Inflation is the next big thing in Europe?

Updated: 2011-02-11 10:51

By Qian Yanfeng (China Daily European Weekly)

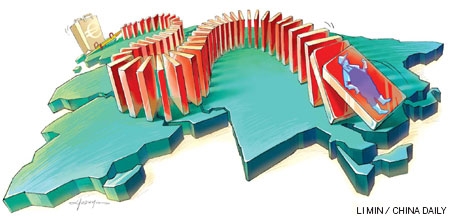

Rising labor costs in China coupled with appreciation of yuan against European currencies point to higher checkout prices.

As inflation in the euro zone rose well above the stated target in December, rising prices of Chinese goods arriving at European ports driven by increasing domestic costs are fanning inflation concerns on the continent.

Annual inflation rose to 2.2 percent in the last month of 2010, up from 1.9 percent in November and clearly higher than the European Central Bank's target of an annual rate of below 2 percent. Will European consumers, already in a bleak mood with high unemployment levels, rises in taxes and pay freezes or cuts , face the end of an inflow of inexpensive China-made products, which, already under domestic inflationary pressure, will further push up checkout prices for European buyers?

|

||||

While a falling euro and a rising yuan have a role in making imports from China more expensive, experts and economists say growing wage increases in China due to persistent labor shortages are, among other cost increases, a critical factor contributing to ever-increasing prices for Chinese exports.

A recent report by Guangdong province's bureau of human resources and social security put the labor shortage in the Pearl River Delta - which along with the Yangtze River Delta around Shanghai is one of the two manufacturing hubs of the country - at about 1 million. Only two years ago, when the financial crisis set in, the province had a surplus of 500,000 laborers. In the period since, labor costs in the two areas have risen by up to a quarter, according to recent media surveys.

Ye Shuhui, manager of Ningbo Jinfan Toy Co Ltd based in East China's Zhejiang province, says besides the appreciation of the yuan, rising wages is the most important reason for the 20 percent price hike in the toys made at his factory, which are exported primarily to the American and European markets.

Although the average wage at the factory has grown by 15 to 20 percent in the past year, he says it is difficult to attract enough workers, who now have much more clout than they once did and are demanding higher pay because of the shrinking supply of labor. The company now has only 100 workers manning its production lines, but Ye says even 200 are not enough, as businesses grew in tandem with China's blistering GDP growth of 10.3 percent in 2010.

"Worker shortages are now the toughest problem for labor-intensive exporters like us, as more and more migrant workers return home and don't come back again. I think the outlook is even worse for the years to come," Ye says.

"Migrant workers can now easily find jobs at home in the rural interior as an increasing number of manufacturing companies relocate to central and western China and local governments step up policy support for farmers-turned-workers to come back and develop the local economy."

Ye says he is not sure whether European wholesalers would pass cost increases to consumers or will simply reduce their own profit margins, but "given the unmistakable trend in manufacturing cost hikes in China - including labor and raw materials - European wholesalers will have no alternative but to accept higher price levels for Chinese exports".

Although to what extent and how far imported inflation from China would drive price levels in Europe remains to be seen, inflation expectations have already been building up in the euro zone. According to a recent European Commission report, the index of consumer expectations that prices will rise over the next 12 months rose more than four points to 15, the highest level since October 2008 when annual inflation was running at 3 percent.

Julian Callow, European economist at Barclays Capital, was also quoted by the Financial Times as warning that inflation in the euro area would rise further and hit 2.5 percent in February.

As Europe is one of China's biggest export destinations, "rising export prices due to higher labor costs will drive the inflation rate in Europe for sure", says Horst Loechel, director of the German Centre of Banking and Finance at China Europe International Business School (CEIBS).

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Carrefour finds the going tough in China

Maid to Order

Striking the right balance

Specials

Spring Festival

The Spring Festival is the most important traditional festival for family reunions.

Top 10

A summary of the major events both inside and outside China.

China Daily in Europe

China Daily launched its European weekly on December 3, 2010.