Central bank pumps more money into market

Updated: 2016-05-30 11:19

(Xinhua)

|

|||||||||

BEIJING - China's central bank on Monday pumped more money into the market to ease a liquidity strain.

The People's Bank of China (PBOC) conducted 65 billion yuan ($9.88 billion) in seven-day reverse repurchase agreements (repo), a process in which central banks purchase securities from banks with an agreement to resell them in the future.

The reverse repo was priced to yield 2.25 percent, unchanged from last Friday's injection of 95 billion yuan and Thursday's 75 billion yuan, according to a PBOC statement.

The move followed a net injection of 45 billion yuan into the financial system on Friday.

On Monday's interbank market, the benchmark overnight Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one another, rose 0.1 basis points to 2.002 percent.

The Shibor for seven-day loans also increased 0.1 basis points to 2.334 percent. The Shibor for three-month loans rose 0.35 basis points to 2.9455 percent.

Related Stories

Central bank drains 10b yuan from market 2016-05-26 17:39

Central bank pumps more money into market 2016-05-24 13:24

Central bank urges action on money laundering 2016-05-23 18:32

China's central bank names new deputy governor 2016-05-20 15:11

PBOC drains 20b yuan from market 2016-05-17 14:34

Today's Top News

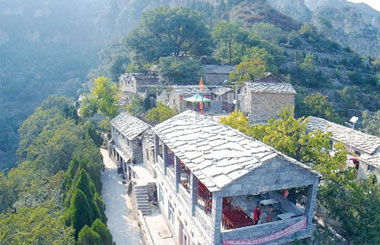

Rescue vessel eyed for the Nansha Islands

Steeled for change

EU has to cope with outcome of British referendum

Four Chinese banks among world's 10 largest

Kiev swaps Russian detainees for Ukraine's Savchenko

Refugees relocated during major police operation

China calls for concerted anti-terror efforts

London's financial centre warns of dangers of Brexit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|