Best of both worlds

Updated: 2014-12-12 11:23

By Cecily Liu and Zhang Chunyan(China Daily Europe)

|

|||||||||||

Chinese companies in financial services, information technology and media are revving up their operations

The rapid growth of Chinese companies in the United Kingdom, both organically and through acquisitions, is significantly contributing to the UK's economic growth and creation of jobs.

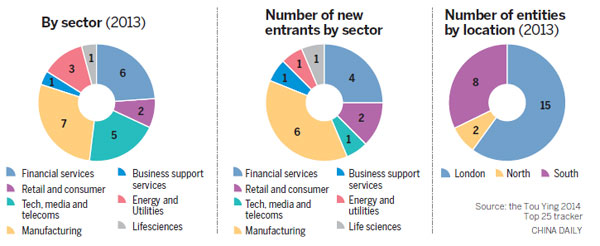

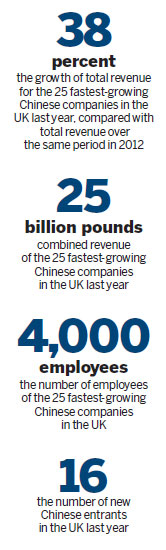

According to the Tou Ying 2014 Top 25 tracker, total revenue for the 25 fastest-growing Chinese companies in the UK last year rose 38 percent compared with the year before. Their combined revenue exceeded 25 billion pounds ($39 billion, 31 billion euros), and together they employ about 4,000.

The tracker, complied in collaboration with China Daily, identifies the 25 fastest-growing Chinese businesses in the UK that have parent companies in China based on annual changes in revenue. The tracker monitored revenue growth from December 2012 to December 2013. In Chinese, tou ying means investing in the UK.

According to the tracker, which is in its second year, the top 25 Chinese companies employed more than 2,600 people and generated revenue of more than 17 billion pounds in 2012, an increase of 27 percent on the previous year. The 2013 tracker monitored revenue growth over the full year from December 2011 to 2012.

Andy Ka, deputy head of the China Britain Services Group at the accounting firm Grant Thornton, says one key trend is that more and more Chinese companies in the financial services, information technology and service sectors are helping Chinese companies in the UK create a bigger presence and grow.

In the financial services industry, four major Chinese banks - Agricultural Bank of China, Bank of China, Bank of Communications and the Industrial and Commercial Bank of China - are playing a key role in helping finance the growth and expansion of Chinese companies in the UK. In the technology sector companies like China Telecom, China Unicom are popular providers of IT services to Chinese companies in the UK.

"Since these services firms already look after their existing clients in China, they understand their clients' company culture and needs. It therefore makes sense for them to follow them to other countries," Ka says.

Ka says Chinese financial services firms in the UK are growing rapidly for two reasons: London is a significant financial center and China has been encouraging its financial services industry to expand overseas.

Wang Huabin, chief corporate banking officer at Bank of China (UK) Ltd, says its cross-border yuan settlements totaled about 120 billion yuan from January to November while its renminbi denominated loans to Chinese and UK companies reached 2.5 billion yuan, a 400 percent increase on last year. More importantly, the renminbi corporate deposit of Bank of China London reached 18 billion yuan at peak time in the first half of this year, which was more than the amount of the whole market of last year and a record to date in London.

In addition, the bank had another great achievement in the UK this year.

"In October, Britain's finance ministry appointed Bank of China, HSBC and Standard Chartered to help organize the first sale of British government debt denominated in China's yuan," Wang says.

Britain is the first Western government to issue an offshore renminbi bond as it strengthens its financial links with the world's second-largest economy.

Wang believes that as the most international Chinese Bank, Bank of China will leverage its strong competitive advantages in areas of matured cross-border business and operations model, the strong capability of offering customized products and services, fully diversified business platforms and globally based expertise to maintain its leading role in bridging UK-China trade and economic development.

Currently, 90 percent of the bank's 450 employees are recruited from local UK markets, many of whom are experienced people, Wang says. Eighty percent of its credit corporate clients are local companies in Europe, Middle East and Africa. Therefore Bank of China London has already been a local bank with significant Chinese DNA. For example, in June, during Premier Li Keqiang's visit to London, Bank of China and Jaguar Land Rover signed a memorandum of understanding to expand cooperation.

