A big idea that is worthy of credit

Updated: 2011-09-16 08:41

By Ahmed Sule (China Daily)

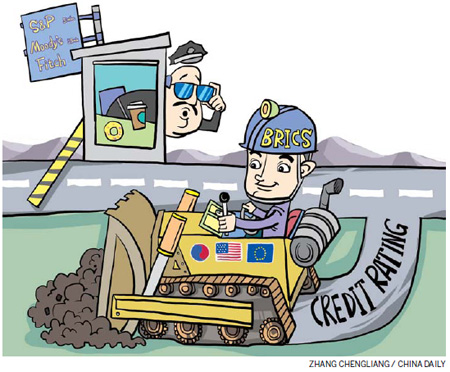

New rating agency would need to be independent and to have credentials from US regulator

Since I penned an article titled "Time for a new credit rating lifeline" (China Daily European Weekly, Aug 19) in which I argued for the formation of a BRICS-led credit rating agency (CRA) to rival Standard & Poor's, Moody's Investor Service and Fitch Ratings, a number of events have taken place within the CRA universe.

It has been reported that the US Justice Department will investigate S&P for its role in improperly rating several mortgage securities in the build-up to the 2008 financial crisis. On Aug 24, Moody's downgraded Japan's government debt by one notch to Aa3. Furthermore, a former Moody's executive informed the US Securities Exchange Commission that the senior management of the company put pressure on its credit analysts to issue favorable ratings in order to please clients and generate further business.

Another event that is likely to have significant ramifications on the structure of the credit rating agencies occurred earlier this month. However, this event was not widely reported in the global financial press. On Sept 6, Dagong Global Credit Rating, the Chinese credit rating agency, indicated that it aims to collaborate with a number of organizations within the BRICS (the emerging economies of Brazil, Russia, India, China and South Africa), the US, Europe and South Korea to form a super-sovereign credit rating agency, which would reduce dependence on S&P, Moody's and Fitch (the "big three").

Guan Jianzhong, the managing director of Dagong, expressed his optimism that the proposed agency "will gain a leading position in the global rating market within the next five years". The formation of a super-sovereign credit rating agency is a step in the right direction, as it would contribute to the improvement of the information asymmetry between debt issuers and investors.

Why is the formation of a new emerging market-led CRA to rival the big three CRAs necessary? What challenges would the proposed agency face and how can they be overcome? What are the prospects for such an agency?

For almost a century, S&P, Moody's and Fitch - which account for 95 percent of the market share - have dominated the global CRA space. Despite the shift in the global financial architecture toward emerging economies, it has been difficult for CRAs from the emerging markets to compete with the big three. One major factor is the lack of access to the world's largest capital market - the US. For a CRA to be recognized as a bond-rater in the US, it is required to obtain a Nationally Recognized Statistical Rating Organization (NRSRO) status, which is granted by the US Securities and Exchange Commission (SEC). So far, only 10 CRAs have been granted the NRSRO designation of which seven are from the US and one each from Canada, France and Japan. There is currently no representative from the emerging market. The formation of a CRA to rival the big three and challenge the dominance of the advanced economies' CRA is long overdue.

Another reason why the formation of this proposed CRA is timely is because of the ongoing reforms and debates impacting the big three CRAs. In the aftermath of the recent downgrades of the US debt and the sovereign debts of a number of European countries, there has been an unprecedented backlash against the big three rating agencies on both sides of the Atlantic. The SEC has recently asked S&P to disclose who within its ranks knew of the decision to downgrade US debt before it was announced. This is an attempt to find out if there was any form of insider dealing.

The SEC is also investigating the role played by the credit rating agencies in developing mortgage-bond deals that helped spark off the financial crisis. In Europe, stern statements have been made by a number of top European politicians. For instance, EU Justice Commissioner Viviane Reding remarked: "Europe cannot let itself be destroyed by three American private companies." There are also plans to set up a European credit rating agency in response to earlier calls by the German chancellor, the Austrian chancellor, the Polish deputy prime minister and Luxembourg's prime minister. European legislators are also considering the possibility of imposing "civil liability" on rating agencies for incorrect judgments on the credit worthiness of sovereign European nations.

The implications of the ongoing onslaught on the CRAs by European and US regulators and politicians are twofold: First there is likely to be a more cautious approach by the big three agencies in the rating of US and European sovereign debt. Second, it is likely to lead to the formation of a Eurocentric CRA and a heavily US and Europe influenced big three CRAs. This could widen the credit information asymmetry between the emerging markets including the BRICS and the advanced debtor economies of Europe and the US.

Since a number of large emerging economies such as China, Brazil, Russia and other oil exporting nations have sizeable exposure to the government and corporate debt in a number of these advanced economies, these emerging countries need access to reliable, transparent and independent credit analyses. With the independence of the big three rating agencies gradually being compromised, the formation of the proposed super-sovereign CRA, which should mitigate against the risk of being pressured by authorities in the advanced economies is timely.

The clampdown on the big three rating agency also presents an opportunity for the new rating agency proposed by Dagong to stamp its presence in the global financial space. As regulators in Europe and the US curtail the influence of the big three, this new agency can exploit the clampdown to gain market share. However, for the agency to gain influence, it would need to be globally recognized, especially by regulators in the developed markets.

One way of gaining this recognition would be for the new rating agency to be registered as an NRSRO by the US SEC. This would give the agency access to the world's largest capital market, thereby increasing its influence. However, this will not be an easy task as evidenced by the fact that none of the current NRSROs have any emerging market influence. In September 2010, the SEC denied Dagong NRSRO status, citing which it claimed to be Dagong's inability to comply with the recordkeeping production, and examination requirements of the Federal securities laws. Some analysts have attributed this rejection to US fear that its dominance in credit rating could be challenged.

To overcome this barrier, the proposed rating agency would need to first get political support from emerging and developing economies. Each of the BRICS nations should officially recognize the new rating agency as a rating organization.

Other emerging markets such as African countries, Middle East and Asian economies should also be encouraged to recognize the proposed rating agency. BRICS and other emerging economies could legislate that before its sovereign wealth funds commit additional investment into the sovereign and corporate debt of advanced economies, these borrowers achieve a target rating set by the proposed agency.

Finally, the BRICS and other emerging markets should also push for the recognition of the proposed agency as an NRSRO by the SEC.

The author, a CFA charterholder, is the macro strategist for Diadem Capital Partners Ltd, London. The views expressed represent the author's personal point of view and do not necessarily represent the views of Diadem Capital Partners Ltd or China Daily.

E-paper

Way over the moon

High inflation rockets mooncake prices out of orbit for mid-autumn festival

From death matches to child's play

Tomb raiders remain a menace

Kicking for joy

Specials

Singing success

Western musicians bring much-needed impetus to live performance industry

Salary bonanza for bosses

Top boss gets 8.78 million euros a year, far more than the State enterprise CEO with highest pay

Kicking for joy

Swedish college student represents China in Taekwondo championships