From Chinese media

High-pressure private loans trouble for small businesses

Updated: 2011-08-05 17:04

By Cai Xiao (chinadaily.com.cn)

Small companies are putting themselves at high risk by to borrowing money from private capital due to a lack of deposit money and more difficult loans, the People's Daily reported.

The paper quoted the People's Bank of China's Liaoning branch as saying that the deposit growth in Liaoning province has fallen for three months in succession. New deposits in June were 44.2 billion yuan ($6.86 billion), 51.6 billion yuan less than those of the same period last year.

Bank lending is more difficult after government took steps to control bank loans to curb inflation.

Borrowing money from private capital can be very expensive, and monthly lending rates can be as high as 3 percent. For a one-year loan of 100,000 yuan, interest can reach 36,000 yuan, putting high pressure on companies,according to the paper.

Experts said government should regulate private lending because the lending rate was too high, which was not good for the development of both companies and private capital, and it could lead to serious social problems if huge lending could not be recalled.

E-paper

My Chinese Valentine

Local businesses are cashing in on a traditional love story involving a cow herder and a goddess

Outdoor success

Lifting the veil

Allure of mystery

Specials

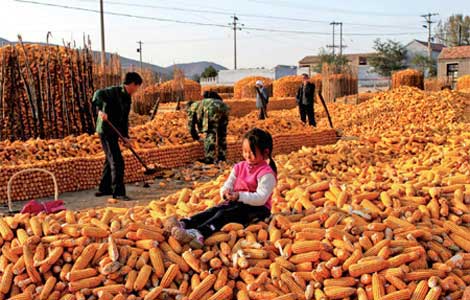

Sowing the seeds of doubt

The presence in China of multinationals such as Monsanto and Pioneer is sparking controversy

Lifting the veil

Beijing's Palace Museum, also known as the Forbidden City, is steeped in history, dreams and tears, which are perfectly reflected in design.

Beer we go

Early numbers not so robust for Beijing's first international beer festival