Non-financial ODI to EU increases 297%

Updated: 2011-01-21 14:54

(China Daily European Weekly)

China's outbound direct investment (ODI) in the non-financial sector hit $59 billion (43.85 billion euros) last year, up 36.3 percent year-on-year, statistics released by the Ministry of Commerce on Jan 18 showed.

Total ODI in the non-financial sector amounted to $258.8 billion by the end of 2010, the ministry reported.

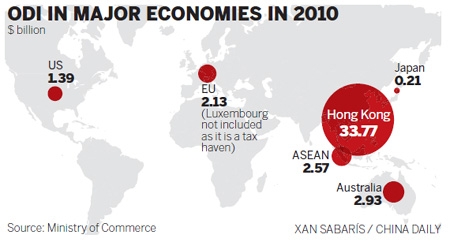

Outbound investment to the European Union, excluding Luxembourg as it is a tax haven, jumped 297 percent to $2.13 billion in 2010.

Despite the rapid growth, the figure is still considered small.

Most of China's outbound investment went to the Hong Kong Special Administrative Region, as well as to countries in Asia and Latin America, with a very small amount to Europe, the United States and Japan, Ministry of Commerce spokesman Yao Jian said.

In 2010, the top three overseas markets for ODI witnessed capital inflows of $33.77 billion (Hong Kong), $2.93 billion (Australia) and $2.57 billion (the Association of Southeast Asian Nations).

The country's ODI to the US grew by 81.4 percent to $1.39 billion last year, while investment to Japan jumped by 120 percent to $207 million.

"Many factors contributed to the phenomenon," Yao said. Chinese entrepreneurs were more familiar with the markets in Asia, Latin America and Africa, Yao said.

"Market openness" also contributed to the smaller proportion of Chinese investment in developed markets, Yao said.

He urged the relevant countries to further open up their markets and investment areas.

After rising by 6.5 percent in 2009, China's ODI gained by 36.3 percent last year, with about 40.3 percent of total investment realized through mergers and acquisitions.

Investment mainly went to sectors such as commercial services (47.3 percent), mining (20.2 percent), manufacturing (10.2 percent) and retail and wholesale (9.3 percent).

"As the internationalization of the yuan accelerates, China's ODI will grow remarkably in the next two years. The growth could reach more than 50 percent this year," said Jinny Yan, economist at Standard Chartered Shanghai.

"Emerging markets and those owning abundant raw materials and resources will be hotspots for Chinese investors, including Canada, Latin-America, Brazil, Australia and South Africa."

Record FDI rise

China's foreign direct investment (FDI) in 2010 reached a record high of $105.74 billion, up by 17.4 percent year-on-year, reversing a 2.6 percent decline in 2009, the Ministry of Commerce said.

Growth of FDI into China slowed last month after three months of gains, rising 16 percent from a year earlier to $14.03 billion. FDI rose 38.2 percent in November.

The 27 countries in the European Union together invested $6.59 billion in China last year, a year-on-year growth of 10.71 percent.

The top sources of the FDI include Singapore, Japan and the US.

According to FDI Intelligence, a special division of the Financial Times newspaper, FDI growth into Asia slowed to 6 percent in 2010 from 16 percent in 2009, with China the best performer in the region.

E-paper

Ear We Go

China and the world set to embrace the merciful, peaceful year of rabbit

Preview of the coming issue

Carrefour finds the going tough in China

Maid to Order

Specials

Mysteries written in blood

Historical records and Caucasian features of locals suggest link with Roman Empire.

Winning Charm

Coastal Yantai banks on little things that matter to grow

New rules to hit property market

The State Council launched a new round of measures to rein in property prices.