Economy

'No-brands' nobble Nokia in new markets

Updated: 2011-08-08 08:01

By Devidutta Tripathy and Tarmo Virki (China Daily)

NEW DELHI / HELSINKI, Finland - From New Delhi to Shanghai to Johannesburg, a flood of cheap handsets from the likes of China's ZTE Corp and India's Micromax Informatics Ltd is destroying Nokia Corp's top position in emerging markets.

Compounding the woes for the Finnish phone maker, Asian handset manufacturers are increasingly turning to Google Inc's free Android software, which is popular with operators and consumers in cut-rate markets.

Nokia is already under pressure in the high-margin smart phone sector as Apple Inc, Blackberry maker Research In Motion Ltd and Google seize market share, leaving the basic cell phone business as Nokia's most valuable part. That is now under threat.

"Three years ago Nokia's position in emerging markets looked impenetrable, but low-cost chipsets and growing scale have helped a number of Asian manufacturers to price aggressively and seize market share," said Geoff Blaber, an analyst at CCS Insight in London.

"The 'lean mean phone-making machine' that used to dominate the sub-$50 space has come under huge pressure from agile rivals."

In June, Nokia abandoned hope of meeting key targets just weeks after setting them, blaming difficult conditions in China and Europe. Its shares slumped 18 percent in one session on skepticism about its strategy to team up with Microsoft Corp for Windows Phone software in the smart phone war.

The battle for the cheap phone market could be even tougher.

Nokia has been able to rely on its brand and distribution chain across emerging markets, home to 1.7 billion mobile phone subscribers.

But ZTE and larger Chinese rival Huawei Technologies Co Ltd, which have traditionally been in the network-equipment business, are aggressively muscling in on mobile devices.

ZTE expects to ship more than 80 million handsets this year, up by a third from last year's 60 million units, a senior executive told Reuters in April.

Key markets for ZTE's handsets include China and Europe.

Huawei has targeted shipments of 60 million handsets this year, even marketing its devices in glitzy Beijing malls and at a Milan fashion show to raise its profile.

"They are already familiar with what the operators are looking for," said Melissa Chau, research manager for client devices at IDC Asia Pacific in Singapore, referring to ZTE and Huawei.

"At the very low end, they offer handsets at very low prices in huge bulk shipments to operators."

Demand for low-end cell phones has surged across emerging markets since the global economic crisis began to ease in 2009. However, Nokia's sales of basic cell phones have fallen for three straight quarters. During January to March, the Finnish company sold 84.3 million non-smart phones, 2 percent fewer than a year ago.

Market share falls

"Nokia should really have begun to fight back two years ago and leaving it so late in the day puts the vendor in a very tough competitive position," said Neil Mawston, an analyst at the research firm Strategy Analytics.

Some of the Asian vendors are hardly household names. But in China, the biggest competitive threat comes from manufacturers that have no name at all.

So-called "no-brand" manufacturers - small Chinese companies using chipsets from MediaTek Inc or Spreadtrum Communications Inc - control 45 percent of the market in the world's most populous country. Nokia's market share in China has shrunk to 19 percent from 33 percent two years ago.

No-brand Chinese manufacturers have also expanded into Africa, India, Latin America and Russia over the last year, according to the researcher Gartner. In total, they sell more phones than Nokia, said Gartner.

Analysts expect these manufacturers to focus next on cheap smart phones running Android software.

In India, Nokia is in a bruising fight.

The company is jostling with about 150 vendors in the world's fastest-growing cellular market, home to more than 800 million subscribers and with mass-market phones selling for about $20 with basic features.

Cheap handsets and phone charges as low as half a cent a minute are fuelling growth.

Some Indian manufacturers, who mostly produce handsets in China and Taiwan, make net margins of only about 2 percent, analysts said.

No-brand Chinese vendors controlled 20 percent of the Indian market in the first quarter, with Nokia at 26 percent, Gartner said. Only two years ago, Nokia had close to 60 percent.

About 220 million new handsets are expected to be sold in India this year, up about 25 percent from last year.

By adapting to local tastes, handset makers such as Micromax grabbed 7.6 percent of handset sales in India last year, said the local research firm CyberMedia Research.

Funded by private equity, Micromax sells handsets packed with features such as dual SIM cards, which allow users to take advantage of different call and data pricing plans as well as separate business and private usage; gravity sensors that allow users to change mobile networks by rotating handsets; and others that can be used as a remote control for televisions, air conditioners and DVD players.

Reuters

(China Daily 08/08/2011 page15)

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

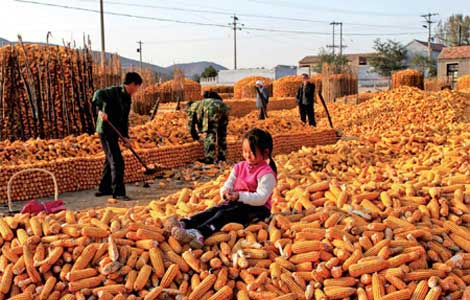

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival