Spotlight no longer on China

Updated: 2016-08-05 08:08

By Andrew Moody(China Daily Europe)

|

|||||||||

The Chinese economy is no longer the major global concern it was at the beginning of the year, thanks to steady growth and rising consumption

Fears about China's economy are no longer center stage.

In January, slowing China growth was seen as one of three major global economic risks along with rising US interest rates and Britain's EU referendum vote.

|

A woman shops at a market in Yichang, Hubei province. The economy is continuing to rebalance away from heavy industry toward consumption and services. Photos Provided to China Daily |

|

Customers at a shopping mall in Hangzhou, Zhejiang province. Consumption was boosted by retail sales, which were up 10.6 percent in June. |

After the midpoint of the year, however, China is proving resilient with GDP expanding 6.7 percent - within the range of the government's 6.5-7 percent target - in the second quarter figures announced on July 15.

The new data led the International Monetary Fund to increase its 2016 forecast for Chinese growth by 0.1 percentage point to 6.6 percent while at the same time revising down its estimate for global growth by the same margin to 3.1 percent.

Christine Lagarde, managing director of the IMF, said in Beijing on July 23 that she was confident of the direction of the China economy.

She was attending the so-called Six Plus One meeting, which included representatives of the World Bank, the OECD and the World Trade Organization, the G20 financial stability board and Chinese Premier Li Keqiang as well as the IMF.

"First of all, we have witnessed the determined and decisive implementation of reforms; and second, there was also support given to the economy in order to encourage growth to go forward," she said.

"On the latter point, it did not take the form of vast fiscal stimulus but simply some solid and steady support in order to make sure that growth was indeed sustainable," she added.

With the reality of Brexit postponing any immediate prospect of the US Federal Reserve Bank raising rates, global risks now center on two main areas: the stability of the European Union in the wake of the UK vote and the US presidential election in November.

Some wonder whether China might also be changing the terms of the economic debate that has dominated since the financial crisis, with much of its growth driven by an active expansionist monetary and fiscal policy, while many of the Western economies are mired in anemic growth while following debt-reducing austerity policies.

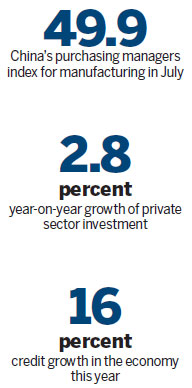

There were further indications on Aug 1 the Chinese economy had stabilized with the publication of China's purchasing managers index for manufacturing.

Despite the headwinds of summer flooding in China and capacity reduction of some traditional enterprises, it contracted to just 49.9 in July.

The Caixin China Manufacturing PMI, published on the same day, actually expanded to 50.6, well ahead of expectations of the Bloomberg panel of experts of 48.8.

Its China Services PMI, announced on Aug 3, slipped slightly to 51.7 from 52.7 in June.

George Magnus, senior independent economist at Swiss bank UBS in London, says the market concerns about the Chinese economy have certainly receded since the beginning of the year.

"Whatever people thought was going to happen to China earlier this year hasn't happened. The economy and Chinese financial markets haven't been event-free but they've been relatively stable thanks to more efficient policymaking in the currency market, and also to fiscal and monetary expansion that has kept the economy from slowing further," he says.

"The top billing instead has been taken by the merry-go-round of Fed expectations and Brexit."

Duncan Innes-Ker, Asia regional director for The Economist Intelligence Unit based in London, agrees some of the fears have abated.

"The second quarter data was relatively stable and has allowed China to slip down the ranks of global concerns," he says.

"When you look at the political and economic issues out there you have Brexit and the Trump versus Clinton contest, which are sapping energy from other discussions around the world. These will continue into the second half."

Innes-Ker says the possibility of a Trump presidency could create global economic uncertainty in the next few months.

"Our view remains that Clinton is the more likely candidate to triumph in the end but the opinion polls indicate it is a lot closer than would be generally desirable. The various parts of his economic policy platform are either mutually contradictory or highly irresponsible."

Louis Kuijs, head of Asia economics at Oxford Economics, says a lot of the immediate concerns about the Chinese economy are no longer at the fore.

"I think for the financial markets and what worries people day to day, China is now less pronounced. They are not so concerned about the risk of sudden capital outflows or of a very sudden change in the currency," he says.

"But although China is not so much on the radar screens, a significant slowdown in China is unfortunately by far the No 1 concern people have. When we do a poll every quarter of our clients, it still comes up as the biggest risk to the global economy."

Angus Nicholson, market analyst in Melbourne for IG Markets, the global brokerage, says the PMI data presented an overall picture of stability.

"If you look at the official index as a whole, output has been very solid and that is very positive," he says.

"The small and medium-size company subcomponent underperformed in July with much of the gains coming from the large corporates which may have benefited from the government's expansionary policies.

"The picture is slightly confused because the Caixin showed a big jump in the performance of the SMEs so we need to see more data to understand what precisely is the trend."

Jing Li, an economist with HSBC in Beijing, says that although there was stability in the official PMI figures, the government may need to give continued support to the economy.

