London vital as global springboard

Updated: 2012-07-13 11:24

(China Daily)

|

|||||||||||

Major Chinese banks see the financial crisis as an opportunity to develop their business in the UK and in Europe, and have made the establishment of a UK subsidiary a priority in their European and global expansion programmes, reports Zhang Chunyan from London.

|

|

An employee of an ICBC’s branch checks euros and yuan in Huaibei, Anhui province. For Chinese banks who expand business overseas, analysts note that creating long-term stable customer relations, making up for cultural differences and turning out more special financial products are the key requirements for their healthy and sustainable development. [Wu He / For China Daily] |

The dramatic 17th-century Drapers' Hallis often transformed into a film set. Last spring, the famous venue in the heart of the City of London was used as Buckingham Palace in the Oscar award-winning The King's Speech.

But this spring, the protagonist in the Hall was not the King, but an expanding Chinese bank.

The Agricultural Bank of China Ltd (ABC), a major commercial lender ranked among the Big Four in China, held a ceremony there to launch the arrival of its overseas subsidiary in London, a milestone in its history, said Yan Haiting, CEO of ABC in the UK capital.

"It's the first time the bank has opened an international office since we began operating in Singapore 18 years ago," he explained.

The London subsidiary will concentrate on wholesale banking, including corporate deposits, syndicated loans, bilateral loans, trade financing, international settlement and foreign exchange settlement and transactions, Yan said.

The additional address means ABC has established 10 overseas institutions in eight countries and regions, and now uses 1,365 agent banks globally.

Last year, that burgeoning network helped deliver enough business for it to be ranked as the world's fifth largest commercial lender by market value — a perfect illustration of how Chinese lenders have successfully expanded into global markets in recent years.

Besides Bank of China (BOC) and the Industrial and Commercial Bank of China (ICBC) — both of which already have long histories in the UK — China Construction Bank (CCB) opened its first subsidiary in Canary Wharf in June 2009, while the Shenzhen-based China Merchants Bank (CMB) set up a representative office in London in July 2009.

Bank of Communications (BoCom), China's fifth-largest lender, meanwhile, opened its first overseas subsidiary in London last November.

All the major Chinese banks quite realistically see the financial crisis, and the European debt crisis particularly, as creating opportunities to develop their business in the UK and in Europe.

For all these Chinese giants, establishing a UK subsidiary is an important step in their European and global expansion programmes, and establishing a British foothold especially is a key landmark in building a global financial services springboard.

UK Trade & Investment CEO Nick Baird said that as one of the most open economies in the world, he believes the UK "is a natural home for Chinese firms".

"The UK is one of the largest recipients of Chinese investment in Europe and China is the UK's fastest growing export market," he added.

Working as what the two governments are billing as "Partners for Growth", the UK and China have agreed to increase bilateral trade by 2015 to $100 billion a year, and to maintain a secure and open trading environment, both domestically and internationally.

The UK also plans to raise its total exports to China to $30 billion a year by 2015.

According to ABC, opening the London unit supports its expansion into Europe and its efforts to create a 24-hour global capital services platform, as well as a multi-currency cross-border settlement network.

"I am confident London is the best possible location to help our bank grow and secure new business from both Chinese and British customers," Yan said.

CCB London, which delivers a range of banking services including corporate deposit, loan, trade finance, commodity finance/ hedging, and sterling clearance, is also CCB's first wholly-owned subsidiary in Europe. CCB is building its reputation in wholesale, retail and investment banking.

One of its biggest achievements so far in London has been a $20 million loan offered to Chinese automaker Geely, to buy Swedish carmaker Volvo in 2010. The Hangzhou-based auto giant bought Volvo for $1.8 billion, making the deal the biggest overseas purchase by Chinese auto enterprises in 2010.

At CMB London, meanwhile, chief representative Pan Kang said its representative office was set up as a first step to tap into UK and European market.

Its main function is to conduct market research and prepare for the launch of banking operation in the UK and Europe.

CMB is considered a market leader in retail banking, private banking, credit card business and offshore international banking in China.

Adrian Blundell-Wignall, deputy director of the directorate for financial and enterprise affairs at the OECD, criticised European banks in a recent Bloomberg Brief: Economics Europe for not only being poorly capitalised but also for mixing investment banking with traditional retail and commercial banking.

Risk exposures in large, systemically important financial institutions can't be properly quantified, let alone controlled, he added.

Bank shares in Europe have been hammered as fears erupt that they are too weak to take the body punches dished out by the eurozone government debt crisis.

"Clients who are finding it difficult to get financial support from European banks will turn to the Chinese for help," said Pan Kang at CMB. Now Chinese banks are playing an increasingly important role in the UK financial services sector and the partnership of growth between Britain and China.

