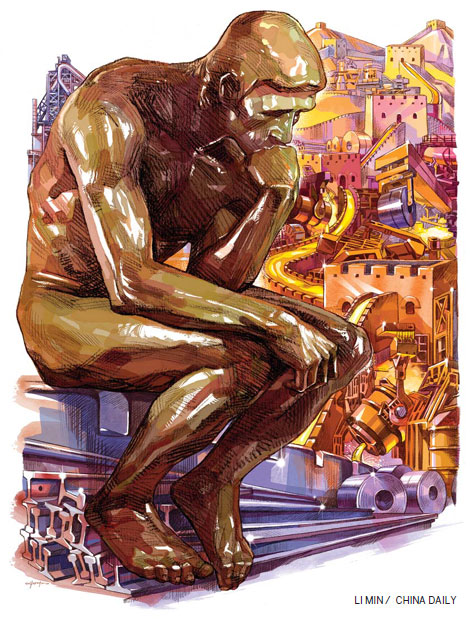

Steeled for change

Updated: 2016-05-27 08:14

By Zhong Nan and Liu Mingtai(China Daily Europe)

|

|||||||||

China is determined to deal with global problem of overcapacity while helping workers affected by the transition

China and the European Union have both fallen victim to the global problem of excess steel capacity, which has resulted from years of rapid expansion of global economies.

Now, they must use a toolbox of policies to restructure the sector, to improve efficiency and reduce capacity while increasing demand. However, implementing such reforms are easier said than done.

The EU, which is facing challenges from terrorism, economic stagnation and immigration, concedes that steel overcapacity is a global issue, yet it largely blames the Chinese government, which it claims has subsidized the nation's state-owned steel companies.

This month, the European Commission launched an anti-subsidy investigation into imports of Chinese hot-rolled flat steel, the subject of an anti-dumping probe since February.

There are now 10 active trade investigations into steel products, as well as 37 anti-dumping and anti-subsidy measures already in place, according to a statement from the commission. "Seven of these investigations and 15 of the measures concern steel products originating from China."

The latest probe also comes shortly after the European Parliament passed a non-legislative resolution to block China gaining market economy status this year, the 15th anniversary of the nation joining the World Trade Organization.

Cecilia Malmstrom, commissioner for trade, says the steel industry accounts for 1.3 percent of the EU's economic output and employs 330,000 highly skilled workers. She claims thousands of jobs in the EU are at risk from a rapid increase of imports, partly caused by Chinese government subsidies.

Shen Danyang, a spokesman for China's Ministry of Commerce, has countered this accusation, however. He says the country has never used subsidies to boost its steel exports, and instead suggests the export rise has resulted from greater competitiveness.

Regardless, China's leadership has insisted it is determined to deal with the global problem of overcapacity.

After enjoying boom times in its exports and real estate market over the past two decades, Shen says China will continue to readjust the industrial production structure to help domestic and foreign steelmakers.

The price of steel has risen in recent months, which Shen says has been driven by a surge in the global price of iron ore. According to media reports, the price of steel rose from $305 to $365 per metric ton in April on the back of China cutting 150 million to 200 million tons of steel and iron production capacity.

The sector has already received a boost from increased activity in infrastructure construction.

"The demand for steel increased as the world economy has gradually recovered," the ministry spokesman adds.

China aims to reduce crude steel production by between 100 million and 150 million tons over the next five years, and is attempting to encourage steel companies to work with downstream consumers to promote high-quality products in sectors ranging from autos and machinery to power and offshore engineering equipment.

Ansteel Group, based in northeastern Liaoning province, has already taken the hint. It opened a new plant in April to make high-end steel products for auto and home appliance manufacturing to offset the weak demand for low-end steel.

The facility, constructed in the southern metropolis of Guangzhou, is part of a joint venture with Guangzhou Automobile Group Co and German multinational ThyssenKrupp. The first phase cost 1.5 billion yuan ($229 million; 204 million euros) and has an annual production capacity of 450,000 tons of steel plate.

