Baton passes to the next generation

Updated: 2015-08-14 08:57

By Yu Ran(China Daily Europe)

|

|||||||||||

New breed of young entrepreneurs are taking over their family businesses and bringing in new ideas

Pan Jianzhong invested his own money into upgrading his family-run shoemaking business in 1992 to prove a point to his mother. Concerned about the risks, Li Ailian, was unsure whether her son's plan to automate the Juyi Group would pay off. She was wrong, as the 1 million yuan ($161,290; 146,919 euros) he pumped into the firm has produced bumper dividends. "I believed the only way to increase the size of the company was to use machines to manufacture high-quality products in a shorter space of time," Pan, general manager at Juyi Group, says.

"My mother is rather conservative and was afraid to take the risk of spending a large amount of cash on expensive machinery, so I had to invest my own money," he says. "She thought the cost would not lead to higher profits, but it has."

In the 1990s, the Juyi Group employed just a few hundred workers. Now, it has 5,000 staff members at a factory in Wenzhou, a city in Zhejiang province, and manufactures 10 million pairs of shoes a year for overseas clients such as DHM, a leading retailer in Germany.

"The company uses computer-guided stitching machines and laser printers that work 10 times faster than traditional hand-crafting," says Pan, who declined to reveal detailed financial figures for the privately owned company. "We have continued to upgrade the factory."

Family businesses, such as the one Pan runs, sprouted up in the 1980s when China opened its doors to the rest of the world. But now they are entering a new phase, as the second-generation takes over the reins.

According to a report by the All China Federation of Industry and Commerce, 75 percent of these companies will be transformed through new technology in the next few years.

The old way of doing business is gradually changing, even though it once generated vast profits. The 2015 Hurun Global Rich List showed that the combined net worth of Chinese billionaires is $1.2 trillion. The country has now more self-made billionaires that anywhere else in the world.

Jack Ma, founder of e-commerce giant Alibaba Group Holding Ltd; Wang Jianlin, chairman of property behemoth Dalian Wanda Group; and Zong Qinghou, the entrepreneur CEO of beverage company Hangzhou Wahaha Group, have turned China into a hotbed of privately owned enterprises.

"Entrepreneurs in China have emerged alongside the nation's decision to open up," Zhang Weijiong, vice-president of the China Europe International Business School, says at the CEIBS China Family Heritage Forum 2015 last month. "Now most family businesses (that were started in the 1980s) are undergoing a succession process from the first to the second generation."

A smooth transition will be crucial to China's economy in the years ahead. Still, one of the biggest challenges the new generation of business leaders face is to convince their parents to change with the times and invest in high-tech manufacturing, which will increase the quality of their products.

Pan's story, in fact, is set to be played out across the country.

After all, the first generation of entrepreneurs made their fortunes by the sweat of their brows, producing cut-price export goods such as shoes, clothes and electrical appliances during a booming global economy.

That has since changed. The recession in the United States and Europe after the financial crisis in 2008 hit overseas orders, while countries such as Vietnam, Indonesia, Cambodia and Bangladesh are now under-cutting clothing and shoe companies in China.

For the second generation in family-run businesses, the task is obvious in a turbulent business world. But while innovation and ideas are vital, it is important they retain the cultural values of their parents.

"I have been teaching my son about having the right views about wealth, independent spirit and creative abilities," Xu Lixun, the executive director and president of Huamao Group, an educational service provider, says at the CEIBS forum. "It is also important to maintain the family's governance structure."

Raphael Amit, a professor of management at Wharton School at the University of Pennsylvania in the US, pointed to another key area that can help family-run enterprises move confidently into the middle part of the 21st century.

The majority of second-generation managers have been educated abroad and have a wider global perspective than their parents when it comes to doing business.

"This will be important," he says. "But running a family-owned company can be a difficult balancing act. You need to preserve growth and financial capital while ensuring a smooth succession."

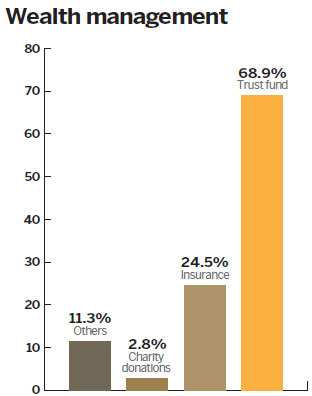

Another crucial aspect in handing over these firms from one generation to the next is wealth management.

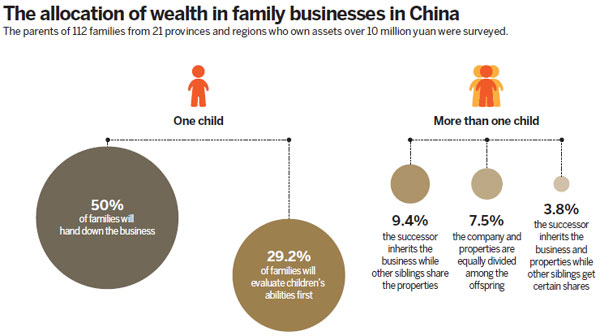

Last month, a CEIBS report explored the risk diversification of cross-border assets and inherited wealth for business owners with more that 10 million yuan.

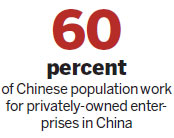

"Privately-owned enterprises in China have not only produced jobs for more than 60 percent of the population, but they have also created great fortunes, which have to be managed well," Rui Meng, co-director of CEIBS Centre for Family Heritage, says.

"We expect wealthy family businesses to pass on their assets in a planned manner, with the help from specialized financial planners," he adds.

But not everyone is seeking "professional" advice. The CEIBS report revealed that more than half of the 112 family businesses polled still manage their own wealth. Even so, 40.2 percent of these companies had turned to wealth management firms.

"Within this group of families, 68.9 percent of them opted for an overseas trust agency and 83.7 percent of them use this as their main investment method," the report highlights.

yuran@chinadaily.com.cn

(China Daily European Weekly 08/14/2015 page16)

Today's Top News

Turkey's early elections 'decidedly possible': PM

Death toll rises to 50, military sends chemical specialists to blast site

12 firefighters among 44 killed in explosions

Chinese yuan extends fall Thursday

China rattles a few cages in the world's financial markets

Tibetan drivers to finally see the end of 'death road'

China becomes world's largest robots market for second consecutive year

Yuan may stumble, but will not fall

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|