Tipping point

Updated: 2014-12-19 11:22

By Andrew Moody(China Daily Europe)

|

|||||||||||

China is on the brink of passing another milestone in its economic development

Investment flows in and out of a country do not usually excite much interest - but in the case of China, 2014 may prove an exception.

Many analysts believe the country's outbound direct investment may exceed its inward foreign direct investment for the first time, a landmark event.

It reflects a coming of age of leading Chinese companies such as telecommunications giant Huawei and computer giant Lenovo; and also the power of the country's investment not just in Europe but in emerging markets like Africa and elsewhere.

The full picture will not be known until the new year when the Chinese government publishes the final year figures.

But the latest data issued on Dec 16 showed that in the first 11 months of 2014, ODI at $89.8 billion (72.7 billion euros) was only $16.44 billion behind FDI on $106.24 billion.

Shen Danyan, Ministry of Commerce spokesperson, strongly indicated ODI was set to overtake FDI for the full year.

A report by the Center for China and Globalization, a Chinese think tank, published in October, also predicted that China's ODI would reach and probably exceed a record $120 billion this year.

If it does reach this level, it would mean the government had easily achieved its current Five-Year Plan (2011-15) objective to equalize investment flows.

It would also be a continuation of a trend that began early this decade when China's ODI was virtually zero.

From 2000, it rose almost exponentially (more than a hundred-fold) - particularly after China's accession to the World Trade Organization in 2001 - from just $1 billion to $107.84 billion last year.

FDI increased 130 percent from $53.5 billion to $123.91 billion over the same period.

Wu Changqi, professor of strategic management at Guanghua School of Management at Peking University, believes China's ODI overtaking FDI would be a milestone for the Chinese economy.

"I think you could say it would be an indication the Chinese economy is entering a new era.

"In the past 30 to 35 years China has been a destination for foreign direct investment, and now this is beginning to change."

Wu, who was speaking in his office in the Guanghua campus, says it reflects a coming of age of Chinese companies.

"Many Chinese companies have passed a certain threshold, like students who graduate, and are looking to for overseas opportunities. They might not have reached master's level yet but they now have certain capabilities," he says.

Bala Ramasamy, professor of economics at the China Europe International Business School, or CEIBS, in Shanghai, who was speaking from Malaysia, agrees that it would be a significant event if China's ODI were to overtake FDI but he is not yet confident it is part of a permanent trend.

"It is significant because over the last 30 years the main talk has been about the inflow of FDI into China but at the same time we should not jump into too much excitement.

"The reason why we can't be certain is because of the current state of the Chinese economy, which is slowing, and also the global economy. It could just be a blip on the charts."

One of the reasons why it is difficult to base firm conclusions on China's ODI data is that the overall statistics can be influenced by single deals.

The $15.1 billion acquisition by China's state-owned oil company CNOOC of Canadian oil and gas company Nexen, which had major assets in Uganda and was also a record Chinese ODI deal, made up a seventh of the value of China's overall ODI deals in 2013.

Chinese ODI also remains a small fraction, just 2.1 percent, of the overall investment in the Chinese economy, which was $5.1 trillion last year.

Despite overseas adventures, Chinese companies therefore still overwhelmingly prefer to invest in China than go overseas. Many believe this could all change and that one of the so-called China megatrends of the next five to 10 years could be Chinese companies going abroad to buy companies, particularly those with either technology or brands. Some forecasts suggest ODI could reach $172 billion by 2017.

There have been a number of major recent deals this year. In January, Lenovo announced it was buying Google's Motorola handset division for $2.91 billion.

Chinese conglomerate Sanpower Group bought an 89 percent stake in Highland Group Holdings, the parent company of UK department store operator House of Fraser for $480 million, in April. This followed another Chinese company, Bright Foods, paying $1.2 billion for a 60 percent stake in UK breakfast cereals maker Weetabix last year.

Also last year, Shanghui International Holdings bought the US company and world's largest pork producer Smithfields for $4.7 billion.

There has also been a series of Chinese strategic stakes in companies throughout Europe and elsewhere.

Investments in Africa have also continued apace, with some under the reporting radar.

A survey of Chinese companies by the European Union Chamber of Chamber of Commerce in China asking Chinese companies their motives for operating their business in the EU, found that 47 percent of the 74 respondents did so to bolster their position in the Chinese market and a further 34 percent to take advantage of intellectual and research and development resources.

About 85 percent said they wanted to provide goods and services to the European market.

However, Peter Batey, chairman and co-founder of Vermilion Partners, a strategic advisory and private equity firm focused on China, based in Beijing, believes acquiring companies just to win in European markets will be less of a lure over the next few years.