"The Pearl River Delta (which includes Guangzhou) is an important base for auto and home appliance manufacturing," says Yao Lin, vice-president of Ansteel. "Building a presence there allows us to bring our steel products to many of China's most important buyers.

"As many domestic steelmakers are seeking ways to expand their export channels amid weak global demand, we need to focus more closely on market demand and localization strategies in Chinese manufacturing bases."

He says the company has invested in a program to train sales specialists at the University of Science and Technology Liaoning for the past three years.

"China is a large steel exporter and a big importer of special steel used in shipbuilding, weapons, automobiles and machine manufacturing. Yet import prices are three times the export price on average," says Zhao Ying, a researcher at the Chinese Academy of Social Sciences' Institute of Industrial Economics in Beijing. "The country needs to improve the quality of its steel products and move up the value chain."

The nation's crude steel output fell 2.3 percent year-on-year to 803.8 million tons last year, the first decline in more than three decades, as demand dropped due to a slower national economy and flagging global demand.

According to the China Iron and Steel Industry Association, almost half of its 96 manufacturing members reported losses last year, with the average selling profit standing at just 0.45 percent.

Sun Jin, director of communications for Wuhan Iron and Steel, one of China's largest iron producers by capacity, says even though the company announced two months ago that it would cut up to 50,000 jobs, there have so far been no layoffs or pay cuts.

"The company just wants to optimize labor resources, reduce human-resource costs and enhance labor productivity," he says. "We'll give workers a basic salary and social security. They just work somewhere else."

During a visit to its headquarters in Wuhan, Hubei province, on May 23, Premier Li Keqiang designated the company as a pilot state-owned company to reduce excess capacity and transfer redundant workers to other posts using financial aid and policy support.

"Reform is the fundamental way for SOEs to grow and prosper," Li said. "However, when cutting excess capacity, superfluous workers must be transferred to other jobs instead of being laid off."

The central government estimates that 500,000 steelworkers will lose their jobs as part of efforts to cut overcapacity. To ease the blow, 100 billion yuan has been allocated to providing retraining and other support measures.

Figures from the China Iron and Steel Industry Association show 77.8 million tons of crude steel capacity has been cut nationally since 2011.

Like other steelmakers, Wuhan Iron and Steel also sees diversification as a way to stay afloat. According to company data, its nonsteel businesses - new materials, energy resources, engineering and information technologies, logistics and modern services - now make a vital contribution to its total revenue.

And it is not only steel mills that are looking for ways to survive.

Shandong Hualian Mining Holdings Co recently invested in the dairy industry as it attempts to move away from iron ore mining and producing fine iron powder.

The company, which recorded a 275 million yuan loss in sales revenue last year, is now a major shareholder in Ground Dairy Industry Co, which makes milk, yogurt and cheese in two plants in northeastern Changchun city and runs three dairy farms.

"The government this year will speed up efforts to help guide unprofitable companies out of the market," says Zhao Chenxin, a spokesman for the National Development and Reform Commission, the nation's economic planner. He adds that efforts to cut overcapacity will be implemented as soon as local governments finalize and submit their action plans to the central government.

However, professor Lu Feng at Peking University's National School of Development says the efforts won't be fully implemented unless local authorities are willing to stop providing assistance to so-called zombie companies, including steelmakers and coal mines.

"Many private enterprises are making energy-efficient steel products, but they may be forced to shut down as some local governments refuse to target unprofitable SOEs," he says.

Contact the writers through zhongnan@chinadaily.com.cn

Fu Jing and Hu Yongqi contributed to this story.

|

Premier Li Keqiang (center) talks with workers at Wuhan Iron and Steel during his visit to the company's headquarters in Wuhan, Hubei province. [Photo/ Xinhua] |

Today's Top News

Economists urge go-slow on EU's anti-dumping steps

Chinese investors eye European soccer goal

Rescue vessel eyed for the Nansha Islands

Steeled for change

EU has to cope with outcome of British referendum

Four Chinese banks among world's 10 largest

Kiev swaps Russian detainees for Ukraine's Savchenko

Refugees relocated during major police operation

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|