Italian bond yields reach record high

Updated: 2011-11-08 07:54

(China Daily)

|

|||||||||

LONDON - Italian benchmark yields climbed to a euro-era record amid concern the region's third-largest economy is struggling to manage its debt loads, while growth in the region is faltering.

German two-year note yields were within six basis points of an all-time low before European finance chiefs met to discuss the region's bailout fund. Greek politicians agreed to form a national unity government to win international aid payments.

The extra yield investors receive for holding 10-year Italian debt over similar-maturity bunds fell from a euro-era record after Il Foglio said Prime Minister Silvio Berlusconi may step down within "hours".

"Ultimately, Italy is a lot bigger issue than Greece for the future of the eurozone, given the size of the bond market," said Lyn Graham-Taylor, a fixed-income strategist at Rabobank International in London. "You've got very high bond yields and they can't live at this level forever."

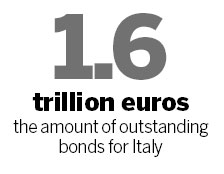

With almost 1.6 trillion euros ($2.2 trillion) of bonds outstanding, Italy has more liabilities than Spain, Portugal and Ireland combined, making it vulnerable to increases in borrowing costs.

Italy's 10-year bond yield climbed 19 basis points, or 0.19 percentage point, to 6.56 percent at 11:10 am London time, after rising to a record 6.68 percent. That pushed the difference in yield, or spread, over German securities to as wide as 491 basis points.

The Italian two-year note yield surged 54 basis points to 6.0 percent, narrowing the spread over 10-year yields to 80 basis points, the least since September 2008.

ECB debt purchases

Volatility on Italy's sovereign debt was the highest among developed markets on Monday, according to measures of 10-year bonds, two-10-year spreads and credit-default swaps. The change in the spread was 6.8 times the 90-day average, the Bloomberg gauge showed.

Italy's borrowing costs rose even as the European Central Bank (ECB) was said to be buying the nation's debt.

Berlusconi's government in August approved 45.5 billion euros in austerity moves, its second deficit-cutting plan in a month, to secure ECB purchases of the nation's debt.

The central bank is free to decide to stop buying Italian bonds if conditions are no longer met, council member Yves Mersch said in an interview with La Stampa released on Saturday.

Investor confidence

Concern that the sovereign debt crisis will plunge the region into recession pushed European investor confidence to the lowest in more than two years this month.

An index measuring sentiment in the 17-nation eurozone declined to minus 21.2 from minus 18.5 in October, the Limburg, Germany-based research institute Sentix said on Monday. That's the lowest since August 2009.

European retail sales declined more than economists forecast in September, dropping 0.7 percent from August, the biggest fall since May.

A separate report showed German industrial production slid 2.7 percent in September, more than expected, according to the median analyst estimate.

The German two-year note yield slipped one basis point to 0.39 percent. It reached a record low of 0.32 percent on Sept 23. The 10-year yield was four basis points lower at 1.78 percent.

Bloomberg News