"To be investing in Europe to attack a relatively stagnant market doesn't appear to be a very attractive proposition. I think to go to Europe to pick up the right technologies seems to be a sensible approach for China," he says.

"Valuations are lower than in many other places, and while not exactly bargain basement, Europe is probably less protectionist in these matters than the United States. Britain is one of the least protected major economies in the world now."

Paul M. Cheng, chairman of Hong Kong-based private equity company China High Growth Fund and a former chairman of international trading conglomerate Inchcape Pacific, says companies are looking to speed up their development.

"They need to catch up. Their brand management capabilities are way behind those of European, American or even Japanese firms. They still tend to produce things and then just sell them rather than determine what consumers want," he says.

"You can criticize them for now - buying these skills from other companies and not being able to do it themselves - but from a business point of view it really makes no difference," he says.

Jeffrey Towson, author of the One Hour China Book and also a former investment adviser to Prince Alwaleed bin Talal, the Saudi Arabian billionaire known as the "Arabian Warren Buffett", says many misunderstand the nature of Chinese companies going abroad.

"People say that Chinese companies are going global. They are actually not going global. They are still trying to win in China, and what they are doing is going out to get stuff to bring back," he says.

"They are not going after Europe as a market. Geely took over Volvo to win in China and this is what many other companies are doing."

One of the reasons why China's ODI may suddenly accelerate is that its existing direct investment has reached the point where it will start regenerating itself, creating a snowball effect.

Those who have set up investments abroad will add to existing facilities and reinvest profits. It is an effect that countries such as the UK, France and Germany with investments in Africa and Asia that originated in the 19th century consistently benefit from.

By the end of 2013, China's accumulated stock of ODI had reached $660.5 billion, ranking it 11th in the world, two places ahead of its 2012 position.

Wu at Guanghua says this is very much a factor in China's ODI being on the brink of overtaking FDI.

"China's overseas stock of capital has been very low. China only started going abroad at the start of the 21st century but it has only now started to reach a point at which it might start to increase rapidly. Those companies overseas are becoming more competent and capable and will expand their overseas operations," he says.

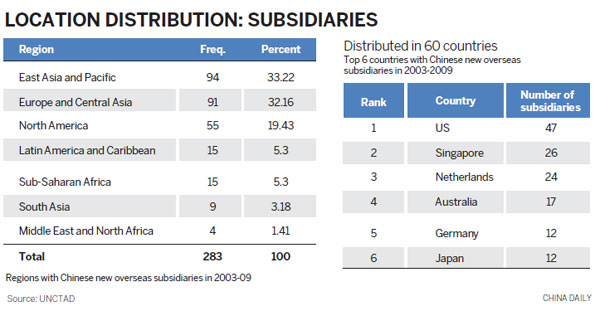

Most of the Chinese mainland's ODI still goes to Asia (including Hong Kong), accounting for about $75.6 billion in 2013 or 70.1 percent of the total.

China's ODI to Europe was actually down 15.4 percent in 2013 at $5.95 billion while that to Africa rose by 33.7 percent to $3.37 billion.

China's ODI to Africa, although a small proportion of overall ODI, has perhaps attracted the most international attention.

Mergermarket Group, a Financial Times-owned consultancy, estimates Chinese ODI to Africa could already be nearer $20 billion than the official figures simply because of the huge number of private deals that often go unreported.

Much of this has been in the resources sector that has been vital for fueling the expansion of China's economy.

There is evidence of increasing change in the nature of African investment with a focus on setting up Chinese-owned manufacturing bases on the continent to take advantage of lower labor costs than in China.

Huajian Group, which has China bases in Dongguan in Guangdong and Ganzhou in Jiangxi, plans a $2.5 billion investment with the China-Africa Development Fund to add to its existing footwear factory near Addis Ababa. It could create 100,000 jobs within 5 years and lead to the export of up to $4 billion of shoes every year.

Martyn Davies, chief executive officer of Frontier Advisory, a research and strategy advisory firm based in Johannesburg, says Africa was the recipient of a huge amount of China's early ODI in the first decade of the century because of the country's need for resources to develop its economy.

"It was almost irrational for capital to be departing an economy that in the last decade was growing at double digit rates if it wasn't for the need to go to places like Africa for commodities to build infrastructure back in China," Davies says.

However, he doubts whether the new investment in manufacturing in Africa will prove to be a sustainable trend.

"Much has been said about Ethiopia resembling a Chinese province going back 25 years but I don't think it would be sustainable without Chinese state investment. It is the Chinese government that is building these enterprise zones, which are then populated by Chinese private companies manufacturing footwear and other products."

Davies believes that apart from resources, the future of Chinese ODI in Africa could well be in building transport and other infrastructure

He cites China Northern Locomotive and Rolling Stock Corporation and China South Locomotive and Rolling Stock Corporation Limited, which are involved in a number of rail contracts in South Africa, as typical of a new type of African ODI.

