Throwing cold water on hot money

Updated: 2013-05-25 07:59

By Xin Zhiming (China Daily)

|

|||||||||||

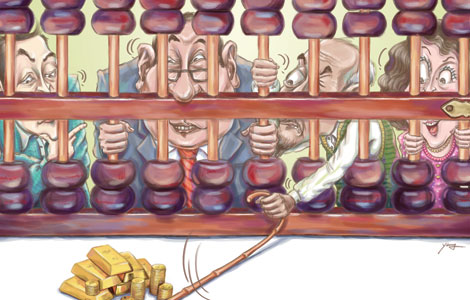

The Chinese economy has become very attractive to speculative hot money. But by allowing the yuan to rise strongly, the authorities cause doubts whether the challenge is handled in a proper and coordinated manner.

Despite the slowing of its economy in the first quarter, foreign capital has been flowing into China to cash in on yuan appreciation and relatively high interest rates.

It is difficult to calculate the exact scale. However, some indicators, such as its foreign exchange purchases and value of exports, cast light on the abnormal influx of capital.

The country's new foreign exchange purchases an indicator for monitoring capital inflows amounted to 1.2 trillion yuan ($193.5 billion) in the first quarter, a huge increase on the 500 billion yuan for the whole of 2012.

According to the State Administration of Foreign Exchange, China had a surplus of more than $100 billion in its capital and financial accounts in the first quarter, compared with $20 billion for the fourth quarter of 2012.

Moreover, the jump in export growth in April, which was 14.7 percent year-on-year, is far higher than market expectations of about 10 percent, resulting in a 114.5-billion-yuan trade surplus. In March, China registered a trade deficit of 7.24 billion yuan.

These abnormal changes indicate an undefined amount of speculative money has been flowing into China.

Estimates put the speculative cash inflows over the first quarter between $100 billion to $181 billion.

In the past, the monetary authorities used to routinely deny such inflows, but this time they have issued new rules to try and thwart them.

The State Administration of Foreign Exchange released a guideline on May 6 that tightened scrutiny of export invoices and imposed limits on long yuan positions.

And on May 8, for the first time since late 2011, the central bank resumed the issuance of bills, a move aimed at sterilizing money supply in the market. Analysts have taken it as a sign that the central bank has joined hands with the foreign exchange regulator to battle hot money.

The dual moves constitute a de facto admission that the risks of hot money have become substantial and policymakers will not sit idle.

After strengthening monitoring of trade claims and increasing the sterilization of the money supply, the authorities do not have many tools to tackle the speculative capital that will not have an undesirable impact on the economy.

Theoretically the country can discourage the influx of hot money by cutting interest rates, but given the already ample liquidity in the domestic market, such a move will have a high price tag.

Policymakers need to avoid pouring oil on the flames.

The exchange rate of the renminbi has risen wildly against foreign currencies recently. Its daily reference rate has risen by 1.5 percent against the US dollar this year, with about 1 percent gained since April. It rose 0.23 percent against the dollar over the whole of last year.

Such a sharp rise is hard to understand given the country's fragile economic fundamentals and the rapid rise in the dollar in the past months.

Right or wrong, the market has generally deemed the daily reference rate of the renminbi as reflective of the central bank's stance. The continually rising rate, therefore, could easily lead to the false impression that the Chinese authorities seek faster renminbi appreciation, thus further encouraging long yuan positions.

China is rightly seeking to gradually liberalize its financial regime and make the mechanism of the renminbi's exchange rate formation more flexible and market oriented. However, the short-term strong appreciation is a great boost for speculative foreign capital.

As part of its reform agenda, the government may also gradually expand the daily floating band for the renminbi against the dollar, as a senior central bank official hinted in April.

Analysts think the expansion of the floating band could happen in July. This will make the renminbi more flexible, which will also be a major step in the country's drive to liberalize the foreign exchange market and internationalize its currency.

But some analysts worry that the move could be misinterpreted by the market as a sign of the central bank wanting faster renminbi appreciation.

Given the potential pitfalls, the monetary authorities must better coordinate their decision-making to minimize its impact on the country's economic stability.

The author is a senior writer with China Daily. E-mail: xinzhiming@chinadaily.com.cn

(China Daily 05/25/2013 page5)

Today's Top News

Japan urged to face history

Dialogue only solution to disputes

China to enhance AU partnership

Scrutiny urged to curb graft

Gutter oil to be used as auto fuel

Shanghai warns against telecom scams

Diaoyu Islands 'have never been Japan's territory'

China closes the gap with Switzerland, Europe

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|