"Despite the stabilization in the manufacturing sector, weaknesses in external demand, as well as fragile business sentiment in the private sector, pose downside risks to growth. To this extent, we believe more growth-supportive policies, such as additional policy rate cuts, banks' reserve ratio requirement cuts, and faster fiscal expansion are still warranted."

She says the slight underperformance of the official PMI was due to the government's policy of restructuring state-owned enterprises.

"It is more sensitive to corporate restructuring activity in heavy industry and eased back slightly because of weakening production. The non-manufacturing PMI continued to expand robustly, as a result of a strong performance in the transportation, telecommunications and tourism sectors."

China's second-quarter data also pointed to the economy continuing to rebalance away from heavy industry toward consumption and services.

Of the first half's 6.7 percent GDP growth, consumption contributed 4.9 percentage points (73.1 percent), up from 4.2 points in the same period last year.

Meanwhile, investment's share of growth was 2.5 points (37.3 percent), down from 2.9 points.

Consumption was boosted by retail sales, which were up 10.6 percent in June, well ahead of expectations and are now rising at the fastest rate since December last year. Sales of passenger cars were up 17.7 percent in June in response to measures by the government to boost vehicle sales.

Innes-Ker at the EIU says the recent data overstates the transition going on in the economy.

"The underlying story is that the economy is rebalancing and you are seeing a shift toward services and consumption, but I fear the current data is probably overstating the transition.

"I think this is because what we are seeing is some form of reclassification going on in the compilation of the data. Some industries that would be regarded as secondary (manufacturing) are now being described as tertiary (services)."

Magnus, also an associate at Oxford University's China Centre, says that although there is evidence of rebalancing taking place, the progress is not as fast as policymakers would like.

"It is always possible to find anecdotal evidence of rebalancing, and incrementally, one could argue that China is rebalancing slowly. But if we take rebalancing to mean fundamental shift in the consumption share of GDP at the expense of investment and also a parallel shift of the state share of the economy in favor of the private sector, then rebalancing isn't making much progress."

One of the more worrying aspects of the second-quarter data was the weakening in private sector investment, which fell to a record low, growing just 2.8 percent year on year. The private sector accounts for 60 percent of China's total investment and some 80 percent of all jobs.

This new data came after a new study by economists at Peking University, which showed that private sector gearing, or borrowing against assets, had fallen from 48 percent in 2008 to 35 percent in 2015, indicating the difficulty private companies had obtaining finance. Many are being forced into the shadow banking sector, paying rates of 20 percent or more.

Larry Hu, China economist at Macquarie Securities, told the Financial Times that weak private sector investment was the most important data point in the recent figures.

"Whether private investment can turn round in the coming months is the key to the Chinese economy in the second half," he says.

One of the major questions is to what extent growth is being supported by a surge in credit.

Credit growth in the economy this year, at 16 percent, is growing at almost double the rate of nominal GDP of 8.4 percent (growth when taking into account price adjustments). Such credit growth is adding to debt, which according to some estimates is now 250 percent of GDP.

Kuijs says the authorities had set an objective to rein in credit earlier this year.

"This is absolutely not sustainable and should be rising at the same pace as the economy."

Magnus believes the scale of China's debt could mean the economy could hit a Minsky Moment within two or three years.

This is the point, named after US economist Hyman Minsky, at which the level of debt suddenly arrests growth.

"It seems likely China is going to hit this point where the banking system is excessively leveraged, and where too many borrowers are borrowing to keep up with their debt service and amortization obligations.

"The way it manifests itself, though, is likely to be different in China than in the West in 2008 (at the onset of the financial crisis) because the banks are state owned and won't be allowed to fail or become illiquid."

Liu Zhiqin, senior fellow of Chongyang Institute for Financial Studies at Renmin University of China, insists that using credit to boost the economy is the right approach.

"I don't believe it is the big problem that some suggest. Most of China's debt is owed internally. I think the government is right to invest in infrastructure and other major projects to drive economic growth," he says.

"You only have to contrast this with what is happening in many Western countries which are following debt reduction austerity policies and have, as a result, weak growth."

China's second-quarter growth certainly looks more impressive than that of the major Western economies. The IMF forecasts the US will grow by 1.9 percent this year, Japan by 0.5 percent and the eurozone economies by 1.6 percent.

"The fundamentals of the Chinese economy remain positive and I think the country will achieve strong and balanced growth and at the same time drive global growth," adds Liu.

andrewmoody@chinadaily.com.cn

|

Quality control in a factory in Hangzhou, Zhejiang province. The private sector is a vital part of China's economy. Provided to China Daily |

(China Daily European Weekly 08/05/2016 page1)

Today's Top News

Leaders of Iran, Azerbaijan seek to boost trade

Storm in Macedonia kills at least 17

Bank of England cuts rates to record low, restarts QE

Chinese tech to make Himalayan train possible

London unveils new anti-terror unit amid knife attack

Woman killed, five injured in London knife attack

Fury at Republican Party over Trump snub of Ryan

Ukraine's Savchenko on hunger strike

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|