Rough road ahead for automakers

Updated: 2011-01-28 12:38

By Yao Jing (China Daily European Weekly)

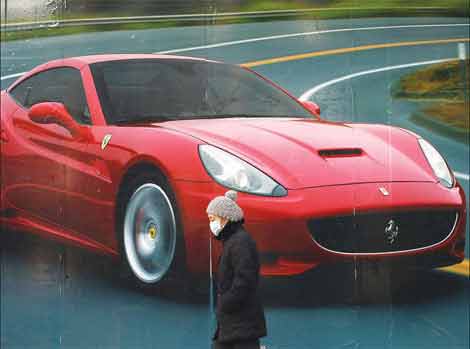

Companies may reduce advertisement expenses in major cities like Beijing

Automakers may not step on the gas when it comes to advertising this year in some major Chinese cities following Beijing's decision to clamp down on the number of new cars.

With some other cities expected to follow Beijing's lead, carmakers may refocus their attention and advertising to second- and third-tier markets, which still offer room for growth.

"Our automobile advertising revenue grew to 30 million yuan (3.4 million euros) last year from 20 million yuan in 2009. It accounted for over 10 percent of our total advertisement income," says Yao Guancheng, general manager of the auto marketing department at Life Style Media Group, a Beijing-based media company.

Yao, however, is keeping his fingers crossed when it comes to revenues this year. He is not that too optimistic of an increase as most of the dealers are reducing the number of 4S dealers in Beijing.

|

Auto advertising in Beijing during the first 11 months of 2010 was estimated to have generated 195.7 million euros. [Provided to China Daily] |

"Nearly 25 percent of our automobile revenue comes from the 4S dealers, who are slashing their advertisement budget by 50 percent this year. At the same time, carmakers are also expected to reduce their ad spend by nearly 30 percent in 2011," says Yao.

Beijing has drawn up an ambitious plan to reduce the annual automobile sales in the capital to 240,000 in 2011 compared with over 900,000 vehicles in 2010, to ease traffic congestion. The vehicle reduction plan will have a direct impact on dealership and many of them may be forced to close down, says a Beijing-based auto analyst.

"Automakers will weigh these factors before deciding on the final advertising budget for 2011. With vehicle caps this year and record sales last year, it may not be all that easy for companies to increase their advertising budgets," an official from the marketing department of a leading media house told China Daily on condition of anonymity.

Auto advertising in Beijing during the first 11 months of 2010 was estimated to have generated 1.74 billion yuan (195.7 million euros), a growth of 52.8 percent year-on-year, according to consultancy firm CTR Market Research.

Although at present only Beijing is implementing the rules, analysts say it is only a matter of time before other cities follow suit.

According to data from the State Information Center, when it comes to car ownership in metropolises like Beijing and Shanghai, the average is about 200 vehicles for every 1,000 people. In most second- and third-tier cities, that number drops to 100. For some smaller towns, the average is just 30 automobiles for every 1,000 people.

But there is flip side.

Chen Zhaohong, an auto analyst from Guangzhou, says the new rules will see carmakers selling more luxury cars in big cities and focusing on entry-level sales in second- and third-tier cities.

The traffic cap rule will affect the advertising strategy of second-rung players, and have very little impact on luxury automakers, says a spokeswoman from fashion magazine Esquire China.

"Our advertisers are mainly high-end automakers. Second-tier players just invest 1 - 2 million yuan every year. Advertising orders in January and February 2011 have risen compared with the same period last year."

Data released by HuiCong D&B Market Research, a Beijing-based market research company, shows BMW invested 319.5 million yuan (35.5 million euros) on print ads during the first 11 months of 2010. German carmaker Audi is reported to have spent 251 million yuan (27.9 million euros) for print ads in the same period.

"Buyers of low- and middle-grade cars may consider shifting to higher end models as it will become increasingly difficult to obtain license plates," says Yao Yingquan, chief planning director with MEC Interaction Beijing, the advertising agency of Mercedes-Benz.

According to Yao, the advertising budget of Mercedes-Benz is determined on its sales across various cities. In addition to Beijing, the company will focus on 23 other second- and third-tier cities this year.

Despite the blips, automakers are expected to increase their overall advertising budget for China as there is still huge, untapped potential in the smaller cities.

William Zhang, advertising director of CAD, a Shanghai-based automobile magazine, feels that automakers will hike advertising in China, as it has surpassed the United States as the world's largest automobile market.

"Our advertising income is directly related to the budget of automakers. We are expecting the income to increase substantially this year."

CAD, like many of the other print companies reliant on automobile advertisements, will focus more on new media this year to reach out to the growing number of younger auto buyers.

"They (younger buyers) prefer to access to information through websites, iPad and iPhone rather than magazine or television. We will use new media and diversify advertising avenues to reach out to more younger buyers."

Auto ad spending on traditional media between January to November 2010 - including cars, SUVs and MPVs - grew by 45.2 percent year-on-year to 20.96 billion yuan (2.36 billion euros) last year compared with 14.18 billion yuan during the same period of 2009, according to CTR Market Research.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.