China's financial services sector has recently had several breakthroughs in the UK. In September, the Industrial and Commercial Bank of China received approval from British regulatory authorities in September to become the first Chinese mainland bank to establish a branch in the UK since 1949.

Previously, ICBC could only operate a subsidiary in the UK that was subject to strict capital requirements.

"ICBC highly values the British market and regards London as one of its core strategic markets for overseas development," ICBC Chairman Jiang Jianqing says.

"ICBC is currently in the process of gaining control over Standard Bank Plc and will turn it into its overseas flagship for the commodities, currencies and capital markets to serve clients in global financial markets," Jiang says.

Jiang says the ICBC London branch and ICBC (London) PLC, the bank's local subsidiary, will be primarily engaged in traditional commercial banking, with the former focusing on the development of large wholesale business and the latter on retail and small and medium-sized businesses.

He says the new branch will also play a larger role in promoting bilateral trading and serving enterprises from both countries.

Strong bilateral economic ties have been highly significant in the development of Chinese companies in the UK. The UK is China's third-largest trade partner in the European Union, its second-biggest source of actual foreign investment and a major destination for overseas investment from China.

"Cumulatively, Chinese companies have made around $40 billion in Britain," says Zhou Xiaoming, the former minister counselor of the Chinese embassy in London, who added that the figure is nearly double the amount of UK investment in China.

"The first seven months of this year have seen a surge of Chinese investment. Chinese companies have made nine major mergers and acquisitions. With total investment of over $5 billion, they have invested more than they did in all of 2013," Zhou says.

Another milestone in China's financial services industry occurred in November when China Re became the first Chinese insurer to own a syndicate on Lloyd's of London, the reinsurance market.

The deal provides China Re with additional business to complement its existing portfolio in London. It also creates the potential for greater inflows of Chinese business and a greater understanding of Chinese risks to Lloyd's.

The China Re syndicate is projected to underwrite about 120 million pounds ($188 million, 151 million euros) in premiums in 2015.

Li Peiyu, chairman of China Re, says his team is grateful to Lloyd's for considering its application.

"The new stand-alone China Re syndicate will further raise awareness of the China Re brand in the Lloyd's market. Our long-term strategy is to increase our activities in the international markets, and we look forward to working with international clients and their brokers placing business in the Lloyd's market," Li says.

According to the Tou Ying 2014 Top 25 tracker, Chinese companies in the technology, energy and manufacturing sectors also performed well in the UK. Many of these firms are privately run and are leaders in their industries.

Huawei Technologies Co Ltd, the information and communications equipment provider, opened its first office in the UK in 2001 and now has 15 offices and 890 employees across the country.

More than 70 percent of Huawei's employees and most of its top management team in the UK office were recruited locally. Huawei says it will continue to expand its investment in the UK in coming years and plans to have a staff of 1,500 by 2017.

In the UK, Huawei has worked closely with domestic telecommunications operators, such as BT Group PLC, and with universities.

But Chinese companies are not solely focusing on London. Zhou says investments are branching out to Birmingham, Reading and Northampton.

TP-Link UK Ltd, a global provider of networking products whose headquarters are in Shenzhen, Guangdong province, has a division in Reading.

TP-Link initially expanded to Europe by selling its products through distributors, but it later established subsidiaries in a number of European countries to manage sales, says Eric Wang, head of TP-Link UK Ltd's Western Europe division.

Wang says sales this year of TP-Link products have grown by about 25 percent sales in the UK.

According to a report by IDC, an American market research firm, wireless products from TP-Link have captured a 49 percent share of the wireless equipment market this year, up from 41 percent last year. Its line of Wi-Fi range extender products now has a 70 percent share of the UK market, according to industry statistics issued by Context, an European IT market research company.

TP-Link's UK team has grown from about 30 employees last year to the current total of nearly 50. It has also brought in professional human resources systems and increased its office space by 50 percent to about 4,600 square meters.

In August, TP-Link shifted its Western European headquarters from Germany to the UK. This year, sales of TP-Link products in the UK are estimated to be $55 million, second only to Germany. Total sales revenue for TP-Link's 15 Western European markets are estimated at around $260 million.

