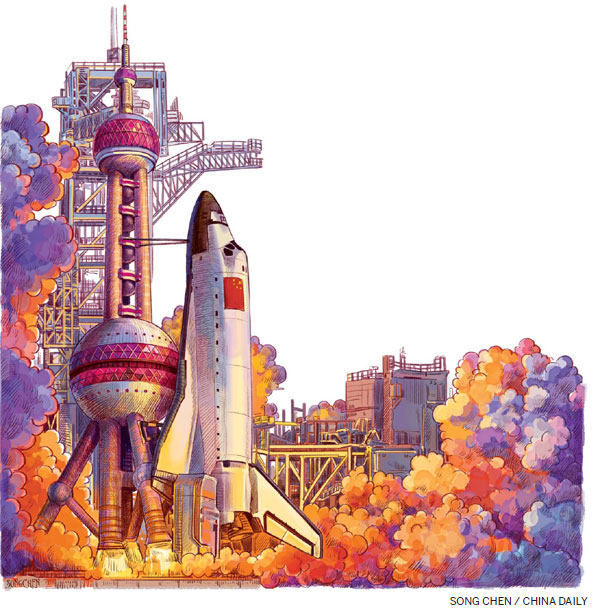

Launch zone

Updated: 2013-11-08 09:14

By Andrew Moody (China Daily Europe)

|

|||||||||||

New experimental project in Shanghai could herald the take-off of next round of economic reforms in the country

A collection of warehouse developments facing the breeze of the East China Sea might seem an unlikely symbol of China's future.

The Waigaoqiao Free Trade Zone in the north east of Shanghai's Pudong district and set up as a bonded zone in the 1990s, is one of four areas designated to be the Shanghai free trade zone.

The FTZ, consisting of just 29 sq km, could be the most important economic reform in China since the establishment of the Shenzhen special economic zone in the early 1980s, which paved the way to China becoming the manufacturing workshop of the world.

This time, however, the FTZ, officially called the China (Shanghai) Pilot Free Trade Zone, is not about manufacturing but the opening up of China's service sector - and, in particular, financial services, to the rest of the world.

It could herald Shanghai eventually becoming a global financial hub, with top Chinese banks such as Bank of China and ICBC competing with Wall Street giants such as JPMorgan Chase and also lead to the yuan becoming a major international reserve currency.

All this was still in the future when the FTZ, whose territory also includes the Pudong Airport Free Trade Zone, Yangshan Free Trade Port area and the Waigaoqiao Free Trade Logistics Park, was officially launched at the end of September.

For now it is just a three-year pilot and a testing of the water as to how certain key reforms would work if they were introduced across China as a whole.

Chief among these are interest rate liberalization (giving banks the freedom to set their own interest rates and able to compete for deposits as opposed to them being centrally set as in the rest of China) and greater yuan convertibility than the current tight foreign exchange restrictions allow.

Businesses in 18 key areas will be allowed to operate in the zone, including banking, legal services, travel agencies businesses, human resource consultancies, medical services and even foreign businesses offering entertainment venues and those producing and selling gaming consoles.

There has been much focus so far on the "negative list" on what will not be allowed in the zone with it including gambling businesses, golf courses and any businesses auctioning off cultural relics or involved in pornography.

Thousands of domestic businesses have already tried to register in the zone with the FTZ service center receiving some 500 enquiries a day.

Citibank and DBS are so far the largest foreign financial institutions to announce establishing sub-branches in the zone. Many others are expected to announce their involvement.

Over at her 6th floor offices in Pudong New Area, Jane Wang, tax partner at business advisers PwC China, says she has been inundated by requests from clients for advice.

"It has been overwhelming. It is a really big topic at the moment. Everyone is looking at it and trying to understand the details and the background and what kind of policy the government will issue in the future," she says.

It is the detail that everyone is waiting for. Many are expecting further announcements after the Third Plenary Session of the 18th CPC Central Committee, which begins on Nov 9.

Long Guoqiang, director-general of the General Office of the Development Research Center of the State Council, said last month the government would be "prudent" in implementing policies.

"The Shanghai FTZ will be the pilot and explorer of China's economic upgrading," he said.

A key question remains as to the extent of the convertibility of the yuan within the zone. Currently in the rest of China companies wanting to change large amounts of the Chinese currency have to apply to the State Administration of Foreign Exchange. Chinese citizens can individually exchange $50,000 of yuan in any one year. There is no problem with currency transactions if they are for the trade of physical exports and imports. The restrictions apply to currency trades on their own. What is not known at present is what limits, if any, will apply in the FTZ area.

The other major uncertainty is to what extent the banks, foreign and domestic, will be able to compete with each other by setting their own interest rates. It is assumed they will only be able to offer financial services to those companies registered within the FTZ.

One of the major challenges for those setting the framework for the establishment of the zone is preserving a border between the FTZ and the rest of China and reducing the risk of any arbitraging opportunities.

Today's Top News

SOE reforms to be launched after plenum

'Singles Day' to see big spenders

Launch zone challenges

European satellite continues fall to Earth

CPC session begins to set reform agenda

Economic growth to continue

Super typhoon kills over 10,000

World powers, Iran to hold news nuclear talks

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|