"These companies are picking up some big projects in South Africa. I think what China is trying to do generally is consolidate its domestic infrastructure and construction companies into global winning firms. I think Africa is now giving them a platform to do that."

Although China remains the world's largest destination for FDI from other countries, its annual growth is beginning to stagnate.

Year-on-year growth was just 2.2 percent in the first half of this year, according to the Ministry of Commerce, a far cry from the annual growth of more than 20 percent before the financial crisis in 2008.

Stefan Sack, vice-president of the European Union Chamber of Commerce in China, says the economic slowdown in China is having a depressing effect on FDI into the country.

"As a result of the slowdown, there is less incentive for foreign companies to increase their capacity (which would require additional FDI) but just make do with existing facilities," he says.

The mix of China's FDI has changed greatly since 2004. Then some 96 percent of all FDI was in manufacturing, with services just 1.4 percent. By the end of 2013, services made up 28 percent of all FDI with manufacturing down to just 40 percent.

The government has been trying to encourage more inward investment in key service sector industries (particularly within financial services) with initiatives such as the launch of the Shanghai free trade zone in September 2013.

Sack says the rush by foreign companies to set up factories is now well and truly over.

"Some of the attractions of the secondary sector in China are now waning. There is a focus now on the new and coming tertiary sector but it is still pretty closed to foreign investments," he says.

"If foreign companies are to engage in more high-value-added activities in China, they will want more IP (intellectual property) protection and this remains a big issue for many European and American firms."

Cheng, from private equity firm CHGF and also author of On Equal Terms: Redefining China's relationship with America and the West, says the Chinese market is becoming increasingly tough for foreign firms because of intense competition.

"In America you are always going for 8, 9 or 10 percent market share but in China if you get 1 percent you are doing very well in terms of absolute dollars," he says.

The change in pattern of FDI reflects China's changing economic model and may in future mean less reliance on German companies like Siemens and the French giant Alstom with their engineering expertise in building its infrastructure.

Some countries such as the UK believe that it could be a major beneficiary of China's transition to a service sector economy.

Britain's services sector accounted for just 46 percent of its GDP in 1948 but this had risen to 78 percent in 2012, and China is now keen to achieve a similar rebalancing, possibly on the back of some UK firms investing in China.

Batey at Vermilion, who has been in China since 1986, believes this is something of an exaggeration of the trend.

"Personally, I think this is rather overplayed. It makes a nice mantra for the UK government to come out with. That is not to say, however, there is no truth in it at all."

In terms of the bigger picture, Wu at Guanghua School of Management says the fact that China's ODI is on the brink of overtaking its FDI is almost a paradox.

"It is almost contradictory or paradoxical. The rapid economic growth of China should attract a lot more capital instead of it becoming a net exporter of capital.

"There are a number of candidates for explanation such as the need for resources and also capital flight but it is also the case that the overseas investment is largely to serve the growth of the domestic economy."

Ramasamy at CEIBS believes China's ODI overtaking its FDI will almost be seen as a virility symbol for other emerging market countries in Asia, Africa and Latin America.

"Companies from emerging markets are often seen as second class. That Chinese companies are making significant inroads into developed markets signals a change."

Wang Chao contributed to this story.

andrewmoody@chinadaily.com.cn

|

Wu Changqi, professor of strategic management at Guanghua School of Management at Peking University, believes China's ODI overtaking FDI would be a milestone for the Chinese economy. Wang Zhuangfei / China Daily |

|

Stefan Sack, vice-president of the European Union Chamber of Commerce in China, says the economic slowdown in China is having a depressing effect on FDI into the country. Provided to China Daily |

|

Peter Batey, chairman and co-founder of Vermilion Partners. Cecily Liu / China Daily |

|

Bala Ramasamy, professor of economics at the China Europe International Business School, or CEIBS, in Shanghai. Provided to China Daily |

|

Paul M. Cheng, chairman of China High Growth Fund. Parker Zheng / China Daily |

|

Martyn Davies, chief executive officer of Frontier Advisory. Mark wessels / for China Daily |

|

Jeffrey Towson, former investment adviser to Prince Alwaleed bin Talal. Feng Yongbin / China Daily |

(China Daily European Weekly 12/19/2014 page6)

Today's Top News

China set to make tracks for Europe

Global net tightened in hunt for Chinese fugitives

Russians flock to stores to pre-empt price rises

Wong Kar-wai: Timeless director who makes time wait

China pledges $3b investment for Europe

Obama to sign Russia sanctions bill, White House says

Beijing condemns Pakistan school attack

Wolfsburg signs China midfielder for 2 1/2 years

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|