Wang says TP-Link products provide a better user experience this year after it researched the needs of UK consumers. TP-Link is also heavily promoting its brand this year. Each year, it has spent about 3 to 4 percent of its revenue on brand-building, trade fair promotions, advertising and media coverage, including social media, says Wang, who added that he expects TP-Link to maintain growth of around 10-20 percent in the UK for the next two to three years.

While TP-Link and Huawei have grown organically, other Chinese companies have grown in the UK through mergers and acquisitions.

One example is Chinese marketing firm BlueFocus, which bought We Are Social, a UK digital marketing company. While We Are Social helped BlueFocus with digital marketing activities outside China, support from BlueFocus allowed We Are Social to help their clients explore opportunities in China's social media.

Other examples include Chongqing Machinery and Electric Co's acquisition of Precision Technologies Group, a manufacturing company headquartered in Manchester, in 2010 for 20 million pounds.

Precision, which has conducted business in China since the 1980s and established an office in China in 2007, has seen sales in China increase annually.

Neil Jones, group business development director at Precision, says his team has made strides in promoting new products and training skilled workers this year.

For many years, the company has worked with the Rochdale Training Association, which trains workers and offers apprenticeships in building maintenance, warehousing, plumbing, health and social care, as well as electrical engineering. Together they have allowed apprentices to study in an academic environment and work in Precision's manufacturing facilities.

Precision's achievements have been recognized this year with a number of awards, including UK Trade and Investment's North West China Business Award. Its apprentice system also garnered the Rochdale "Apprentice Employer of the Year" award.

The Sunday Times Inward Investment Track also recognized Precision as one of 20 up-and-coming medium-sized subsidiaries of foreign companies. Both Precision's parent company and its UK subsidiary were included in the Financial Times Fast Track 50 award this year.

Jones says this year Precision has focused on providing the right aftersales package for its clients.

"We want to not only sell them the product, but more importantly we want to ensure their businesses will grow in the long term along with ours," he says.

Another significant rush of Chinese investment has come in UK real estate, Ka says.

He adds that many Chinese companies are prepared to invest in the UK real estate and are aware and appreciative of the differences in the two countries' business environments.

"They do a lot of research before they come, and they carry out practices in a local way."

Looking into the future, Ka says Chinese companies should focus on establishing internationally recognized brands that emphasize their products' quality.

"This takes time, and a lot of Chinese companies have only just started this process, but it will come in time as Chinese companies increasingly learn how to operate in the UK market," he says.

Michelle Chen, a partner at the US-based international law firm Squire Patton Boggs, says she expects many Chinese firms' investments in the UK to consolidate, meaning firms that perform well will grow while non-performers will go bankrupt. Currently, with a flurry of Chinese investments into the UK, it is unclear which companies will become strong performers.

"At the moment many of the investments are new, and those that can withstand the test of time will grow and flourish," Chen says.

Chen says a major challenge many companies face is the post-merger phase in which two different corporate cultures attempt to successfully integrate with one another.

"To achieve a smooth integration, Chinese companies need to understand UK laws, learn how to interact with employees in the UK and become familiar with the business environment there," Chen says.

"To achieve successful long-term investment, Chinese companies need to respect the local culture, the local regulations and view their investment from a long-term perspective," she says. "The UK is a great destination for Chinese investment because it has always had a very open investment culture and a robust legal environment that gives all players a level playing field."

Contact the writers at cecily.liu@chinadaily.com.cn and zhangchunyan@chinadaily.com.cn

|

Industrial and Commercial Bank of China announces the operations of the London branch at a launch ceremony in London on Dec 1 to become the first Chinese mainland bank to establish a branch in the UK since 1949. Wu Congsi / Xinhua |

|

Wang Huabin, chief corporate banking officer at Bank of China (UK) Ltd. Provided to China Daily |

|

Eric Wang, head of TP-Link UK Ltd. Xie Songxin / China Daily |

|

Andy Ka, deputy head of the China Britain Services Group at the accounting firm Grant Thornton. Provided to China Daily |

(China Daily European Weekly 12/12/2014 page6)

Today's Top News

Traffic normalized at occupy sites, 209 arrested

UK sees growth of Chinese companies at record rate

British mother jailed for terror-related posts on Facebook

More MH17 crash victims identified

Asia has new richest person

UK rolls out red carpet for Chinese shoppers

HK police start clearing Admiralty protest site

Deflation 'may force central bank's hand'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|