New Year to bring investors little assurance

Updated: 2011-12-26 07:55

By Daryl Guppy (China Daily)

|

|||||||||

The charts suggest there is a high probability 2012 will be a replay of 2008 as markets retest the 2008 lows. The conditions leading to this market fall are not the same as those that were seen before the 2007 collapse. In 2007, the markets were dominated by end-of-trend patterns, including head and shoulders and rounding tops. Markets at the end of 2011 mostly do not have these patterns. Instead, markets are being dominated by substantial increases in volatility, which are a reflection of political and economic instability.

As we move into 2012, we catch a glimpse of large problems to come. They are just small bumps on the horizon now, but they may come to dominate markets in 2012. They include the previously hidden process of re-hypothecation, which contributed to the MF Global collapse and the destruction of client funds and counterparty funds. The practice of essentially re-mortgaging inflated paper assets also used regulatory arbitrage. The United Kingdom has less stringent laws than the United States so US funds were shifted to those jurisdictions.

The details of the MF Global collapse dramatically changed the nature of counterparty risk. The full effect on euro bond trades is yet to be fully assessed.

The bitter euro pill of forced economic restructuring as a result of unsustainable debt will be exported to the US. The US continues to refuse to take the medicine it so freely prescribes to other countries. Structural economic reform in the US is inevitable. And it will be painful and will have adverse effects on the global economy. The fast relief rallies are not enough to establish a trend and volatility will not disappear.

Europe has a two-speed economy. The powerhouses of Germany and France are not strong enough to offset the poor performances of Greece and other heavily indebted members of the euro zone.

The DAX stock index, which tracks German companies, developed a dramatic and clean break from the uptrend line in July 2011. Weak rebound consolidation developed from support near 5,000. This level was the shoulder level of the inverted head and shoulder recovery pattern in 2008 and 2009. The potential failure of support at 5,000 in 2012 will see a retest of the 2008 DAX lows at 3,800.

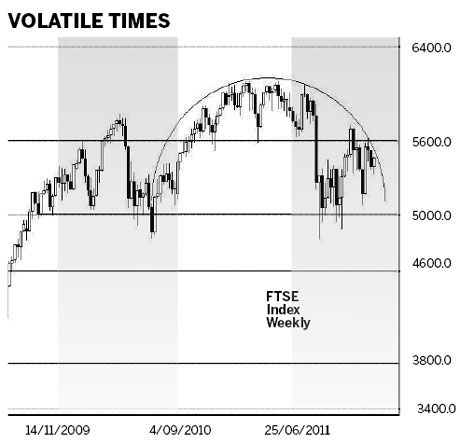

The FTSE index, which tracks UK companies and is now trying to separate itself from the Euro zone, has similar long-term bearish patterns. The FTSE has a rounding top trend reversal pattern. The downside targets are near 4,500. This is also the level of the neckline in the inverted head and shoulder recovery pattern in 2008 and 2009. Failure of this level leads to a retest of the 2008 lows near 3,700.

The key European index charts show the potential to retest the lows of 2008. This bearish behavior is not as strong in US markets. Even so, the US market charts show evidence of developing weakness.

A head and shoulder pattern developed in mid-2011 on the DOW Index, which tracks US companies. Downside targets were achieved and a L-shaped consolidation pattern developed. The breakout from the L-shaped consolidation has high volatility on the upside and downside. The neckline trend line for the head and shoulder pattern acted as a resistance level. This effectively limits the degree of any rebound rise in the DOW and creates a strong resistance level.

The DOW can reach and exceed the 12,800 highs of 2011 but this is most likely to be a bumpy ride. This includes very fast moves to the trend line followed by very fast retreats from the trend line. Volatility makes longer term investing difficult.

The chief weakness in the DOW is the failure to decisively break out of the L-shaped consolidation pattern. The weak breakout suggests that further negative developments in Europe and in the US have the capacity to quickly drive the DOW below the 11,600 level and retest the 10,600 level.

The year 2012 brings the prospects of a continued year of struggle. Investors will watch for breaks below or above the key trigger points. Genuine economic growth is difficult and the volatility risk is high.

The balance on global markets is bearish but this also hides an important feature. The volatility seen in 2011 will also dominate 2012. Some issues raised by MF Global and sovereign debt defaults are already hinting at an expansion of systemic risk. This volatility includes rapid rises and rapid falls. Trends are less persistent and more unstable. Long-term trending behavior is replaced with short-term whipsaws. This is a market for skilled traders and it challenges many of the assumptions of long-term investing and trend trading. In 2012, as much caution will be needed as was in 2011.

The author is a well-known international financial technical analysis expert.