Drug makers eye small cities

Updated: 2011-12-21 07:52

By Liu Jie (China Daily)

|

|||||||||

|

|

Country's health reforms open doors to foreign healthcare firms

BEIJING / SHANGHAI - As reform of China's medical care system makes its way down to some of the smaller cities in China, multinational pharmaceutical companies are turning their eyes to those places, while they may face challenges and uncertainties, analysts said.

This year, various international drug makers, including Bayer HealthCare, Pfizer Inc and Sanofi SA, announced plans to enter China's second-, third- and even fourth-tier cites. The pharmaceutical markets in such places are growing faster than in first-tier cities, which in the past have often been the places where growth was most rapid.

The businesses said they see a demand for their products in those cities, especially as the government's ongoing healthcare reform aims to provide universal medical care for the 1.3 billion population by 2020.

"Foreigners are moving into China's smaller markets because there is huge potential there," said Wang Youhong, an analyst with Haitong Securities. "At the current stage, having a vast rural market may be just a vision for them and entering smaller cities is more practical, because market conditions there are not very different from those in big cities and residents will accept new products with higher prices from multinational drug makers much more readily."

Bayer HealthCare, a subsidiary of Germany's Bayer AG, released its new plan for China in March, saying that it considers the huge Chinese market to be composed of three regions. Now, its central region is based in Beijing, the southern region has its base in Shanghai, and the western region is based in Chengdu.

"The strategy will enable us to be customer-centric, to disaggregate operational complexity, be more flexible and speed up operational decision-making at the frontline," said Chris H. Lee, managing director of Bayer HealthCare China.

"It will help us to stay close to front-line employees and be more attentive to their needs and development."

He said he believes the western region will grow faster than the others.

He also said the company will add 1,000 sales representatives to its Chinese workforce in 2011, an increase of 30 percent from a year before.

The plan calls for Bayer HealthCare to tailor its expansion plans to the conditions that are present in each of the three regions.

In 2010, each of its sales representatives generated 6.44 million yuan ($1 million) on average for the company. For the top 10 multinational drug makers in China, the average comparable amount was 4.39 million yuan, according to the R&D-based Pharmaceutical Association Committee, a nonprofit, non-governmental organization under the China Association of Enterprises.

So far, the plan has been progressing smoothly, the company said. Bayer HealthCare China is one of the top three multinational drug makers in the country measured by sales. In 2010, the value of its sales increased to 7.24 billion yuan, an increase of 22 percent from the year before. That momentum is expected to continue this year.

Pfizer, based in the United States, has also established a strong presence in large Chinese cities and is working with partners in the country to distribute its products to smaller cities.

In April, it signed a Memorandum of Understanding with the Shanghai Pharmaceutical (Group) Co Ltd to register, distribute and eventually sell a Pfizer product in China. The two sides also plan to work together to promote the use of Pfizer's Prevenar (7-valent), a pneumococcal conjugate vaccine. In June, Pfizer established a similar partnership with the Zhejiang Hisun Pharmaceutical Co Ltd and, in August, one with the Jointown Pharmaceutical Group Co Ltd, a Hubei-based company and one of the top five medicine distributors in China. As a result, Pfizer has been able to draw on its Chinese partners' resources and has gained entry to markets in the country's central and eastern regions.

For the first half of the year, Pfizer China reported sales revenue of $565 million, an increase of 24.6 percent above the same period a year before.

As for the French drug maker Sanofi, its business is developing quickly in China and other emerging markets; in 2010, its sales in emerging markets exceeded those in both the US and Europe.

That performance partly arose from selling the right products in those markets, said a report from IMS Health, an international medical care research firm.

Take Plavix, a cardiovascular medicine, and Lantus, an insulin treatment, as examples. Because they have been marketed well and carry fairly low prices, both can be found at hospitals and pharmacies in smaller cities. In 2010, 1.88 billion yuan worth of Plavix and 549 million yuan worth of Lantus were sold in China.

The enthusiasm of multinational drug makers for China's smaller cities is being driven in part by the medical reform that China has been undertaking since 2009.

In April 2009, China began acting on a plan to make comprehensive reforms to its medical system. The plan's eventual goal is to establish a universal healthcare system for the country by 2020, giving people both access to affordable public hospitals, clinics and similar places and coverage from public medical insurance.

The first phase of the plan is to be completed this year, providing medical care to 90 percent of the population. In 2010, an additional 12.3 billion yuan in government money was allocated toward the medial reforms. That came on top of the 850 billion yuan that was provided between 2009 and this year.

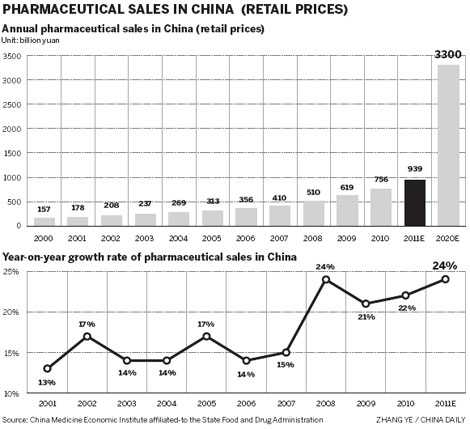

Stimulated by the reform and the population's ever-increasing demand for improved medical care, the value of the Chinese pharmaceutical market is expected to grow at an average annual rate of 20.1 percent between 2010 and 2015, reaching 694 billion yuan by 2015, IMS Health said.

After years of looking toward big cities in China, multinational companies have come to better understand the country's markets. Even so, many obstacles stand in the way of their entry into smaller cities, analysts said.

At the same time, multinational drug makers are expanding their sales force, further indicating their commitment to sales and marketing. The IMS report said the largest of the drug makers employs 3,500 sales representatives, stopping short of identifying the company.

So far, the chief difficulty for multinational companies that want to compete against Chinese companies will be in finding markets that offer the greatest potential for growth and in tailoring their products to meet the diverse needs of customers.

"Their domestic competitors have established both complete sales networks and sound relations with the governments and hospitals found in smaller markets, which is something that isn't easy for multinational companies to achieve in a short space of time," said Lydia Xu, a pharmaceutical researcher with the Samsung Economic Research Institute.

A shortage of talent is also causing headaches. According to research conducted by healthr.com - a medical job website - the demand for pharmaceutical workers in China's second- and third-tier cities increased greatly in the first quarter of the year.

During that period, the number of jobs in the medical industry in the city of Tianjin increased by 30.5 percent from a year before. The percentage increase between the same periods was 42.3 percent in Chongqing, 34.3 percent in Gansu province, 26 percent in the Ningxia Hui autonomous region and 38 percent in the Inner Mongolia autonomous region. A large proportion of the job opportunities, about 27.1 percent, were for sales representatives.

"Recruiting local people with good educations and medical experience is not easy," said a human resources manager from a multinational drug maker, who declined to give her name or that of her employer.

"Sending a sales team from headquarters, with people who are willing to work in smaller cities for the long term, is not practical because there are different cultural and social environments in those regions."

Some sales representatives from Chinese drug makers have taken to moving to multinational companies for better pay and training opportunities, giving such companies a good pool of talent to draw from in smaller cities. Doctors in hospitals serving such places are also good candidates.