Slow motion

Updated: 2013-09-20 15:32

By Andrew Moody (China Daily)

|

|||||||||||

What effect will China's slowing economy have on its growth prospects - and the rest of the world?

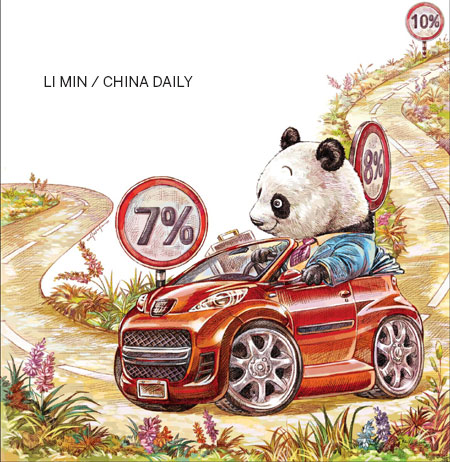

The Chinese economy is slowing. Even if GDP growth meets the government's target of 7.5 percent for the year as a whole, it will still be at a 14-year low.

Premier Li Keqiang made it clear at the World Economic Forum Annual Meeting of the New Champions 2013 in Dalian earlier this month that the world's second-largest economy was entering a "crucial stage" of its development.

He said a "structural transformation" had to take place if the economy was to maintain economic growth in the long term.

That transformation will involve the economy moving from one driven by investment, much of it in infrastructure and other major projects, to one more fueled by the spending power of Chinese consumers.

One of the uncertainties this year has been about the pace of deceleration of the Chinese economy.

In the middle of the year there were fears that China's debt (combining government, local government and consumer borrowing) had risen by some estimates to 200 percent of GDP and that China's growth might be heading below the psychological 7 percent floor.

In fact, only this week Sheng Laiyun, a spokesman for the National Bureau of Statistics, said this figure was the government's minimum tolerance level.

Concerns about growth led to the government announcing a mini stimulus with targeted investments in railways and public housing.

Recent data with factory output hitting a 17-month high in August, growing at 10.4 percent year-on-year and retail sales growth rising to 13.4 percent in the same month as well as fixed asset investment recording 20.3 percent growth (boosted partly by the mini stimulus), point to a more robust second half.

Yet the trajectory for growth is almost certain to remain downward in the medium and long term as the economy adjusts to a new model.

So what are the prospects for China's growth, what type of structural transformation needs to take place and what the implications of slowing growth may be, not just for China, but also the rest of the world?

Henry Bell, first secretary, economic, the British Embassy in Beijing, says the concerns about China's growth are not going to go away.

"There was certainly a lot of noise in the media in the summer about what was happening to the Chinese economy and I think that this is something we are going to have to get used to.

"The big picture is that China is transitioning from a long period of very high growth of about 10 percent between 1972 and 2012. In the coming years we are going to see that level of growth slow down more significantly."

Bell, however, insists the recent positive data might suggest that the economy is on course to meet the government's growth target of 7.5 percent for the year.

"I think a lot of the more hysterical reporting is probably far off the mark. I don't think there is much danger of China suffering a hard landing - however, that might be defined - in the coming period."

Oliver Barron, head of the China office of London-based China economics research company NSBO, believes it is easy to underestimate the scale of the transformation China has to make if it wants to move away from its export and investment-led model.

"What China wants to do is boost consumption and reduce its reliance on investment, but when you look at what has happened over the last decade, the consumption share of GDP has been falling and investment has been steadily rising.

"So there is a lot of momentum that China has got to reverse and I don't think it has to happen in one step."

Today's Top News

Leader calls strategic links with Beijing a model

Maduro aims to build trade plan with China

China to help deal with chemical weapons

Employee claims Danone gave bribes

Court media officers get greater say

Regulation cuts spending on meetings

Nature's light show 'once-in-a-lifetime' trip

Taoists on a mission to promote ancient lore

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|