Xi's lunch may mean eating humble pie

Updated: 2014-01-03 09:59

By Ed Zhang (China Daily Europe)

|

|||||||||||

Big state firms are likely to face difficult year if they don't change their ways

Two things have determined that the Chinese stock market - Shanghai and Shenzhen combined - will have an eventful 2014, now that the central regulator, China Securities Regulatory Commission, is set to lift the 13-month ban on new listings.

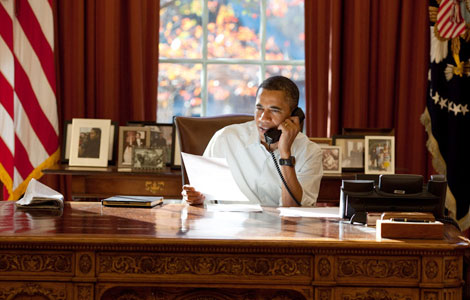

One was President Xi Jinping's widely-reported order of a 21-yuan ($3.5, 2.5 euros) lunch at a working-class restaurant in Beijing on Dec 28.

The other was the government's "opinion" on better protection of small shareholders' rights, published on Dec 27. Since it was released by the State Council, and contains nine key points, it is known as the "state nine points".

What both mean is really simple: the state-owned enterprises that used to behave badly in the market are going to be in trouble, unless they learn their lesson and mend their ways quickly.

First, don't mistake the 21-yuan "presidential lunch" as merely a PR gesture. The president could have kissed a few babies instead, or simply smiling and saying hello to a cleaning woman in the street would have earned him a better photo for "being nice". But "being nice" is not his message, at least as understood by investors with political savvy.

This is a nation where corruption, as a modus operandi, starts from the banquet table. And some of the national champions in dining extravagance are SOE executives and their assistants. That explains in part why SOEs could price their shares at a very high level when they were listed - only to be followed by fatal workplace disasters that shocked the press now and then, and the disappearance of highly positioned executives one after another, reportedly under corruption charges.

How many of the SOE officials now under investigation had had a single meal together with the workers in oil fields or assembly lines in the past 10 years? How many of them can even remember what simple dumplings taste like?

Now Xi's "presidential lunch" is a clear warning to them. The anti-corruption campaign that started in 2013 is not expected to wind down any time soon. It will spread from Beijing to all government offices and all SOEs - and inevitably will affect their share prices.

The best strategy for SOEs to maintain their share prices is to sack their corrupt officials early and waste no time in seeking cooperation with the private sector in operations with true growth potential - say, a joint venture under some mixed-ownership scheme. Otherwise, by following the old way of doing things, or playing sitting duck, they can only see their business go downhill, in their own industries and in the markets.

In the meantime, what the "state nine points" would do is keep admitting more companies into the domestic investment game. The new players in the market may not necessarily be great companies, and certainly most of them are going to be smaller than the giant SOEs already listed. But in their various businesses and equally various ownership schemes and management team lineups, they represent interesting choices.

Having more companies competing to attract investors would make some of the old SOEs look all the more dull and uninteresting - again, unless they can adapt quicker than the CSRC's implementation of the nine points, and also quicker than many private-sector companies.

Of the nine points, as independent market commentator Ye Tan pointed out, an important one is the straightforward statement that the listed companies will have to make due compensation for small investors' losses from share issuers' irresponsible behavior, something they have never had to fear in the past.

This marks the beginning of a belated change in the underlying concept of China's capital market, as Liu Jipeng of Chinese University of Political Science and Law noted, from making the market serve enterprises (mainly SOEs) to protect the investors.

But can the SOEs really understand the change? If they can't, what kind of report card can they show to the market?

And to tell which SOE is quick to learn and act, one may have to see which company's chairman and CEO are willing to have their everyday meal in the workers' canteen.

The author is editor-at-large of China Daily. Contact the writer at edzhang@chinadaily.com.cn

(China Daily European Weekly 01/03/2014 page13)

Today's Top News

Merkel fractures pelvis skiing, cancels visits

Portugal declares three-day mourning for Eusebio

Forbidden City to be closed every Monday

Icebreaker prepares for breakout

Beijing rejects Abe's call

Illegal ivory stash destroyed

Israeli ex-PM Sharon's condition in steady decline

Yahoo says ads in Europe spread malware

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|