Europe shows signs of recession as PMI drops

Updated: 2011-10-25 08:00

(China Daily)

|

|||||||||

ZURICH - European services and manufacturing output contracted in October at the fastest pace in more than two years, adding to signs the region's economy is edging toward a recession.

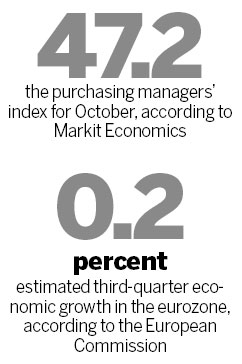

A eurozone composite index based on a survey of purchasing managers in both industries fell to 47.2 from 49.1 in September, London-based Markit Economics said in an initial estimate on Monday. That's the lowest since July 2009 and below the 48.8 forecast by economists, according to the median of 17 estimates in a Bloomberg survey.

The European Central Bank (ECB) earlier this month resisted calls to lower interest rates, instead extending its use of unconventional tools, even as the economy is showing signs of a deepening slowdown. German investor confidence dropped to the lowest in almost three years this month.

The figures "are dismal across the board", said Howard Archer, chief European economist at IHS Global Insight in London. "Eurozone economic activity is clearly being held back by tighter fiscal policy increasingly kicking in across the region, and the major hit to confidence coming from the heightened sovereign-debt tensions and financial-market turmoil."

The eurozone services indicator fell to 47.2 this month from 48.8 in September, Monday's report showed. The manufacturing gauge dropped to 47.3 from 48.5 in the previous month. Markit will report final October figures next month.

Global recession

|

The eurozone economy probably failed to gather strength in the third quarter, expanding 0.2 percent from the previous three months, the European Commission in Brussels estimates.

In the fourth quarter, it may expand just 0.1 percent, it forecast. The ECB last month also cut its growth projections for this year to 1.6 percent and 1.3 percent next year.

Nouriel Roubini, co-founder and chairman of Roubini Global Economics LLC, said on Monday that there's a 50 percent risk the United States, the United Kingdom and the eurozone will slip into a recession in the next 12 months.

Business confidence in Germany, Europe's biggest economy, slumped to a 16-month low in October and consumer sentiment also weakened.

The ECB on Oct 8 opted to extend emergency cash to banks and resume purchases of covered bonds to help contain the crisis. The central bank has also been forced to purchase bonds of distressed nations such as Italy and Greece as governments struggled to reach an agreement on their crisis-fighting tools.

Deutsche Bank AG, Germany's largest lender, on Oct 4 scrapped its profit forecast and announced 500 job cuts and further write-downs on Greek bond holdings, citing a "significant and unabated slowdown in client activity".

Bloomberg News