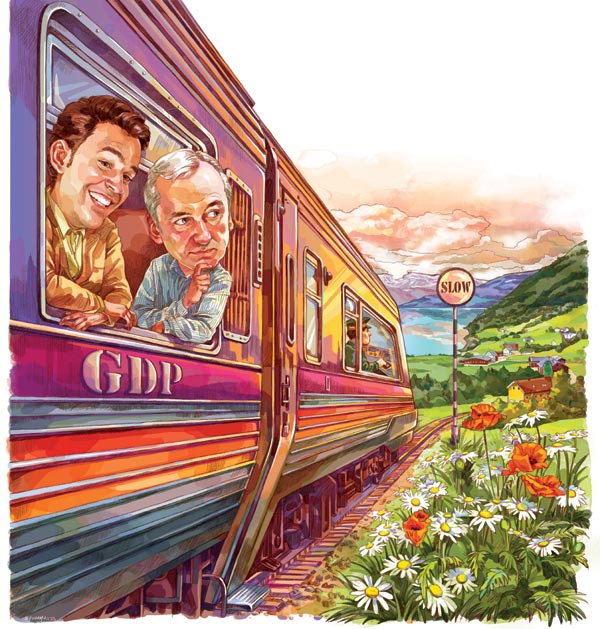

Growth pangs

Updated: 2014-10-27 07:43

By Andrew Moody(China Daily)

|

|||||||||||

|

|

[Li Ming/China Daily] |

What China's slowing economy means to the rest of the world

China is slowing. It grew by 7.3 percent in the third quarter, the weakest quarterly growth for 66 months, according to the National Bureau of Statistics.

Although some expect a slight rebound in the final quarter, the consensus among economists is that the world's second-largest economy, which is now set to grow at its slowest annual rate for 24 years, is entering a new phase.

Premier Li Keqiang spoke this month of "positive and profound changes" taking place as the economy makes the transition from being investment-led to one where domestic consumption plays a bigger role.

Consumption contributed 48.5 percent to GDP in the first three quarters, compared to 45.9 percent in the same period last year.

Many economists expect the government to set a growth target of 7 percent for 2015 at next March's meeting of the National People's Congress, compared to 7.5 percent this year.

Until 2012, the target had been held at 8 percent for eight successive years but this was regarded only as a floor below which it would not fall and so was often significantly exceeded.

While slowing growth might be ultimately good for the health of the Chinese economy, it comes at a difficult time for the rest of the world, particularly Europe with increasing concerns Germany may slip into its third recession since the financial crisis began as well as heightened worries about a new eurozone crisis.

Louis Kuijs, chief China economist at the Royal Bank of Scotland who is based in Hong Kong, says China's slowdown comes at a problematic time for Europe in particular.

"There is no doubt about that. It is not just the fact that China is slowing but the way that it is slowing which is the key factor," he says.

He says the big concern is slowing fixed-asset investment, which is mostly likely to affect exports to China, particularly those of capital goods on which economies like Germany depend.

Two major components of fixed-asset investment have fallen markedly over the past year: growth in corporate investment has fallen from 19.8 percent in December last year to 13.8 percent in August, according to RBS' own analysis of China's NBS figures; and real estate investment growth from 21.2 percent to 10 percent.

"If you look at the overall economy, the slowing of GDP does not appear to be that drastic but it is where the real story is. It is what is happening to these components of fixed-asset investment that is really bad news to countries like Germany.

"It has little to do with falling consumption in China, as many seem to think. Consumption in the country is not actually very import-intensive. You have only got to look at the shopping baskets in Chinese supermarkets. Even Mercedes cars are by and large made in China," he says.

Related Stories

Understanding the slowdown 2014-10-23 13:36

Observers divided over China GDP 2014-10-23 10:52

Time for all to embrace economic "new normal" 2014-10-23 10:22

'Purpose, urgency' to reform 2014-10-23 07:30

Firm policy action can beat growth pessimism 2014-10-22 10:09

China's 2014 economic growth likely below 7.5% 2014-10-22 09:18

Today's Top News

Highlights of Shenzhen Int’l Photography Week

Palace Museum needs to design landmark souvenirs

In Guangdong, 42 hours of fear

Ambassador urges young people to build up ties

Capital outflow fears unfounded

New proposals for care of the elderly

European Council appoints new commission team

Financing of projects focal point for APEC

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|