Liu Qiang, CEO of BoCom's London subsidiary, said its London unit relies strongly on the excellent "customer, financial and network advantages of our parent bank to serve Chinese enterprises operating overseas, foreign companies that have close trade connections with China, and local businesses in the UK".

The subsidiary has more than 20 employees in the UK. Their customers include China National Petroleum Corp, China's largest oil and gas producer and supplier, and Associated British Foods, a diversified international food, ingredients and retail group.

BoCom's London representative office was set up in 1993 to deal with the bank's nontransactional activities. BoCom has 11 overseas institutions in New York, Tokyo, Singapore and Hong Kong.

However, there are still many challenges for Chinese banks to further expand.

A tightening of banking regulation in the wake of the financial crisis will be one, Pan said.

"Higher capital and liquidity requirement will eat into the profit of the banks," he added.

For Chinese banks who expand business overseas, analysts also note that creating long-term stable customer relations, making up for cultural differences, and turning out more special financial products are the key requirements for their healthy and sustainable development.

London is seen as the prime location in which to establish what some are calling an offshore RMB trading "Western Centre".

Chinese banks fully appreciate they have to be there in force, to further develop their business, in the hope of achieving the kind of critical acclaim and financial clout, that The King's Speech did in cinematic terms.

|

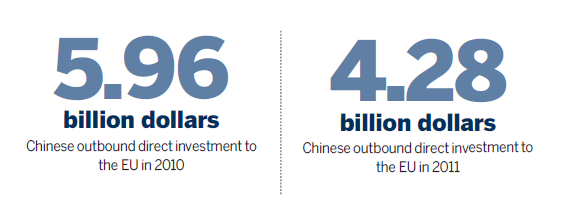

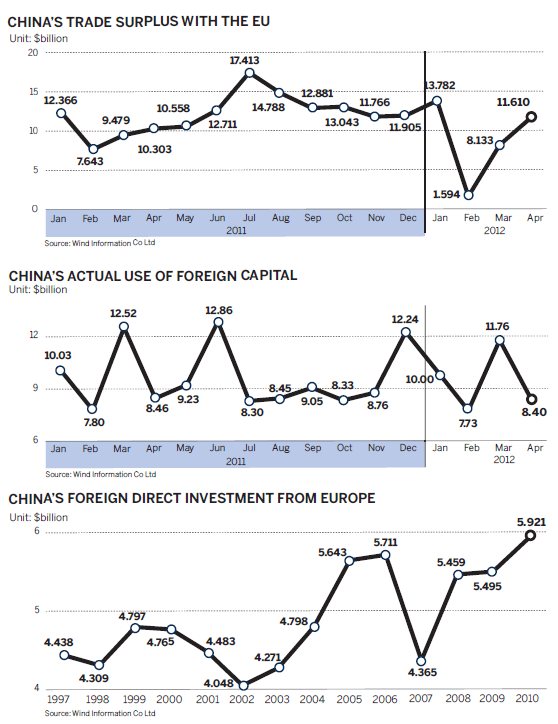

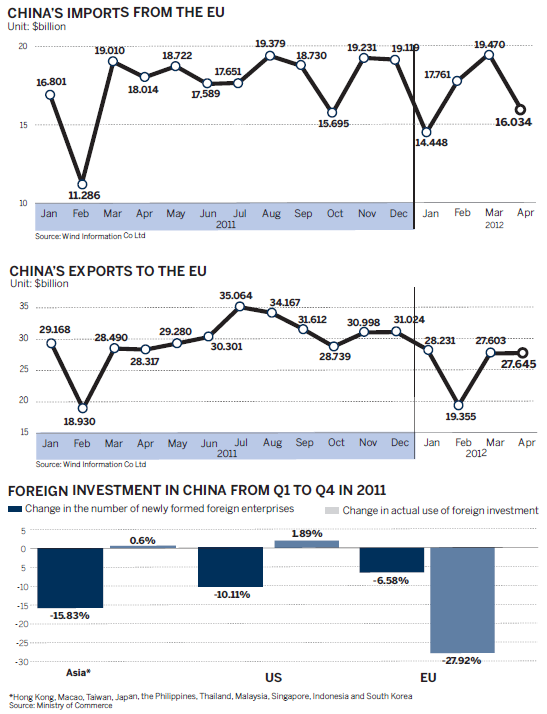

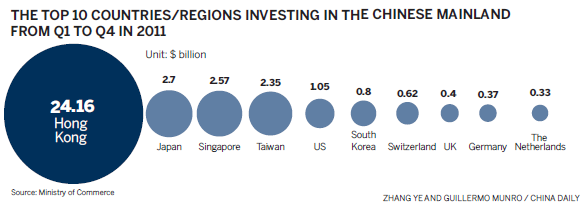

TRADE AND INVESTMENT BETWEEN CHINA AND THE EU

|