot carbon-trading program in Shenzhen, Guangdong province, the city began consulting local businesses and government departments about its draft regulations for the project. The regulations emphasize that carbon credits are corporate assets.

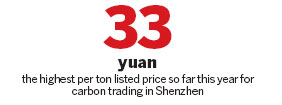

The launch ceremony of the Shenzhen Emissions Trading Scheme saw Shenzhen Energy Group sell 10,000 metric tons of carbon credits to PetroChina International Guangdong at 28 yuan ($4.60) per ton. Hanergy Holding Group also bought 10,000 tons at 30 yuan per ton. Both businesses purchased the credits for investment purposes.

"The launch of the carbon-trading market in Shenzhen demonstrates that China has taken a substantial step in reducing carbon emissions. Following Shenzhen, other carbon-trading pilots at provincial and city levels are making big strides," said Wu Delin, deputy secretary-general of the Shenzhen municipal government.

It has taken nearly three years to establish China's first pilot carbon-trading market. In July 2010, Shenzhen, seven other cities and five provinces were named the sites of China's first low-carbon program. The announcement by the National Development and Reform Commission was followed by the foundation of the China Emissions Exchange in Shenzhen two months later.

The move from low-carbon programs to carbon trading came in 2011, when the central government announced pilots in two provinces and five cities, including Shenzhen, Beijing and Shanghai. One year later, China's first regulations on the administration of carbon emissions were enacted by the Standing Committee of the Fifth People's Congress of Shenzhen Municipality.

|

|

Song Chen/For China Daily |

Market-oriented measures

"By founding the exchange, we are trying to use market-oriented measures, rather than administrative and taxation measures, to promote emissions trading and the construction of low-carbon cities," said Chen Haiou, president of the China Emissions Exchange. "Three years ago, we didn't expect the government to make such great efforts to develop carbon trading at such a high pace."

A major target for carbon trading is to push the city forward in areas such as energy saving and emissions reduction, said Wu. Research conducted over recent years revealed that industrial enterprises, transport, buildings and waste disposal are responsible for most of Shenzhen's carbon dioxide emissions.

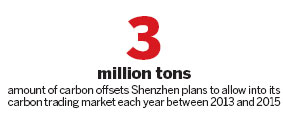

In the initial stages of the carbon-trading project, Shenzhen's municipal government put 635 manufacturers and 197 buildings, including shopping malls, hotels and office buildings, under carbon-emission management.

The companies are mostly large enterprises with high levels of emissions. Research carried out in the period 2009-11 found that in 2010 alone, these companies emitted 31.73 million tons of carbon dioxide, accounting for 38 percent of the 83.4 million tons of the city's carbon dioxide emissions. They also accounted for 59 percent of Shenzhen's total "industry value added" - its contribution to national GDP - and 26 percent of its own GDP.

By 2015, the city will cut carbon dioxide emissions per unit of GDP to 21 percent below the 2010 level, according to its low-carbon growth plan. However, because it's extremely difficult and expensive to reduce transport and residential emissions, the municipal government set a reduction target of 25 percent for industrial enterprises.

To that end, the government has allocated the 635 businesses more than 100 million tons of free carbon credits over the next three years, based on their previous emissions and industry value added. Companies that exceed their emissions quotas will be fined at a rate three times the average market price of the excess emissions.

Before they signed their quota agreements with the government, each participating company took part in the allocation process by assessing the potential for further reducing its carbon intensity and estimating its annual growth of industry value added in the period 2013 to 2015.

If a company has failed to cut carbon dioxide emissions per unit of GDP at the agreed rate a year after they signed their quota agreements, and its industry value added does not increase as quickly as estimated, the government will take back a proportion of its carbon credits accordingly.

Related Stories

Carbon emissions trading gains momentum in China 2013-07-21 21:32

Shenzhen firms must buy carbon emissions rights 2012-09-19 20:45

Today's Top News

China warily eyes Japan's SE Asia buying binge

Financial guru looks to nation's future

Officers suspended after alleged beating

Mental health care falls short

Deliveries up as mercury rises

Audit targets local government debt

Xi's speech underlines commitment to reform

Brain drain may be world's worst

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|