Op-Ed Contributors

It's not a game of gain and loss

Updated: 2011-09-28 08:05

By Lee Il Houng (China Daily)

|

Wang Xiaoying / China Daily |

Where there are people, there are externalities, be it positive or negative. Externality is the impact of one party's action on another party whose interest is not part of the consideration when the action is taken. Resolution of conflicts arising from externalities becomes more complicated if they involve two sovereign countries.

But negative spillovers among countries are nothing new. In fact, the International Monetary Fund (IMF) was formed precisely to prevent pre-World War II type disputes among countries that involved raising trade barriers and devaluing their currencies to compete against each other - so-called beggar-thy-neighbor policies which eventually led to the Great Depression.

The cost of externalities can be large in a globalized world, and often perceived to be larger when one's own economy is in difficulty as many countries find themselves today. This is particularly so because countries are constrained from using traditional macroeconomic policies owing to lack of fiscal space and high-risk aversion coupled with still impaired balance sheets that undermine recovery. For these reasons, the IMF undertook an assessment of the actual spillovers (the Spillover report) of five systemic economies. The economies are China, the eurozone, Japan, the United Kingdom and the United States.

Shocks in Japan affect China most (and vice-versa), and the UK and the eurozone are most closely related in terms of spillovers. Only the US is shown to affect everyone profoundly.

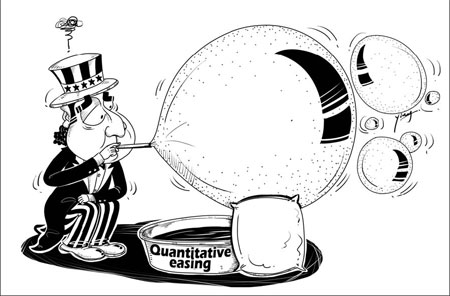

The main transmission of US policy shocks to other countries is, not surprisingly, identified as the financial channel, associated with the US dollar's role as the reserve currency. In this regard, the study found that quantitative easing has a larger effect when financial conditions are stressed and liquidity is uncertain. This is because long-term bond yields across countries become highly correlated under these conditions. Accordingly, the first round of quantitative easing (QE1) was found to have had a greater effect than QE2.

Another important US spillover is in the fiscal area. For instance, the findings show that fiscal consolidation would have a manageable negative growth spillover effect. More importantly, it would reduce a key global tail risk, since the loss of confidence in sovereign debt sustainability will have serious negative consequences for the rest of the world. This would argue for a strong medium-term fiscal consolidation in the US, but with phased implementation to avoid jeopardizing the recovery in the near term.

Ultimately, a healthy US economy is what the whole world needs. But there can be some tension between meeting domestic objectives and containing external negative spillovers. An easy monetary policy is sensible in the US, given its weak recovery and still moderate core inflation, especially in light of the required fiscal consolidation noted above.

But there is no longer a need to avert a global meltdown, as was the case when QE1 was implemented. Besides, booming - and especially financially open - emerging market economies do not need additional monetary stimulus at this stage. QE2, although only modestly, had a direct effect on emerging markets' yields and currencies, adding to asset and commodity price pressures. There is no easy solution and the need to strike the right balance between the current extraordinary support and sustaining the recovery was a key topic discussed during the IMF 2011 annual consultation with the US in July.

What about externalities from China? With a closed capital account, the financial channel is not seen as playing an important role. Given China's prominence in global trade, the spillover from a hard landing in China will be large, especially on commodity producers.

While a hard landing is not likely, a potentially worse situation to avert is maintaining China's current growth path, which may prove to be unsustainable. Cheap capital to large businesses is leading to excess investment, including in sectors that may become redundant as China's global trade share nears a threshold. This is done at the expense of higher interest payments by small and medium-sized enterprises, which are operating at an increasingly thin margin.

In addition to robust growth, China's trading partners are also hoping to see a stronger yuan that would have positive spillover in terms of stronger demand from China.

As these examples of two countries show, there are positive and negative externalities both to policy decisions. Greater consideration for each other and a more long-term view when making policy decisions, despite the political pressures arising from the short-term costs, could help all parties involved. Already, countries accounting for 90 percent of the global national product are working together under the G20 process toward these goals.

The author is the senior resident representative of IMF in China.

(China Daily 09/28/2011 page9)

E-paper

Pearl paradise

Dreams of a 'crazy' man turned out to be a real pearler for city

Literary beacon

Venice of china

Up to the mark

Specials

Power of profit

Western companies can learn from management practices of firms in emerging economies

Foreign-friendly skies

About a year ago, 48-year-old Roy Weinberg gave up his job with US Airways, moved to Shanghai and became a captain for China's Spring Airlines.

Plows, tough guys and real men

在这个时代,怎样才"够男人"? On the character "Man"