View

Liquidity, not liability a risk

Updated: 2011-01-12 08:02

By Huang Yiping (China Daily)

China should be worried about fiscal sustainability especially because of the reckless spending habits of its local governments. But this is cause for concern, not an immediate triggering of crisis.

Even if we count the "non-funded" pension funds, local government borrowing and potential non-performing loans, the total public liability is still only about 50 percent of GDP. Over the past few years, fiscal deficits have risen to about 2 percent of GDP. But fiscal revenues have been growing by about 20 percent a year for more than 15 years. And although the growth rate slowed in 2009 to 9 percent, it rebounded last year to 21 percent.

Given the massive credit expansion over the past two years, the quality of banking assets is likely to deteriorate. Yet a banking crisis is still highly unlikely to occur in the conceivable future. This is because the average non-performing loan ratios of Chinese banks are still pretty low, below 5 percent for most banks.

More importantly, the government is likely to assume responsibilities for new non-performing loans in the near future. One possibility is that the government could transfer non-performing assets to asset management companies, just as it did in 1999.

The corporate balance sheet is quite healthy, too. Corporate income as a share of national income increased steadily during the last 10 years. Despite the adverse effects of the global financial crisis, China's industrial profit growth increased throughout last year and crossed 20 percent in the second half of the year.

Judged by usual indicators such as the price/income ratio, rental yields and the vacancy ratio, the country's property market shows obvious signs of a bubble. But normally, the deflation of a housing bubble is triggered either by a sudden slowing down of income growth or a dramatic tightening of monetary policy. It can happen faster when households become overly leveraged. But that is not yet the case in China. Mortgage loans account for about 12 percent of the total outstanding loans, which is equivalent to 24 percent of GDP and only a little more than a year's household savings.

All these factors suggest that, while risks may be on the rise in China, a collapse or bursting of bubble or a crisis is unlikely in the near future. The fundamental factors supporting macroeconomic and market stability are continued strong economic growth and very healthy balance sheets for the government, companies, banks and households. The liability side is unlikely to pose a risk to the Chinese economy this year.

Liquidity, however, has become a bigger challenge for Chinese policymakers and investors. The sudden rise in the flow of "hot money" into China because of the US Federal Reserve's (Fed) Quantitative Easing (QE2) is already asserting a lot of pressure on Beijing. Irrespective of the Fed's motivation, QE2 is likely to continue in 2011 and further complicate China's economic situation.

The direction of China's monetary policy is even more complicated. Since the end of 2008 the country's central bank has maintained a very loose monetary policy, as seen from new loans worth 9.6 trillion yuan ($1.45 trillion) issued in 2009 and possibly 7.8 trillion yuan last year. The central bank will probably set the new loan target at 7.2 trillion yuan for this year, lower than those in the previous two years but still 50 percent more than the original target for 2009.

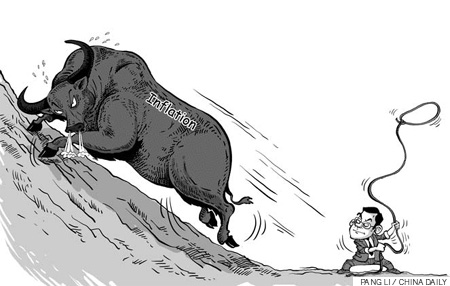

Credit expansion has been useful in supporting growth. The downside is that the loose monetary policy has created inflationary pressures. The year 2009 saw prices rising in waves first in the stock market and then in the housing sector. In 2010, the government tried hard to crack down on property prices. And though economists in general are skeptical about the effectiveness of the restrictive measures, housing prices have at least stopped increasing.

But then prices of beans, garlic, apples, cotton, sugar and other commodities began rising one after another, and made government officials run around inspecting inventories and punishing speculators.

There are two probable reasons why the government is reluctant to tighten the monetary policies. One, it is still more worried about growth than inflation. And two, it is somehow convinced that the rise in prices in the recent past was a reflection of structural adjustment, not overall inflation. The problem, according to government argument, did not require monetary policy action.

So how will the Chinese economy perform in 2011? There shouldn't be much uncertainty about GDP growth reaching 8.5 to 9.5 percent. Export growth should remain solid. Whether or not the trade surplus will widen rapidly again depends on China's import policy. Any widening of China's external account imbalance, or lack of progress in rebalancing, could lead to significant international pressure on Chinese exchange rate policy.

Unless the central bank changes its current policy approach, inflationary pressure is likely to rise further, at least in the first half of this year. But the rapid increase in inflation should eventually make policymakers change their stance, because they are certainly worried about the political consequences of high inflation. We could see high inflation in the first half of the year and aggressive policy tightening in the second half, including interest rate hikes, currency revaluation and tightening liquidity. And such measures should exert some downward pressure on inflation, asset prices and economic growth.

One big uncertainty surrounds the trend in housing prices. Last year, the government implemented two rounds of tightening policies - one in April, the other in October. As a result, housing prices did not go up. But they probably did not go down, either. Housing prices will tend to rise as soon as the government shows any sign of loosening its controls, though the government has confirmed that it will continue to crack down on housing prices this year.

Some experts, however, have forecast a significant decline in housing prices. The analysis here suggests otherwise. A more likely outcome is continued stabilization, not collapse, of housing prices this year.

The author is a professor at the China Center for Macroeconomic Research, Peking University.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Carrefour finds the going tough in China

Maid to Order

Striking the right balance

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.