China top market for Germany

Updated: 2011-09-09 15:46

By Li Fangfang, Lan Lan and Bao chang (China Daily European Weekly)

|

|

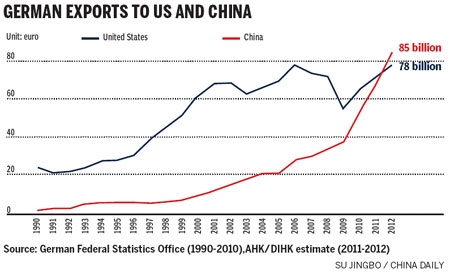

China and Germany are good business partners. So much so that China is expected to be Germany's biggest trade partner outside the European Union next year.

According to a new report, Germany's exports to the world's fastest growing major economy have almost tripled over the past five years.

The Association of German Chambers of Industry and Commerce (DIHK) said in a report released Wednesday that it estimates Germany will export 85 billion euros worth of products and services to China next year. This would surpass its sales to the United States, which the DIHK forecasts at 78 billion euros.

The United Nations Commodity Trade Statistics show that Germany's yearly exports to China almost tripled within the past five years, from $26 billion (18.48 billion euros) in 2005 to $71 billion in 2010. Germany imported Chinese goods worth $101 billion, making China the origin of most German imports.

Based on that data, DIHK said there is a strong foundation for further growth in mutual trade in the coming years.

"The 12th Five-Year Plan (2011-2015) and the first exclusive Sino-German government talks are a strong foundation for future growth of Sino-German trade," says Alexandra Voss, a delegate of DIHK visiting Beijing. "Sectors where we expect a particularly high growth potential in 2012 are machinery, automotive, medical technology and business services."

DIHK estimates that there are more than 1,000 German companies in China producing and selling machinery, and an additional 300 manufacturing vehicles and parts for them. Roughly 100 are active in the field of medical technology.

"Sino-German cooperation is flourishing already," Voss says. "And with the fast developing Chinese market, I still see a big potential for further growth of German business."

The robust Chinese market has contributed to Germany's recovery from the global recession, says Zhang Li, a researcher with the Chinese Academy of International Trade and Economic Cooperation affiliated to the Ministry of Commerce.

"There's a pretty good opportunity for German companies with strengths to explore the Chinese market, as China is encouraging imports partly to promote innovation and upgrade its industrial structure," Zhang says.

However, in Germany, some high-tech products are subject to export control, which has constrained the expansion of trade volume, she says.

Besides high-tech goods, German companies are also competitive in the service sector and want to expand trade in services with China.

According to the German Chambers of Industry and Commerce, in 2010, Germany exported $21 billion in energy plant equipment, followed by $17 billion in vehicles and vehicle parts, $9 billion in machinery, $4 billion in medical equipment and $3 billion in aircraft components.

"It is of much significance to see that these are all the focus business areas of Siemens, especially in China. The forecast is indeed a reflection of our growth prospects in China," says Kenneth Hsu, vice-president of Siemens Ltd China.

"Statistics also showed that in the next five years, the emerging countries are expected to account for over 50 percent of the world's economic growth. We see a lot of opportunities in China," he adds.

Today, China is one of the most important regions for Siemens, an engineering conglomerate. Customers in China generate 7 percent of the German company's total revenue. Some 90 percent of the products that it sells in the country are high-tech.

"Siemens has invested several hundred million euros in China in the last few months to increase local value creation. This trend will continue," says Siemens President and CEO Peter Loescher. "Also, as chairman of the Asia-Pacific Committee of German Business, I consider it my responsibility to further intensify the partnership between Germany and Asia."

China's automobile market cooled sharply this year as the government ended its incentive measures to spur vehicle purchases. But German automakers, Volkswagen AG or the three luxury brands, still enjoy booming business.

In the first half of the year, Volkswagen, which occupied 19 percent of the domestic market share, delivered 1.11 million vehicles to Chinese consumers. This 16.4 percent increase in one year led to China surpassing Germany to be Volkswagen's biggest market in the world.

Volkswagen's luxury brand, Audi, reported a 28 percent sales growth in the first six months of this year to also make China Audi's largest market globally. The boom was greatly backed by its imported vehicle sales of 27,300 units, which grew by 76 percent over last year.

In October, Dieter Zetsche, CEO of Daimler AG, told China Daily that China is expected to be Daimler's biggest market by 2015. He promised to increase investments in the country by 3 billion euros, the biggest investment by the German automaker in an overseas market.

In the same time period, Daimler plans to sell 300,000 cars annually in China, investing at least three times what it has put into the market so far. China is now Daimler's third largest market, behind Germany and the United States.

"And we believe it could be earlier if the market demand continues its robust increase as local GDP (gross domestic product) grows," he says.

In the first seven months of this year, Daimler's luxury car brand, Mercedes-Benz, delivered almost 110,000 Mercedes-Benz, smart, AMG and Maybach vehicles to the Chinese mainland.

"Strong sales figures of Mercedes-Benz cars during the first seven months of the year have resulted in a year-on-year growth rate of nearly 50 percent, far above that of the total market," said Klaus Maier, president and CEO of Mercedes-Benz (China) Ltd.

Statistics from the General Administration of Customs of China show that in the first half of the year, China imported 467,000 cars, a majority of them coming from Germany and Japan. This is an increase of 24 percent from a year earlier.

The China Passenger Car Association predicts that China is likely to import 1 million vehicles from abroad this year.

Also seeing the potential from China's rapidly developing economy, German pharmaceutical company Bayer moved its general medicine headquarters to Beijing in May. It is the first to do so among multinational drugmakers.

"We echo the statement that the flourishing Sino-German cooperation brings huge market potential for further growth. For Bayer, we see China as a market of great opportunities and tremendous growth," says Johannes Dietsch, president of Bayer Greater China Group and chairman of Bayer (China) Ltd.

With a total investment of more than 3 billion euros, Bayer is investing in world-class manufacturing facilities for high-tech materials, widely used by many industries, including construction, transportation and IT sectors.

On top of that, it also has transferred technology know-how to China by establishing global research and development centers that will unearth healthcare solutions and develop new applications for high-tech materials.

"China has become Bayer's third-largest market after the US and Germany. With the growth rate of 38 percent in our sales in the region last year, we are confident we can double our sales and achieve our growth ambition of 6 billion euros by 2015," Dietsch says.

E-paper

From death matches to child's play

You probably recognize the character (x) as a word of whimsy, but its origins are not so innocuous.

Tasting the new tapas

Mountains to climb

Short and sweet

Specials

China at her fingertips

Veteran US-China relations expert says bilateral ties have withstood the test of time

The myth buster

An outsider's look at china's leaders is updated and expanded

China in vogue

How Country captured the fascination of the world's most powerful fashion player