And all could live happily ever after

Updated: 2014-02-14 08:48

By Wu Jiangang (China Daily Europe)

|

|||||||||||

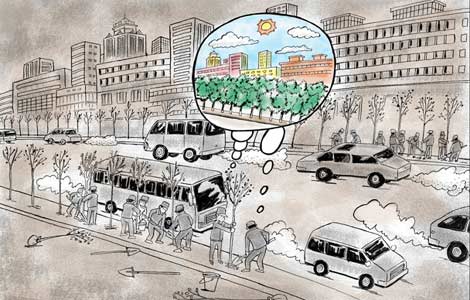

With regulations in place and other measures, shadow banking saga does not need to have a sad ending

Although the Chinese shadow banking system is renowned for being opaque, the latest annual financial market report by the Chinese Academy of Social Sciences estimates the system had 20.5 trillion yuan ($3.3 trillion, 2.5 trillion euros) in total assets - roughly 40 percent of China's GDP - last year.

As China is now the second-largest economy in the world, we need to examine the nature and risks in the shadow banking sector.

China's growth model has worked well for the past 30 years in terms of GDP growth, which is supported by government investment and exports. The funds for government investment were generated because of low spending on social welfare, high taxes and financial-sector monopoly. Exports rose because of low wages and generous incentives but at the expense of the environment.

But this growth model is becoming more and more unsustainable as wages and real estate prices keep rising, pollution becomes more severe, the monopolistic finance sector becomes more and more unfeasible, and government investments become more inefficient.

The turning point for China was 2008, when the export sector was hit by weak external demand caused by the US subprime mortgage crisis. To prevent large-scale unemployment and potential social instability, the central government approved about 4 trillion yuan for infrastructure projects and mobilized the state-owned banking system to provide loans.

Lending leapt from 3.6 trillion yuan in 2007 to 9.6 trillion yuan in 2009. In addition, these projects needed subsequent funding.

Before 2008, the vast majority of lending in China was done through the regular banking. But after 2008, as policymakers began to worry about the credit boom, inflation, a property bubble and overcapacity, they tried to apply the brakes. The regulator imposed severe requirements on commercial banks in the form of deposit reserve requirement, loan ratio and capital adequacy ratio.

As the projects that had already started needed further funding and local governments secured loans implicitly guaranteed by the central government, commercial banks used many financial tools or innovations that are now classified as shadow banking to provide unregulated loans.

The main tools or innovations are wealth management products, loans through trust companies, entrusted loans, inter-bank repurchase agreements and bank guarantees. According to official figures, wealth management products were worth only 530 billion yuan in 2007, but soared to 1.7 trillion yuan by the end of 2009, and 9.9 trillion yuan by the end of last September; total lending through trust companies was 340 billion yuan in 2007, 680 billion yuan in 2009 and 2.6 trillion yuan last year; total entrusted loans were 170 billion yuan in 2007, 440 billion yuan in 2009 and 1.8 trillion yuan last year.

It is hard to calculate how much commercial banks have used the inter-bank market to meet cash demand, but the liquidity crises in last June and December vividly reflect the scale in which banks use inter-bank repurchase agreements in the money market to repay short-term debt.

Shadow banking in China can be regarded as the banks' shadows, since a large part of shadow banking is off-balance sheet business of commercial banks.

Two other main forms of shadow banking are monetary funds and private finance, which are expanding rapidly because of the Internet.

As shadow banking grows, it is outside the purview of regulators and creates systemic risks.

As the main part of shadow banking is by regulated, systemically important banks, the risk is clear.

We do not really know where these off-balance sheet loans have gone, but from the fact that private enterprises have found it especially difficult to secure credit in recent years, we can surmise that these loans have flown to local government financing vehicles and real estate projects.

There is some evidence to back up this assumption. One is that the latest audit of local government debt tallied shadow banking at 17.9 trillion yuan by the end of June, up 67 percent from the 10.7 trillion yuan at the end of 2010. Another is that real estate prices may have more than doubled in many cities since 2008.

As the real estate bubble in China poses a danger and a plunge in housing prices can cause problems, there is not much else left for the government to do.

First, the government should bring shadow banking under regulation. Systemically important banks, especially, should be required to disclose the details of off-balance sheet businesses, and different regulatory approaches can be made according to the characteristics of different off-balance sheet businesses. In fact, a recent document of the central government (Document No 107), providing a regulatory framework, is a solid first step in defining and classifying shadow banking, but detailed regulations are needed.

Second, the government should cautiously manage the expectation of housing and land prices to avoid sharp rises or falls. To achieve that, the most important thing is to manage money supply. Third, the government should carefully evaluate construction projects and deal with inefficient projects. Since more debt will mature this year, local governments, instead of raising new debt to repay old debt, can instead sell state-owned companies to raise funds. The government should also stop propping up failed projects and let government financing vehicles to go bankrupt. In the long term, the government should retreat from investment projects and transfer its function from investment-oriented government to a service-oriented one.

Finally, the government should break the financial monopoly by allowing private capital to open banks and giving up interest rate management. The government must cede control in other industries, especially service sectors, for private enterprises so they can create investment opportunities and lending demand.

Shadow banking is a normal reaction by financial institutions given the government's control over interest rates, the government's investment spending and rising housing prices as it helps correct interest rate distortions, and offers investment opportunities for idle money and financing of corporations that have difficulty in securing credit through normal financing channels.

Will China's shadow banking turn out to have a good ending? The question depends on the wisdom and determination of the government to manage the housing bubble and the courage to transform its own functions.

The author is a lecturer at the Management School of Shanghai University and a research fellow at the China Europe International Business School Lujiazui International Finance Research Center. The views do not necessarily reflect those of China Daily.

(China Daily European Weekly 02/14/2014 page11)

Today's Top News

Germany, France eye new data network

No much progress in Syria peace talks

Lantern Festival fires kill 6 in China

China urges US to respect history

KMT leader to visit mainland

11 terrorists dead in Xinjiang

Illegal detention reports probed

4 die in Austrian train-car crash

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|